Subscribe

Sign up for timely perspectives delivered to your inbox.

Meditation is trending: According to the Centers for Disease Control and Prevention, the use of meditation by U.S. adults increased more than threefold, from 4.1% in 2012 to 14.2% in 2017. Many advocates of the practice cite benefits including reduced stress, improved sleep and increased focus. Even large corporations are getting involved, with many promoting a wider view of well-being in the menu of programs they offer their employees. Remarkably, this increased awareness of the benefits of a resilient workforce has not extended to the management of corporate balance sheets. In fact, corporate leverage has risen in recent years to alarming heights, and investors would do well to consider the potential consequences.

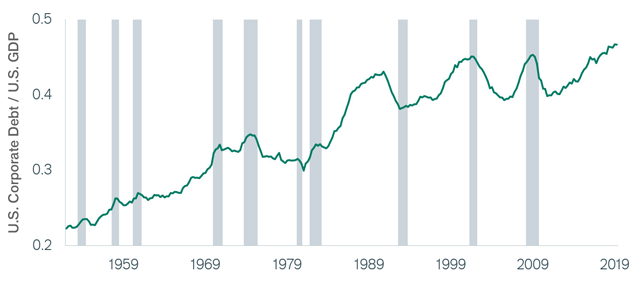

U.S. corporate indebtedness has reached $10 trillion, or 46% of gross domestic product (GDP), a level that exceeds prior peaks.1 Net leverage – i.e., after subtracting cash balances – has also reached new highs. Net debt to EBITDA (a measure of cash flow) for the median stock in the S&P 500® Index (ex financials and real estate, which have their own debt dynamics) is 2.1x, the highest level since at least 1990, according to Jefferies.2 Smaller-size companies have participated in the debt boom as well: Net debt to EBITDA for the median stock in the Russell 2000® Index is 2.3x, also a high.

Amid the dramatic increase in leverage, underwriting standards are slipping. There has been a notable increase in the amount of BBB bonds (the lowest level of investment-grade debt), growing from approximately $0.8 trillion in 2008 (36% of total rated bonds) to $2.7 trillion by year-end 2018 (47%).3 Former Fed Chair Janet Yellen, now free from the constraints of that role, didn’t mince words in a February 2019 finance industry gathering, noting, “I do think nonfinancial corporations have run up, really, quite a lot of debt … I have concerns about the deterioration in lending standards that we have seen … a large share of it is covenant-lite and some of the explicit ways in which covenants have weakened are a concern to me.”

Source: fred.stlouis.org, BEA, Board of Governors. Data: 1/1/52 to 4/1/19. Shaded areas indicate U.S. recessions. Corporate Debt = Nonfinancial corporate business; debt securities and loans; liability, Level/GDP.

The leveraging up of Corporate America is in part a logical response to extremely low interest rates. If savers are desperate for yield, why not issue cheap debt that is also free of stringent terms? Especially when locking in low long-term funding costs, a company can drive per share value higher by pursuing organic investment, strategic acquisitions, and/or stock dividends and buybacks. However, not all of the investment decisions taken with this nearly free money will prove smart over time. Some will undoubtedly be clunkers, especially decisions made later in the cycle.

One needn’t be a yogi to recognize that debt reduces corporate resilience. When times are tougher – which they surely will be at some point in the future relative to today’s 10-plus years of economic expansion – the fixed interest and principle payments consume cash flows that could otherwise be used to shore up the business. Overly levered companies simply have less staying power, whether the challenge is company specific, industry level or macroeconomic in nature. The second key consequence of the debt boom is that operating profit outcomes will be magnified unlike ever before. Importantly, this holds true for stable companies, in addition to cyclicals. While the positive vibes endure in the current stock bull market, it is worth remembering debt is impartial, magnifying both good and bad outcomes.

One needn’t be a yogi to recognize that debt reduces corporate resilience. When times are tougher … the fixed interest and principle payments consume cash flows that could otherwise be used to shore up the business.”

Taken together, less-resilient corporate balance sheets and a greater magnification of future operating profits suggest higher risk for equities. Our team of analysts and portfolio managers considers debt-carrying capacity on a case-by-case basis, recognizing that certain business models and management teams are more capable of shouldering the burden than others. We value businesses first in a downside scenario, including both weak cash flow results and balance sheet leverage impacts. In this way we aim to be eyes-wide-open about the risk side of the equation. We’re identifying well-capitalized (and attractively priced) companies among U.S. banks, select small-cap staples, global large-cap pharmaceuticals and a variety of Japanese small/mid-caps. Companies that are financially strong also hold the ability/option to capitalize during periods of economic weakness by investing at lower prices, which typically materialize in such circumstances.

A colleague sums it up: “One bad balance sheet can greatly damage otherwise solid portfolio performance.” While somewhat extreme, and we’d aim to use diversification to our advantage in defending against such an outcome, the sentiment is nonetheless useful. It helps keep our team mindful of the benefits of a liquid and well-capitalized balance sheet during these heady times in markets.

Thank you for your co-investment with Perkins Investment Management.