Knowledge. Shared Blog

November 2019

Investors Possibly Ill-Positioned for Continued Market Rotation

-

John Fujiwara

John Fujiwara

Portfolio Manager, Diversified Alternatives

Diversified Alternatives Portfolio Manager John Fujiwara argues that investors are not sufficiently considering the prospects of a steadying U.S. economy and a potential rise in inflation.

Key Takeaways

- This autumn’s rotation from defensive to cyclical stocks is likely a harbinger of an improving U.S. economic outlook and a long-delayed increase in inflationary pressure.

- Should economic growth accelerate, the year’s dominant momentum trades of government bonds, high-growth tech stocks and defensive equities may deteriorate further.

- With bonds likely under pressure and additional equities upside limited, investors should consider further diversifying portfolios by increasing exposure to inflation-sensitive assets like commodities and strategies designed to be uncorrelated to traditional asset classes.

Financial markets are inherently complex, with innumerable participants using the pricing mechanism to express diverse views on a range of subjects. Therefore, we become concerned when it appears that markets are tilted in one particular direction. This has been the case for much of 2019 as investors priced in the continuation of a low-growth, low-inflation environment. Beneficiaries of this viewpoint were duration, traditionally defensive equity sectors and secularly advantaged technology stocks. Geographically, the U.S., with its healthy consumer sector, stood above developed market peers.

Signs of a rotation away from these segments emerged in September as more cyclical and value names began to outperform. While many attributed the shift to what had become glaring valuation differentials and short covering, we instead believe that this could be the beginning of markets factoring in a more resilient and – after a sustained absence – normalizing inflation.

Defensive Groupthink

Years of below-trend economic growth and weak inflation – despite global central banks’ best efforts to reignite the private sector’s animal spirits – left investors wondering if low growth was the new normal. While 2017’s U.S. tax reform provided a temporary lift for riskier assets, this year’s escalation of the U.S.-China trade war caused the pall to return. Reinforcing this concern was the Federal Reserve’s (Fed) decision to reverse course by cutting rates three times in 2019.

Trade, along with other geopolitical risks and an extended business cycle, pushed investors to seek safety and growth wherever they could find it. This led to the interesting phenomenon of much of 2019’s strong equity gains being led by traditionally defensive pockets of the market, including the consumer staples and utilities sectors as well as companies in other sectors that tend to generate steady cash flows throughout the business cycle. Also pacing markets were innovative tech companies that promised secular growth. The relative strength of the U.S. economy – driven largely by personal consumption – and the liquidity offered by its financial markets caused the country to be a favored destination. In this sense, U.S. stocks became the world’s preferred defensive trade. Emerging markets (EM), conversely, were punished as fear of slowing trade flows overwhelmed any potential benefits from falling U.S. Treasury yields. Within investment styles, lopsided markets were illustrated by the ratio of short positions taken on value stocks to those on growth reaching extreme levels.

From Near Meltdown to Possible Melt Up

Since late summer, signs that these imbalances were beginning to correct have emerged. Investors only shrugged at a nearly 48 basis point (bps) rise in 10-year U.S. Treasury yields and indication from the Fed that its pause in rate cuts was indefinite. This marked a stark contrast to last December when investors hyperventilated over Fed plans to continue its normalization program. Since the Fed’s October “hawkish” rate cut, several U.S. stock indices have logged record highs and the spreads between corporate credit yields and those on their risk-free benchmarks have narrowed considerably.

