Subscribe

Sign up for timely perspectives delivered to your inbox.

What has Sky television, the World Wide Web, Taylor Swift and Henderson High Income got in common? They were all born in 1989. Over the next 30 years each has grown considerably to influence the lives of people in different ways. Would the Premier League be what it is today without Sky? Could we survive modern life without the internet? Could we get through painful breakups without the dulcet tones of “We are never ever getting back together”? Or could investors cope without the high level of dividends Henderson High Income has paid over the last 30 years?

Henderson High Income has been described as the ‘Ronseal’ of investment trusts, given it delivers exactly what the name suggests. The Trust’s objective is to provide a high level of dividend income while also maintaining the prospects of capital growth by investing in a prudently diversified selection of companies listed on the UK stock market.

Over the last 30 years there have been a number of market events for equity investors to worry about; Black Wednesday in 1992, the Asian Financial Crisis in 1997, the dotcom crash in 2000, the Global Financial Crisis in 2007/08, the Eurozone Debt Crisis in 2010 and the UK’s proposed exit from the EU more recently. Despite those market events, the high level of dividends paid by Henderson High Income has remained constant with a £10,000 investment at launch yielding £24,000 in income alone, assuming investors hadn’t reinvested their dividends . Over the same period that £10,000 would have earned just £12,000 in a bank account based on the Bank of England base rate. While Henderson High Income has provided investors with an alternative and attractive source of income, for those investors that are looking for total returns the Trust has also delivered. If an investor had reinvested their dividends back into the Trust, that £10,000 would be worth £148,000 today based on the Trust’s NAV total return. That really does highlight the power of compounding. For comparison a £10,000 investment in the FTSE All-Share over 30 years would be worth £100,000 on a comparable total return basis.

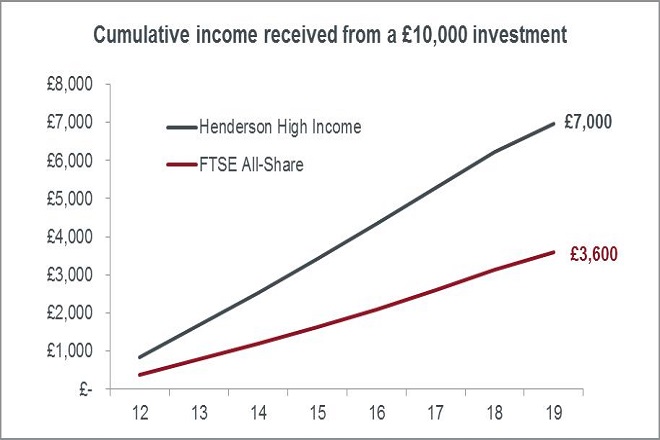

Of course not everyone has a 30 year time horizon but even looking at more recent data shows the attractive income of the Trust. A £10,000 investment on 1st January 2012, when I first became involved with the Trust, would have earned £7,000 in income. That is more than 12x the amount of income an investor would have received from a savings account (£575 base on the BoE base rate). That comparison may be unfair given we have been living in a low interest rate environment for a decade but a similar investment in a FTSE All-Share tracker fund would have paid an estimated £3,600 in income. Almost half the income investors in Henderson High Income have received.

*Past performance is not a guide to future performance

But what about the capital performance? Despite Henderson High Income paying double the amount of income as the UK market, an investor’s £10,000 would also be worth £14,700 today (assuming no dividend reinvestment) which compares to £14,200 for the FTSE All-Share investment. So investors have received a significant income return with no compromise in capital performance. If an investor were to reinvest their dividends back into the Trust over the same time period, the total return would be 121% verses the 89.6% return from the FTSE All-Share. A strong argument for the benefits of active fund management.

A lot has happened over the last 30 years since Henderson High Income was launched but the attractions of the Trust’s dividend are as relevant today as they were in 1989, if not more so in this low interest rate environment. As shown above, the Trust can be used not only to supplement income but also deliver superior total returns for those investors happy to reinvest their dividend back into the Trust. Here’s to another 30 years of attractive dividends and performance.

Glossary

Dividend: A payment made by a company to its shareholders. The amount is variable, and is paid as a portion of the company’s profits.

NAV (Net Asset Value): The total value of a fund’s assets less its liabilities.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.