Investment roundtable: Views on the global economic outlook

Global Bonds

-

Chris Diaz, CFA

Chris Diaz, CFA

Co-Head of Global Bonds | Portfolio Manager -

Andrew Mulliner, CFA

Andrew Mulliner, CFA

Portfolio Manager -

Nick Maroutsos

Nick Maroutsos

Co-Head of Global Bonds | Portfolio Manager

Our senior global bond portfolio managers respond to common investor questions on the global economic outlook.

Key Takeaways

- With different regions around the world at various stages of the economic cycle, Co-Head of Global Bonds Nick Maroutsos suggests investors may need to take a global approach to find the most attractive risk-adjusted bond opportunities.

- Currency markets indicate that the US economy is further away from recession than many developing countries, says Co-Head of Global Bonds Chris Diaz, a scenario that should help the dollar remain relatively strong.

- Portfolio Manager Andrew Mulliner urges investors not to focus too closely on the trade war – which he feels is aggravating, not causing, a cyclical slowdown in the global economy – but to concentrate instead on the factors impacting the underlying cycle.

As the investing world grapples with the threat of global recession and falling government bond yields, we invited senior members of our global bonds team – Nick Maroutsos, Chris Diaz and Andrew Mulliner – to respond to common investor questions. In the Q&A that follows, they provide their individual outlooks for the US, European and UK economies, and discuss the US yield curve, currencies, politics and more.

What is your general outlook for the global economy? Is recession on the horizon?

Nick Maroutsos: We don’t see the US entering a recession. Other regions, however, may not be as fortunate. The US consumer remains resilient, aided by continued jobs growth and wages managing respectable gains of just over 3% annually. Further easing by the Federal Reserve (Fed) should help keep both consumers and corporations from pulling back spending. Trade issues have yet to filter through the broader economy – although some sectors, such as manufacturing, have experienced acute stress.

Other regions face grimmer prospects. Europe is particularly dysfunctional, with Brexit looming over the UK and potentially negative economic growth in the eurozone. The region’s weakness is not only reflected in economic data, but also in low-to-negative government bond yields. In fact, we believe that the European Central Bank (ECB) has little choice other than to re-engage in extraordinary measures, namely asset purchases.

Looking at Australia, the picture is mixed: While the country faces stresses in its housing market, employment remains strong. For a variety of reasons, we believe that the Reserve Bank of Australia (RBA) will aggressively lower rates, which should help economic growth stay positive.

If your base case is that the US is not entering recession, what then should investors make of the US Treasury yield curve inversion?

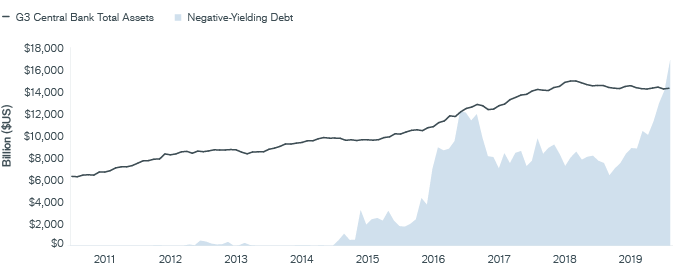

Chris Diaz: In a world with nearly $15 trillion1 worth of negative-yielding government bonds, we are exceptionally wary of seeing risk-free Treasury rates as a reliable indicator of where the economy is going. The sheer volume of negative-yielding debt is a strong signal that there are artificial influences on the yield curve, in large part caused by the significant quantity of government bonds being bought by central banks. Central banks are non-economic buyers; they are buying bonds to support global growth in a disinflationary environment. These are exceptional times, and we should look at the yield curve in that light.

Other indicators suggest that the US economy is in pretty good shape – outside of the trade-related and manufacturing sectors. Unemployment is near a 50-year low, income levels are rising and the stock market is back near the record high set this summer. As the majority of hiring in the US is being done by small- and medium-size companies, and the importexport sectors are not a large part of US gross domestic product (GDP), neither a significant degree of contagion from the US-China trade battle nor economic weakness in Europe is likely to weigh on the US So while the US economy is cooling, we do not expect this stage of the cycle to lead us straight into a recession.