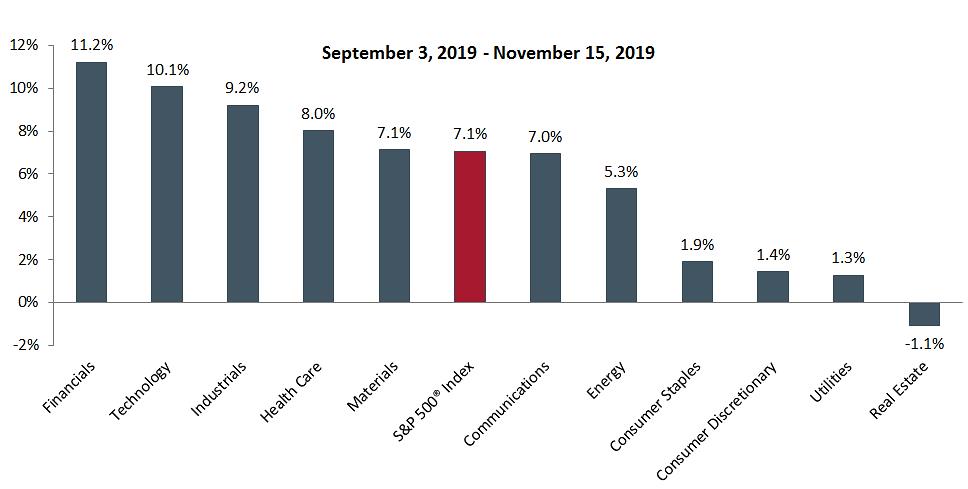

Unlike the early-year rally, heretofore neglected equity sectors have led the charge, among them traditionally cyclical financials, industrials and materials while utilities and consumer staples have lagged. Also buttressing financials is the resuscitation of value, which has bucked the years-long trend of underperforming growth stocks.

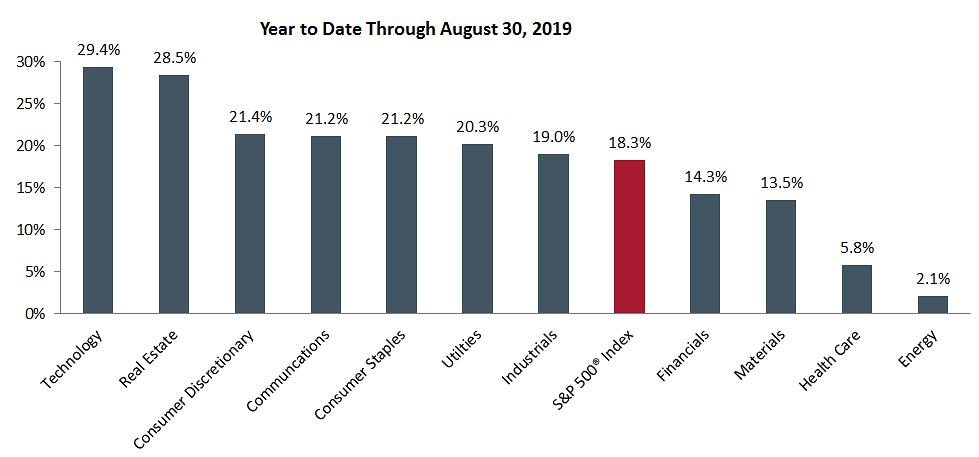

Exhibit 1: 2019 S&P 500® Index Sector Returns

Traditionally defensive sectors – along with tech and a resilient consumer – led stocks higher through August, before being replaced by more cyclical market segments.

Source: Bloomberg. Sector weights based on GICS classifications.[/caption]

Source: Bloomberg. Sector weights based on GICS classifications.[/caption]

The leadership of cyclical and value stocks hints at more favorable economic prospects. Behind this is growing optimism that a resolution to the trade war is within reach. Outside of this arguably self-inflicted wound, the U.S. economic backdrop has remained solid. Both manufacturing and services purchasing manager indices show signs of bottoming, corporate earnings have exceeded expectations and the consumer, supported by a healthy jobs market, has proven resilient.

Playing Catch-up

Our view is that – should trade optimism not prove ephemeral – the economic environment sets up well for the rally in riskier assets to continue. An improving economic outlook will likely favor the cyclical sectors that have recently outperformed. Similarly, the removal of near-term headwinds may provide breathing room for value stocks to find additional catalysts to improve their valuations. At the very least, the nascent steepening of the yield curve should help the profitability of banks, which comprise a material share of the value segment.

We also believe that a resumption of trade flows should help emerging markets recover lost ground. Unlike the early-year underperformance, EM stocks have more recently held their own against developed market peers. With the “defensive U.S.” trade likely over and little risk of Fed rate hikes drawing flows from investors capitalizing on yield differentials, EM assets may be entering a sweet spot.

Inflation No Longer an Abstraction

The same conditions that are favorable for riskier assets are also conducive for an uptick in inflation. We don’t foresee runaway inflation, but after consistently running below trend, annual price increases may finally inch toward the Fed’s 2.0% target. In addition to the risks posed by rising wages leaching into higher prices, materials producers have significantly underinvested in new projects in the wake of a half decade of weak commodities prices. Such periods of underinvestment can lead to price shocks once demand returns. A lesser-recognized inflationary factor may be corporations exhausting lower-priced inventory purchased in anticipation of the trade war and replacing it with more expensive materials and intermediate goods.

