Subscribe

Sign up for timely perspectives delivered to your inbox.

Ian Bettney, Portfolio Manager within the Secured Credit Team, examines the recent changes to the laws governing the UK mortgage market, and their impact on the performance of some pre‑crisis UK non‑conforming residential mortgage‑backed securities (RMBS).

The UK mortgage market has in recent years undergone two major reforms following rulings by the Financial Conduct Authority (FCA). The first, “modified affordability assessment”, aims to ease some of the stricter lending rules that were created after the Global Financial Crisis to prevent excesses in lending, and which unwittingly trapped many borrowers with a good credit history by making them unable to refinance at the lower interest rates that followed.

The second ruling concerns “retirement interest only (RIO)” products. The FCA reclassified RIO mortgages as standard products, enabling high street lenders to enter this niche market, previously dominated by specialist equity release lenders. This has also increased refinancing options for many borrowers.

We anticipated that these reforms would materially impact the performance of select pre‑crisis UK non‑conforming RMBS and have been positioning our portfolios to benefit since early 2019.

The FCA estimates that there are about 150,000 borrowers in the UK currently repaying mortgages that were originated prior to the financial crisis and who could benefit from switching to a new product but are unable to do so.

Most of these so called ‘mortgage prisoners’ have been trapped in their existing deals since the financial crisis when lenders tightened criteria and regulators prescribed a more stringent affordability assessment for new lending. Over the subsequent years interest rates have fallen to historic lows, the housing market has recovered and intense competition has squeezed mortgage margins tighter. Many of these mortgage prisoners have been stuck paying expensive interest rates relative to new products as they could not satisfy the new lending criteria, despite having been up‑to‑date with their payments.

There has been increasing awareness around this issue over recent years, culminating with the FCA implementing changes to its “responsible mortgage lending rules”. Lenders can now apply the concept of “modified affordability assessment” where a borrower:

Similarly, concerns have grown for pre‑crisis borrowers with interest‑only mortgages who have no likely method to repay the mortgage at maturity other than selling the property.

There are currently around 1.5 million purely interest‑only and, part‑capital repayment, mortgages outstanding in the UK according to the FCA. Although the actual maturity spike is several years away, increasing numbers will soon need to be repaid in full and now require access to refinancing options.

To help address this issue, in addition to the challenges of an aging demographic, the FCA reclassified “retirement interest only (RIO)” mortgages as a ‘standard product’, enabling high street lenders to enter the market where previously, later‑life products had been a niche space, dominated by specialist equity release lenders.

RIO mortgages allow consumers to keep paying monthly interest payments until they die or go into long‑term care. The lender then sells the property to repay the balance of the loan. In the past the regulator lumped RIO mortgages with equity release, calling both ‘lifetime mortgages’ under the terms of the Mortgage Credit Directive.

RIO mortgages are a simpler product than equity release so they require a less detailed sales process and need less advanced qualifications to sell. The key potential attraction of RIOs is that regular monthly payments continue to be made, in contrast to equity release where interest payments are added to the outstanding balance and compounded. Hence, borrowers do not have to worry about severely depleting their equity if they stay in the house longer than expected. Typical RIO lending criteria include a borrower minimum age of 55 years, a maximum LTV of 55% with projected pension income, including investments and rental properties, accepted for affordability assessment. While the initial uptake has been slow, increasing numbers of high street lenders have started offering RIO mortgages throughout 2019.

For us, the clear criteria of these new products allows analysis of outstanding transactions to identify which mortgage pools should have the highest concentrations of borrowers who could benefit from being able to refinance. We expect this behaviour will drive up prepayment rates and materially shorten the maturity profile of select transactions within the non‑conforming UK RMBS market and have positioned our portfolios to benefit from the change.

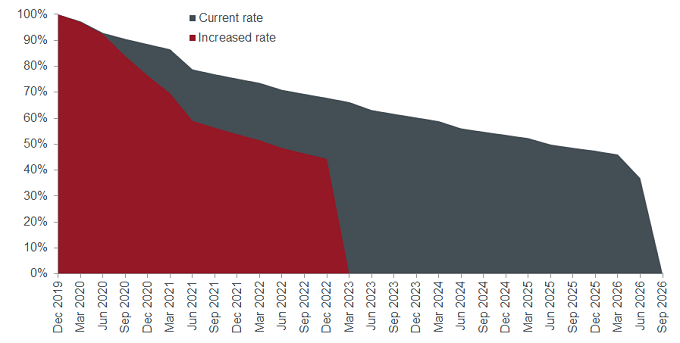

The chart below is a pictorial representation of what the impact of increased activity for the repayment profile of select bonds might look like, compared to current rates of repayment.

Source: Janus Henderson Investors, quarterly data, as at 27 November 2019. Note: payment profiles assume clean‑up call exercise at the earliest point

Recent research from Standard & Poor’s also shows the potential impact of the modified assessment changes. It concludes that in excess of a third of legacy UK non‑conforming borrowers could match the new criteria and therefore benefit from refinancing. Many of these legacy transactions are currently priced to full extension, assuming borrowers continue to repay their mortgages at the current rate and, trade at a discount to par (due to the margin on the notes being below current market spreads).

Thus, if as we expect, prepayment rates increase significantly, then the securities will benefit from both the accelerated return of principal (at par) — thereby increasing our realised yield — and an upward market repricing of these bonds.