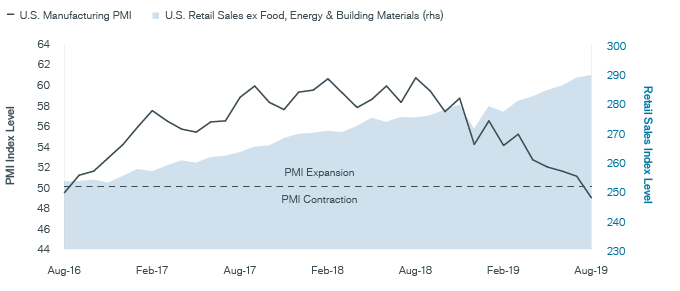

US Manufacturing Purchasing Managers’ Index and Retail Sales Diverge

Possibly affected by trade, US PMI signals contraction, while data indicates the US consumerremains strong.

Source: Bloomberg, as of 31 August 2019

What are the currency markets telling us about the probability of recession?

Diaz: The currency markets are telling us that the US economy is in significantly better shape than other G102 countries and is further away from recession than many developing countries. In recent years, I think interest rate differentials have become a less influential factor for currency valuation, a scenario that is unlikely to change in the current low-yield environment. A valuation of the US dollar anchored in actual or predicted interest rate differentials should be treated with skepticism. Relative economic strength and political concerns – see the UK’s pound sterling, for example – have been and are likely to remain more important. As long as the US economy remains stronger than the rest of the world, the dollar should remain relatively strong.

We’ve established that other regions may not be as fortunate as the U.S. What do eurozone data tell you about the outlook for those economies?

Andrew Mulliner: Current eurozone data is generally weak, particularly in economies with large exposures to manufacturing and trade, such as Germany. The weakness of European growth relative to most other global economies has been a fairly persistent state for most of the last decade, reflecting the hangover from the European sovereign crisis, consistently tight fiscal policy and monetary policy that has tended to lag behind the needs of the economy.

The more recent weakness is a truer reflection of the weakening of the global economic cycle, largely dictated by China and aggravated by the trade war. Europe, and Germany in particular, are much more exposed to global trade than most other large developed economies. This explains why Germany is so clearly the epicenter of economic weakness in the eurozone. Unfortunately, the depth of pain being experienced by the German manufacturing sector is so significant that a German recession is increasingly likely, and with it, we should expect to see higher unemployment. Typically, with an economy like Germany in recession, the rest of the eurozone would be expected to suffer to a reasonable extent as well. However, the silver lining in this scenario may be a long-awaited turn toward fiscal easing – in Germany in particular, but also in the eurozone as a whole.

Negative-yielding global debt and G3 Central Bank total assets

With central banks acting as the marginal buyer of bonds globally, a greater amount of debt exhibits negative yields as economies slow.

Note: G3 central banks include the US Federal Reserve, the European Central Bank and the Bank of Japan. Negative debt represented by the Bloomberg Barclays Global Aggregate Negative Yielding Debt Market Value USD. Bloomberg Barclays Global Aggregate Bond Index is a broad-based measure of the global investment-grade fixed-rate debt markets.

Nick alluded to the further challenges Brexit will present. What are the ramifications of a no-deal Brexit for the economies of the UK and Europe?

Mulliner: A true “cliff edge” no-deal Brexit would clearly be extremely disruptive to the UK economy and to the European economy, but to a lesser extent. Given the degree of entanglement between the two built up over the last 40 years, a sudden end to the relationship would potentially disrupt transport links and the supply of medicines and food, as well as result in severe costs to businesses with supply chains that crisscross the channel. The Bank of England recently revised its no-deal Brexit scenario and is now expecting a 5.5% fall in UK GDP with unemployment doubling and inflation rising significantly. The impact on Europe would also be substantial, albeit much smaller than the UK, with certain countries, industries and companies particularly affected. Ireland, specifically, is very vulnerable, as is the auto industry, given the complexity of the supply chain.

Whether a cliff edge no-deal Brexit actually happens is another question, but the reality is that the UK economy is already facing the risk of slipping into a recession. Away from Europe, the direct real economic impact of Brexit would likely be relatively insignificant. However, with market sentiment already fragile, a no-deal Brexit could end up being the straw that breaks the camel’s back in terms of risk sentiment and further denting of the UK’s already flagging business confidence.

What parts of the world are economically healthiest, and what opportunities do those areas present for taking risk in fixed income?

