Subscribe

Sign up for timely perspectives delivered to your inbox.

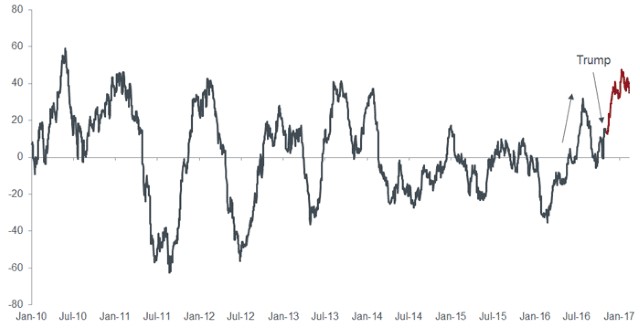

However, the catalyst for the rise in bond yields predates the US elections; since mid-2016 there have been signs that growth was picking up in the major economies. Economic surprise indices such as the G10 Citigroup Economic Surprise Index, show that economies were experiencing a cyclical uplift prior to Trump’s election, and Purchasing Managers’ Indices (PMIs) were indicating a concerted uptick in global activity.

This uptick occurred in response to a number of factors, including a loosening of monetary policy in China about a year earlier, sparking a rally in commodities. Thus, the rotation seen in equities from defensives to cyclicals and banks, the consensus move on being long the US dollar and rising bond yields were already in progress. Trump’s election simply amplified it – a ‘Trump bump’ if you like (see chart 1).

Chart 1: Major economies were experiencing a cyclical uplift pre-Trump

[caption id=”attachment_250099″ align=”alignnone” width=”640″] Source: Bloomberg, G10 Citi Economic Surprise Index, as at 14 February 2017[/caption]

Source: Bloomberg, G10 Citi Economic Surprise Index, as at 14 February 2017[/caption]

Headline inflation is on the rise around the globe on the back of rising commodity prices, while core inflation (which excludes volatile items such as food and energy) remains more muted (see chart 2). In the US the tick up in activity and expectations of expansionary policies have helped the trend, while in the UK the commodity uptick has been exacerbated by a weakening sterling following the Brexit vote. Headline inflation trends are similarly on the way up in Europe and Japan.

Chart 2: Differentiating core from headline inflation

[caption id=”attachment_250088″ align=”alignnone” width=”640″] Source: Bloomberg, monthly data as at 31 January 2017[/caption]

Source: Bloomberg, monthly data as at 31 January 2017[/caption]

Given the current inflation expectations, consensus among market participants now appears to be for a rise in 10 year US Treasury bond yields to 3%, which would represent a further significant sell-off (lower prices) in bonds. Additionally, data shows that short positions in US government bond futures have reached extreme levels compared to history.

A cyclical uptick and not a structural trendFurthermore, there is evidence that money supply growth has been declining in China and the US in recent months. Given that monetary changes usually lead activity swings by between six and 12 months, this indicates a mild slowdown around spring time this year. We therefore believe that consensus positioning has gone too far and this is, perhaps, a sign that the reflation trade may soon have run its course.

All in all, this is not an unusual picture and does not in our opinion represent a regime change; it simply reflects the normal ebb and flow of economic cycles.

As bond investors our focus is on income, while we try to also preserve capital for our investors. Although we believe that the current run of inflation will likely tail off by the second half of the year, we tend to manage our portfolios pragmatically.

In 2016 we kept an open mind on duration (interest rate sensitivity) with a view to potentially extend or lower it within our portfolios subject to how the world economies behaved. Thus we profited by positioning for the different policy responses that were expected post Brexit and the election of Trump. This was achieved by increasing duration following Brexit, which brought about a monetary policy response, and aggressively cutting it post Trump’s election, which led to a rise in expectations for fiscal policies aimed at growth.

Going forward, given low default rates in Europe, while those in the US have also peaked, should the consensus prove correct, we would view any sell off in bonds as an opportunity to find quality investment grade US corporate bonds. To us, the current yield levels present more of an opportunity than a threat. The biggest threat to our portfolios to our mind is a systemic risk in Europe as a result of politics.

We continue to favour sensible income from large, non-cyclical businesses, which are most likely to continue paying their coupons in the years to come. In 2017, coupons should look after investors reasonably well.