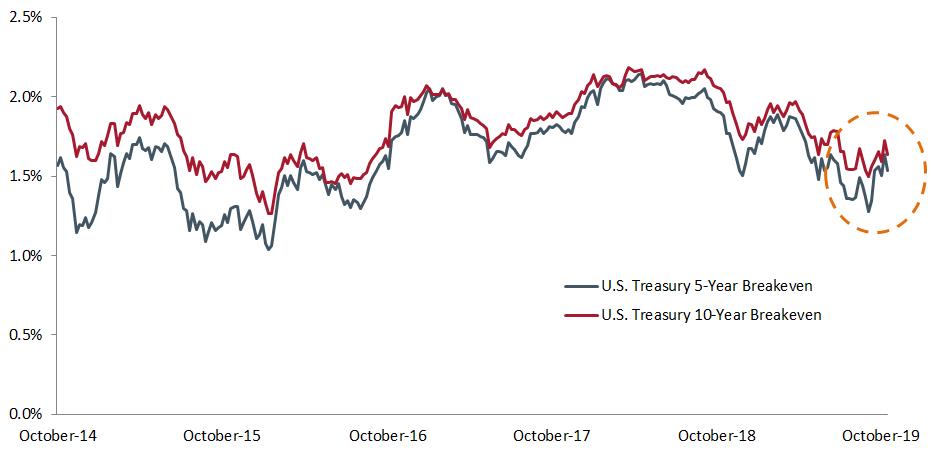

Exhibit 2: Bond Market-Based U.S. Inflation Metrics

While still below 2018 levels, the market has been able to digest higher nominal Treasury yields and bond market-based inflation expectations.

[caption id=”attachment_251987″ align=”alignnone” width=”935″] Source: Bloomberg. As of 11/15/2019.[/caption]

Source: Bloomberg. As of 11/15/2019.[/caption]

On a macro level, the volume of money created during the post-crisis era is inflationary. A contributing factor to subdued inflation is that the velocity of money circulating through the economy is well below its long-term average. Given the volume of broad money in the system, it could take only a slight increase in velocity to ignite an inflationary surprise. Yet perhaps most important, the Fed has stated that it’s willing to let inflation run above target for a period of time before considering the resumption of rate hikes.

Poorly Positioned

We believe that with respect to inflation, the market is perilously positioned. In many circles, disinflation has become dogma. Yet, as evidenced by the recent performance of cyclical stocks and the rise in Treasury yields, a growth spurt in already tight labor markets may catch complacent investors off guard. Should this autumn’s rotation prove well founded and durable, investors scrambling to exit their defensive positions and covering short bets on value stocks may serve as an accelerant to the paradigm shift.

Whose Turn Is It in 2020?

Consequently, we believe market performance in 2020 may look far different than what transpired over much of 2019. Foremost, sectors and asset classes that tend to benefit from higher interest rates look well positioned. Conversely, longer-duration bets – at least in the U.S. – have likely run their course for now. Volatility may increase across asset classes as the dampening effect of lower interest rates diminishes.

With equities at record levels, we believe their upside, in aggregate, is limited, but that masks more granular opportunities. Not only do cyclicals, value and EM stocks likely have more room to run, companies capable of passing along price increases stand to do well in a more inflationary environment.

We believe that the prospects for commodities are favorable. Already, options markets are signaling the possibility of higher returns over the near to mid term. When considered as a long-only asset class, commodities have been recent poor performers. Yet, perhaps more than other investments, the commodities complex tends to be governed by the concept of mean reversion as underinvestment ultimately begets higher prices, especially if demand ticks up.

Thinking Outside the Box

When looking at commodities through an “alternatives” lens, their diversifying benefits, especially in periods of rising inflation, may prove valuable additions to a 60/40 stock and bond portfolio. Given what is shaping up to be a challenging environment for bonds and broad-based stock gains likely limited, strategies aimed to deliver uncorrelated returns may prove to be an effective tool for dampening portfolio volatility should the economic cycle extend well into 2020 and perhaps beyond.

ABANDON YOUR DOUBTS,

NOT YOUR GOALS

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe