Subscribe

Sign up for timely perspectives delivered to your inbox.

Given Australian investors’ reliance on the ‘Big Four’ domestic banks for dividends and income, Jane Shoemake, Investment Director in the Janus Henderson Global Equity Income Team, discusses the impact of recent dividend cuts and why diversification is more important than ever.

In 2018, the top 10 dividend paying stocks accounted for 63% of all dividends paid in Australia, according to the Janus Henderson Global Dividend Index. Of these, the Big Four banks accounted for 41% of the total, highlighting the concentrated nature of dividend payments for investors who depend purely on Australian equities for income.

Given investors’ reliance on the banks for dividend payments, it is concerning to see that NAB1. and Westpac have recently announced lower dividend payments, down 16% and 7.5% respectively for the full year2.. Meanwhile, ANZ only partly franked its recent dividend at 70%, leading to an effective drop on a gross basis of 9% for its final payment and a cut of 4.5% for the full year3.. Only CBA has maintained its payment – for now at least.

We have now seen three out of the Big Four bank CEOs resign in the last couple of years in the wake of the Royal Commission and breaches of financial regulations. AUSTRAC’s allegation of Westpac committing 23 million breaches of anti-money laundering (AML) and terrorism funding laws has been the most recent scandal, resulting in the CEO’s departure.

With regards to the Royal Commission, the banks have already set aside billions of dollars to compensate customers for the failings identified and it is anticipated that remediation charges could eventually total $10 billion. That said, the Big Four’s upward revision of estimated costs in the third quarter of 2019 suggests this figure could ultimately be higher.

Meanwhile, regulator-enforced tighter lending standards and requirements to hold more capital have resulted in lower profitability levels, as measured by the return on equity achieved.

