Subscribe

Sign up for timely perspectives delivered to your inbox.

Optimists cite October manufacturing PMI results as evidence that global economic momentum is rebounding. Such hopes appear premature.

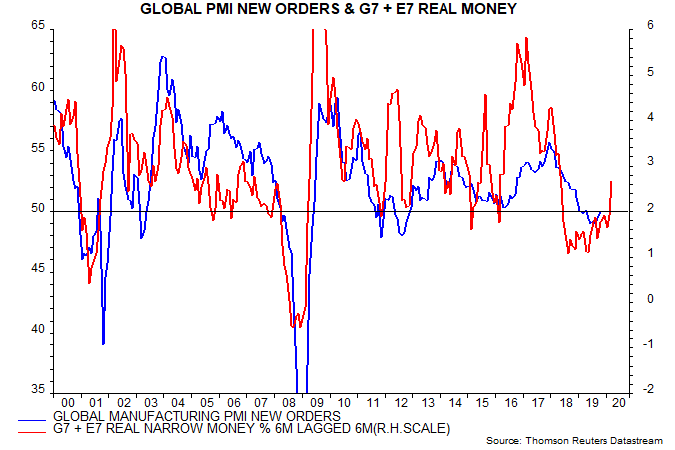

The global manufacturing PMI new orders index bottomed at 49.0 in June / August, reviving to the 50.0 breakeven level in October. A turnaround had been suggested by a revival in global six-month real narrow money growth in early 2019 – see first chart.

Real money growth, however, stalled between February and August 2019. Allowing for the usual lead, a further recovery in PMI new orders could be delayed until late Q1 2020.

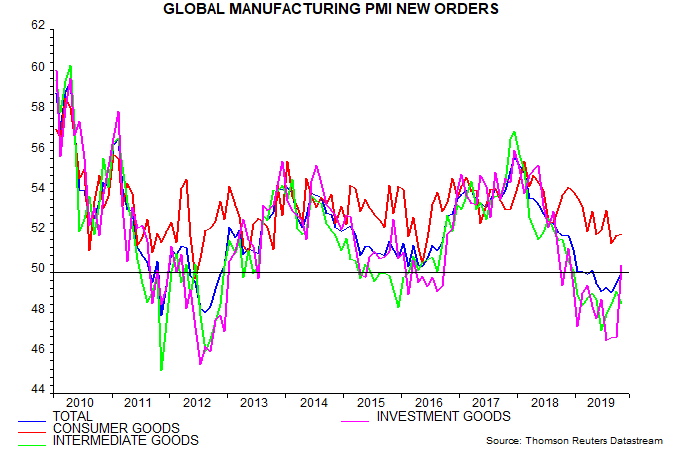

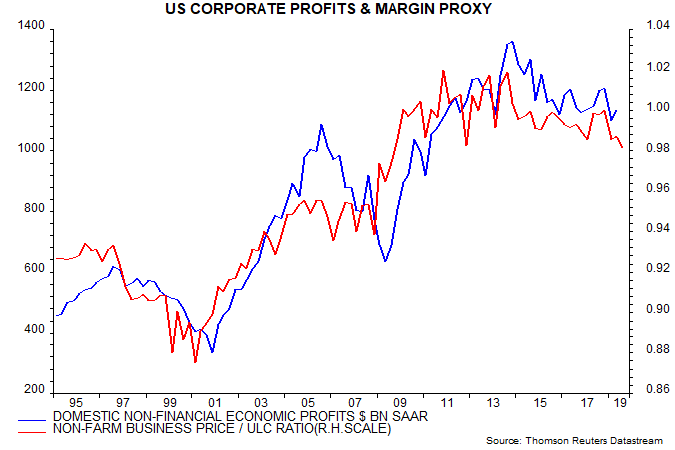

The October rise in the orders index, moreover, was driven by the investment goods component, with consumer and intermediate goods orders little changed – second chart. Business investment, however, usually follows profits, which remain under pressure from weak sales and falling margins. The ratio of US non-farm business prices to unit labour costs, for example, fell in Q3, suggesting a decline in the national accounts measure of domestic non-financial corporate profits – third chart.

The US / China economic dispute escalated in August / September, possibly resulting in some front-loading of investment goods orders ahead of scheduled US tariff hikes.

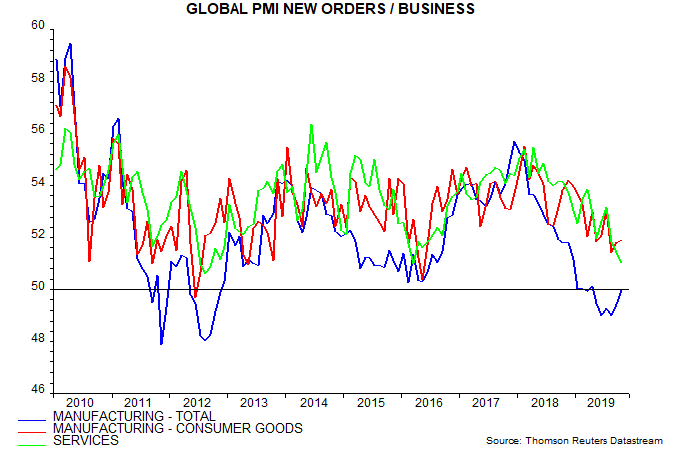

The global services PMI survey, meanwhile, weakened further in October, though is dismissed by the bulls as a lagging indicator. This may be unwise: the services new business index correlates with manufacturing consumer goods orders, with the relationship suggesting a decline in the latter – fourth chart.

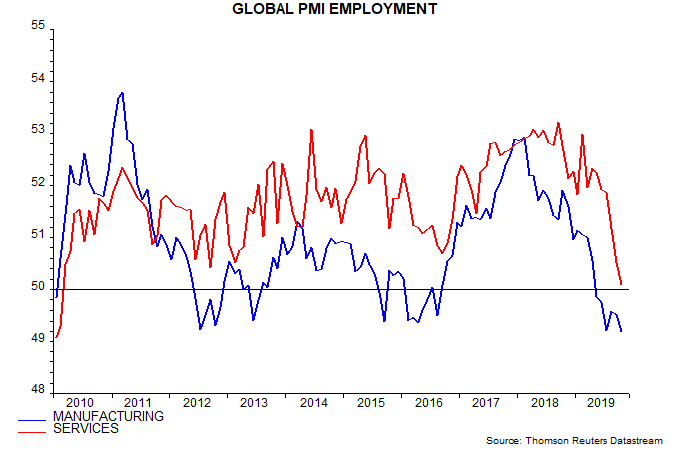

The employment indices of the two surveys signal fading income support for consumer spending, with October readings the lowest since 2009-10 – fifth chart. A rise in unemployment would reinforce a recent trend towards credit tightening by bank loan officers (see last week’s Fed survey), impairing transmission of monetary policy stimulus.