Maroutsos: Given that different regions are at different stages of the economic cycle, and monetary policies are not easing in lockstep, investors should consider taking a global approach to find the most attractive risk-adjusted bond opportunities. While capital may be flowing to the relatively higher yields of the US, other regions that are likely to skirt recession can offer more reasonable valuations. Furthermore, there are several ways to access global issuance in a manner that mitigates risks typically associated with foreign markets. One can hedge local currency issuance back to US dollars or buy dollar-denominated securities issued by US corporations in foreign markets. The incremental yield one can generate with such tactics limits the need to increase interest rate or credit risk.

More specifically, the ability of Australia and the US to lower interest rates makes the front end of their respective curves attractive, in my view, particularly relative to longer-dated securities. Several non-US issuers may also present opportunity – Australian banks, for example, are considered of such high quality that one can gain additional yield by descending their capital structure without incurring materially higher credit risk.

Do you have concerns about valuations as the global economy slows?

Maroutsos: The expectation of additional rate cuts and continued central bank asset purchases is not only keeping downward pressure across the yield curve, but it is also impacting riskier assets. “Fear of missing out” has pushed investors toward higher-yielding corporate bonds in search of carry, or excess income. In this regard, rich valuations reflect investor desperation for yield rather than the underlying health of corporate issuers or broader economies.

That said, we believe the long-term theme of secular stagnation will remain. We expect global interest rates to drift lower, although the path may not be linear. In our view, that buttresses the argument for active management. Implicit in negative bond yields and tight credit spreads are stretched valuations. Amid that landscape, one needs to maintain the ability to trim holdings when prices no longer reflect underlying fundamentals. Yet, if the pendulum swings too far in the other direction, one must maintain the ability to tactically add risk.

Tell us what’s top of mind as you analyse the global fixed income opportunity set.

Diaz: We are closely watching the US 10-year, which is approaching 1%, as we believe it could fall to zero in 2020. Weakening global growth and the expectation for sovereign rates to continue their descent puts risk-free sovereign bonds in a favourable light.

As Nick suggested, corporate credit is a little harder to gauge. We are very late in both the business and credit cycles, companies are highly levered and spreads are tight. On the other hand, defaults are low and debt service should get easier as more accommodative monetary policy leads to lower borrowing costs. We may even see idiosyncratic buying opportunities, perhaps among European corporates, as central bank buying may once again put upward pressure on pricing.

Emerging market sovereigns are even more of a wild card, insofar as they are (broadly) more dependent on trade and on commodity prices, and thus more sensitive to the outcome of the US-China trade dispute.

Has the onslaught of geopolitical headlines caused investors to overlook key aspects of the economic environment?

Mulliner: Our key takeaway of investor behavior over the last year (and to a certain extent even now) has been that the role of the economic cycle has largely been ignored. Trade wars have become the de facto explanation for much of the weakening in economic growth this year. The reality is that the seeds of this slowdown were sown in China in 2017 and 2018, when policy was tightened dramatically as part of a campaign to delever the Chinese economy and especially the shadow banking sector. This was then compounded by the tightening of monetary policy over the same period, primarily by the Fed in the US When you have the second largest economy in the world and the global manufacturing engine engaged in restrictive economic policies, and the largest economy in the world experiencing a material tightening in monetary conditions, it should not be surprising to see a significant impact on global growth and subsequently financial markets.

To be clear, this is not to say that the trade war does not matter. It does and is significant; however, the trade war is aggravating a cyclical slowdown in the global economy, it is not causing the slowdown. Subsequently, while most financial media tends to be highly focused on the next twist and turn in the trade war, investors need to remain focused on the factors impacting the underlying cycle. This means remaining focused on credit provision in places like China, as well as the overall liquidity provision globally to investors, both in the real economy and in financial markets.

1 Source: Bloomberg, Bloomberg Barclays Global Aggregate Negative Yielding Debt, Market Value in trillions of USD, at 30 September 2019

2 The Group of Ten (G10) refers to the group of countries that agreed to participate in the General Arrangements to Borrow, an agreement to provide the International Monetary Fund with additional funds to increase its lending ability. The list includes Belgium, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the UK and the US, with Switzerland playing a minor role.

Global Fixed Income Compass

Explore MoreMore from Our Investment Professionals

The role of bonds in a negative rate worldDespite the ultra-low interest rate environment, Jim Cielinski, Global Head of Fixed Income, discusses bonds’ role as a diversifier in a broad portfolio. The perceived lunacy of negative yields

John Pattullo, Co-Head of Strategic Fixed Income, explores the phenomenon of negative-yielding bonds: how they came about, why anyone might buy them and whether they are here to stay.