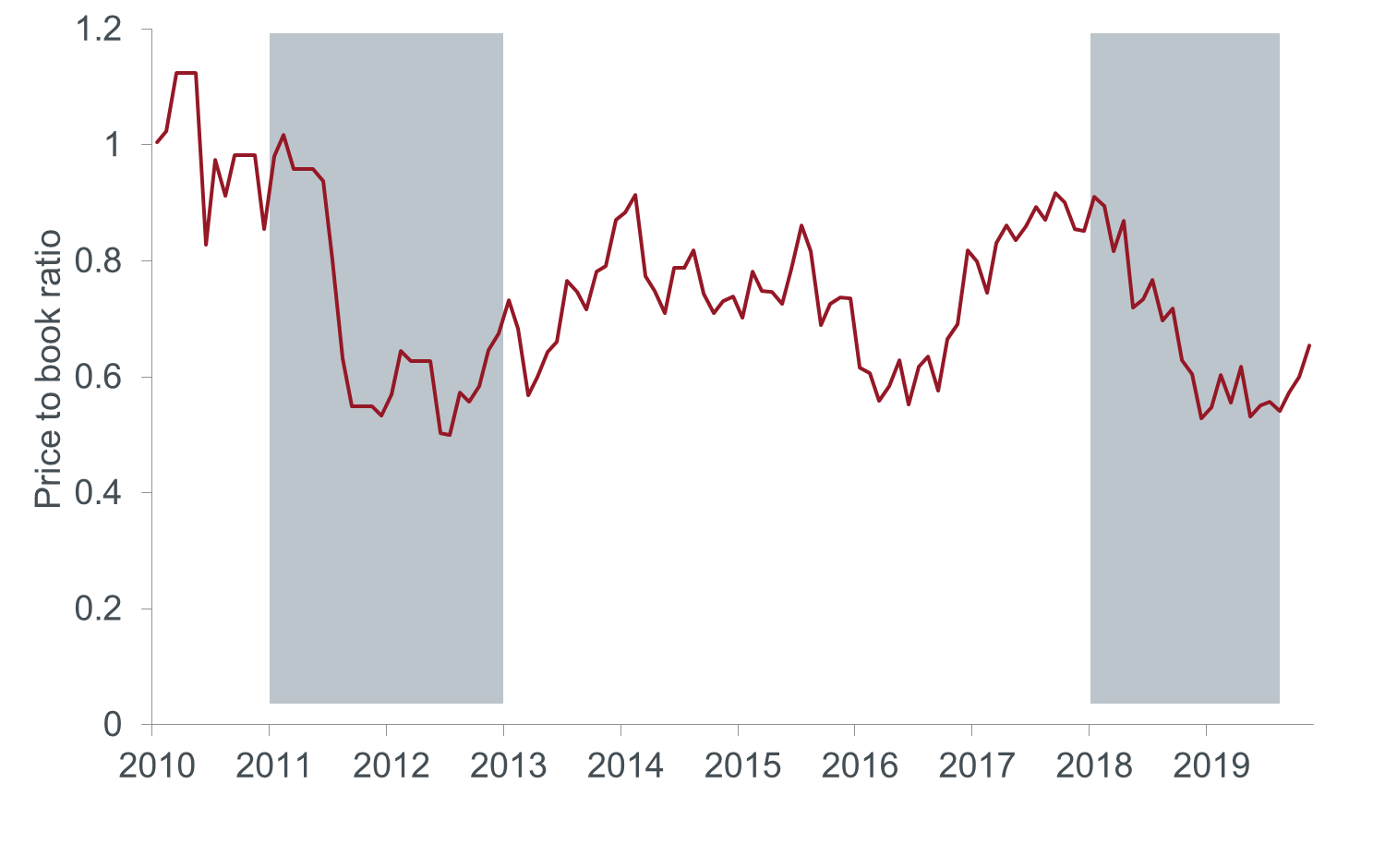

Bank margins have been under pressure for some time given the slowing domestic economic environment, muted loan growth and record low interest rates. This has been reflected in falling bank valuations, as measured by the commonly used price-to-book ratio (P/B) (see glossary below). Despite these lower valuation levels (ANZ, Westpac and NAB are currently trading between 1.2-1.4x P/B4.), we still don’t think these banks look cheap from a global context.

Looking at how events played out during the UK banks’ Payment Protection Insurance (PPI) mis-selling scandal, despite constant reassurances to investors that the end was in sight, compensation payments ultimately cost the banks and building societies £53bn. In addition, we have seen that even when new management have been appointed, it can take a considerable amount of time for financial institutions to regain investors’ confidence following a scandal.

In Europe, banks have traded at valuations as low as 0.4-0.5x P/B. ING, BNP and Nordea, for example, are trading between 0.7-0.9x P/B, which indicates there could be further downside to Australian bank valuations. Looking at BNP as an example, Chart 1 shows how the challenging periods during 2011-2013 and more recently in 2018-2019 affected BNP’s P/B ratio amid negative rates and an economic slowdown.

Chart 1: Price to book ratio of BNP

[caption id=”attachment_255832″ align=”alignnone” width=”1500″] Source: Bloomberg, as at 22 November 2019.

Source: Bloomberg, as at 22 November 2019.

If the markets think profits will disappoint and more dividend cuts are possible, the likelihood is that bank share prices will continue to underperform.

Furthermore, Australian banks’ payout ratios are very high, with the majority in excess of 90%. This means future dividends could come under further pressure if profits disappoint.

Australian investors remain extremely reliant on bank dividends and they have been rewarded for their loyalty over many years. However, we feel it is important to diversify in order to avoid being over-reliant on any one sector or geography. Cuts in UK bank dividends post the Global Financial Crisis and more recently mining shares in 2016 are reminders of the importance and necessity for income diversification. A global approach to equity income also enables investors access to certain sectors that cannot be accessed domestically, such as technology, which is a small sector in Australia, but dominates US indices.

Price to book ratio (P/B): Price-to-book ratio (P/B) is calculated by dividing a company’s market value (share price) by the book value of its equity, which is the value of the company’s assets conveyed on its balance sheet. A P/B value under one can indicate that a company is potentially undervalued or is a declining business. The higher the P/B ratio, the higher the premium the market is willing to pay for the company above the book (balance sheet) value of its assets. P/B ratios vary across industries so a better comparison is often versus the industry average and peers.