Knowledge. Shared Blog

December 2019

Market GPS: Central Bank Policy Key to Staving Off Global Recession in 2020

Jim Cielinski, CFA

Jim Cielinski, CFA

Global Head of Fixed Income

While negative rates and weak economic data create a challenging backdrop, Global Head of Fixed Income Jim Cielinski believes there’s reason to be positive in 2020. In his view, the outlook for fixed income hinges on central bank policy, which he believes can stave off a global recession in 2020.

Key Takeaways

- The latter half of 2019 was marked by contradictions, with U.S. equities hitting record highs as other economic indicators signaled contraction.

- The Federal Reserve – followed closely by global central banks – has been swift to respond to signs of economic fragility, rapidly cutting rates to reverse overly aggressive tightening in 2018.

- A low-yielding world might reduce nominal returns, but in our view, it can still offer opportunities for those who can adapt to the new framework.

Everything seemed to rally in 2019 – except for the global economy. Concerns about a slowdown punctuated the year. Many industrial measures sank into contraction territory, yet labor market data and consumer spending remained robust.

Central banks are easing again. The Federal Reserve performed an about-face, pivoting to rate-cutting mode only months after proclaiming they were “a long way from neutral.” The inversion of the yield curve (the yield on the 10-year Treasury dipping below that of the 2-year Treasury) in August was a troubling sign, as it has typically heralded a recession (albeit up to two years out).

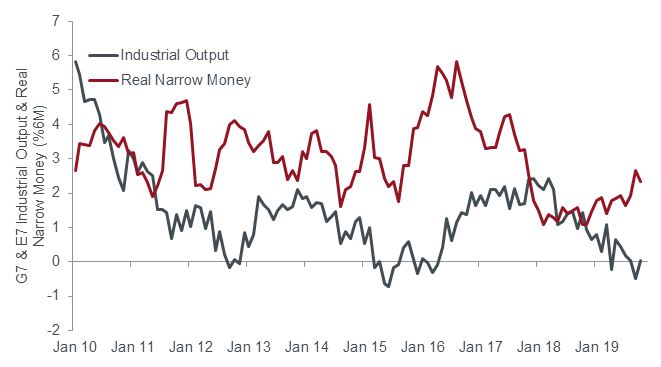

So have central banks done enough to stave off recession? We believe they have, at least for 2020. As the chart below shows, monetary trends appear to be signaling a trough in the recent economic weakness.

Reasons for Optimism

Monetary trends may be signaling a trough in mid-2020.

[caption id=”attachment_255123″ align=”alignnone” width=”661″] Source: Thomson Reuters Datasteam, as of October 31, 2019. October 2019 are estimates based on partial data. Narrow money consists of currency and overnight deposits.[/caption]

Source: Thomson Reuters Datasteam, as of October 31, 2019. October 2019 are estimates based on partial data. Narrow money consists of currency and overnight deposits.[/caption]

Yet, the recovery looks tepid at best. The dash into reflation trades and cyclical assets that has characterized recent weeks could easily be spent if economic activity and corporate earnings fail to respond.

We anticipate mundane economic growth in 2020. These are tolerable conditions for fixed income, where resilient cash flow rather than rising earnings is prized the most. Given low starting yields, investors in fixed income may have to be content with modest returns, although active management and a willingness to travel along the yield curve, the credit spectrum and geographically could help supplement returns.

Debt loads are heavy among companies but have been for some time, and with central banks in easing mode again, this should hold down real borrowing costs. As such, we anticipate defaults to remain low. Valuations broadly reflect this, with global credit spreads closer to their 10-year lows than their 10-year highs. There is room for spreads to grind tighter if moderate conditions prevail, although we would look out for catalysts that could prompt a widening. With politics being the source of recent shocks, a U.S. presidential election year is a hurdle.

Political upheavals have echoed the economic disruption that has been taking place as demographic changes, technology and shifting consumption patterns reshape the world. Lending to companies that will be around in the future requires investors to be on the right side of change. In our view, that means paying attention not only to traditional metrics but also to what matters to future investors and consumers, including a deeper focus on environmental, social and governance factors.

The global economy is at a critical juncture. Investors must not become anchored in their thinking and should keep an eye on key signposts. Labor markets and income will be important areas to watch while geopolitics and sentiment shifts will likely produce market disruption. A low-yielding world might reduce nominal returns, but in our view, it can still offer opportunities for those who can adapt to the new framework.

Want to learn more about where we see opportunities for fixed income in 2020?

EXPLORE THE MARKET GPS FIXED INCOME OUTLOOK 2020

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox