Subscribe

Sign up for timely perspectives delivered to your inbox.

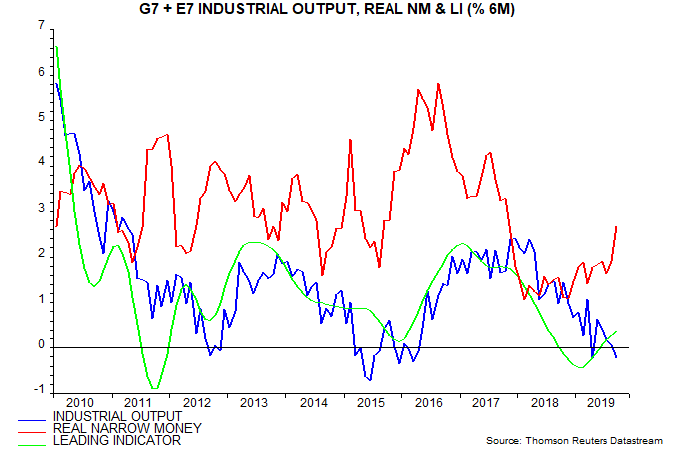

Short-term leading indicators suggest a modest revival in global economic momentum into early 2020 but – like monetary trends – have yet to signal a full recovery.

The forecasting approach here seeks confirmation for global monetary signals from a shorter-term leading indicator derived from the OECD’s country leading indicators. The OECD is scheduled to release September data for its indicators on 12 November but most of the component information is already available, allowing an independent calculation.

The six-month rate of change of the leading indicator bottomed in February and continued to firm in September – see first chart. Allowing for a typical lead time of five months, this suggests a revival in industrial output momentum from Q3 into early 2020.

Leading indicator growth, however, remains weak, mirroring the limited recovery in global six-month real narrow money expansion until September. Economic momentum, therefore, is unlikely to pick up significantly before Q2 2020.

The judgement here is that six-month real narrow money growth needs to move sustainably above 3% (not annualised) to signal a full recovery, in the sense of a return to trend or above-trend GDP expansion. This is not guaranteed despite policy easing.

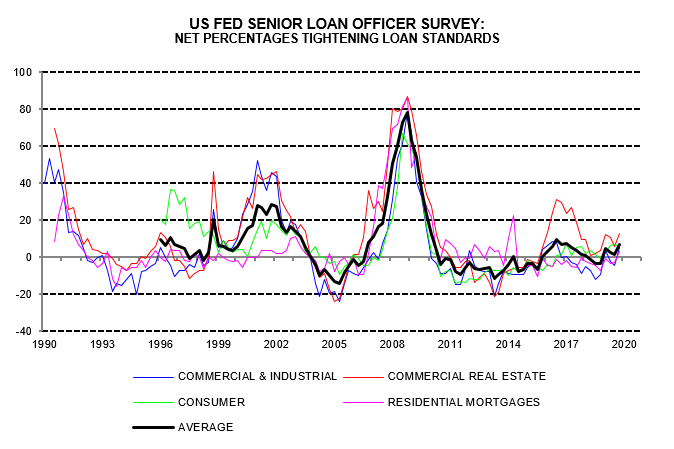

The recent sharp back-up in bond yields will have a dampening effect on money trends, which could also be held back by an autonomous tightening of credit conditions as corporate defaults and unemployment rise in lagged response to economic weakness, causing banks and other lenders to become more risk averse. There were signs of this in the Fed’s October senior loan officer survey released this week: an average of net percentages of banks tightening credit standards across various loan categories rose to the highest since January 2017 – second chart.

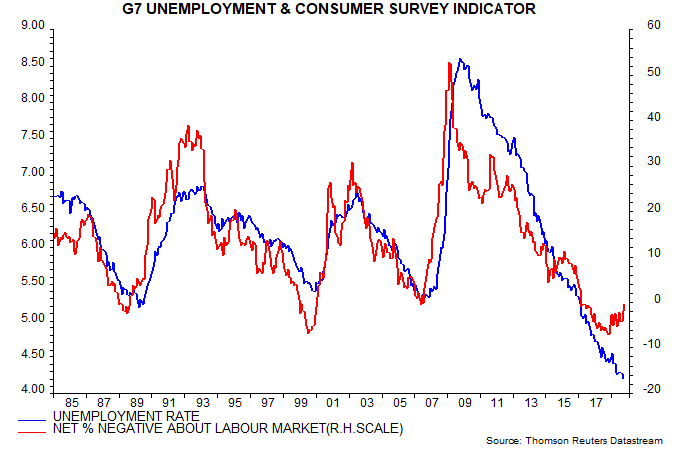

G7 October consumer surveys, meanwhile, showed a further rise in concern about labour markets, suggesting a pick-up in unemployment into early 2020 – third chart. Official jobless numbers rose in the latest month in the US, Japan, Germany, the UK and Italy (plus Spain), though fell in France and Canada.