Subscribe

Sign up for timely perspectives delivered to your inbox.

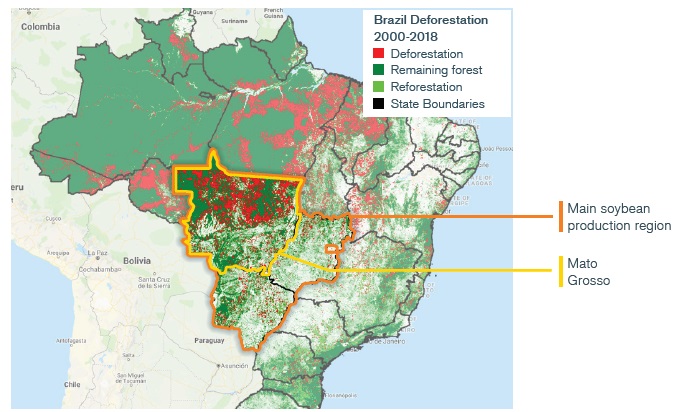

The Amazon rainforest has dominated headlines this year, with huge swaths of it burning as farmers and ranchers turn virgin rainforest into agricultural land. While attention has been rightly focused on record levels of deforestation in the region, the drivers are poorly understood. In truth, the US-Sino trade war, US farm policies and an emerging Chinese middle class have all indirectly driven Brazilian farmers deeper into the Amazon rainforest.

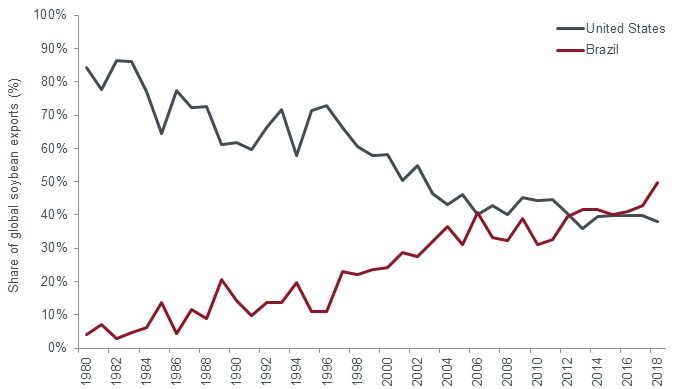

A key driver of Brazil’s agricultural expansion has been the desire to capture the disposable income of the emerging middle class in China, which has fuelled demand for meat – in particular pork, fed from soybeans grown in Brazil and elsewhere. The statistics are stark: 2018 saw nearly 90 million acres of soybeans planted in Brazil, a figure that is expected to rise by another 30 million acres over the next decade. Brazil has more than tripled its soybean acreage, increasing farming at a rate of 3.9% per year since 1990, deforesting an area larger than the United Kingdom during that time. Combined with advancements in farming technology and crop genetics, Brazil’s soybean production has increased six-fold to make it the world’s largest exporter of soybeans (see Exhibit 1).

Source: Bloomberg, 31 December 1980 to 31 December 2018.

Source: Gorelick, Hancher, Dixon, Ilyushchenko, Thau & Moore (2017). Google Earth Engine: Planetary-scale geospatial analysis for everyone. Remote Sensing of Environment. Data from Hansen / UMD / Google / USGS / NASA. Available online from: http://earthenginepartners.appspot.com/science-2013-global-forest

It may seem strange, but much of the blame for the current rate of deforestation can be laid at the feet of the trade war and US farm policy. China buys 65% of the world’s soybeans annually, with the vast majority coming from the US and Brazil. Soybeans became an early casualty in the US-Sino trade war, after China placed a 25% import tariffs on US-origin beans. Brazil immediately stepped in to become the main supplier to China, leading to the uptick in deforestation.

Two unlikely factors may come to the aid of the Amazon rainforest. A positive resolution to the trade war would most likely reduce the incentive for Brazilian farmers to expand production. The hope here is that the US farmer is not so jaded that they refuse to plant soybeans next year and that China follows through with meaningful purchases.

At the same time, Chinese demand for soybeans is reducing as it battles with the ravages of African swine fever, which has reduced pig populations by 30%. The disease has shown no signs of abating and is having a meaningful impact on Chinese soybean demand. At the same time, we expect a fall in pig production in China to be picked up by other parts of the world (including the US), which should bolster the demand story to a certain extent. What is clear, however, is that trade conflict is leading to a dramatic shift in supply chains.

A combination of growing demand from China’s emergent and increasingly affluent middle class and US trade and farm policies have placed a huge strain on a fragile, albeit valuable, ecosystem, as well as adding uncertainty to soybean markets. After a bruising experience in 2019 for the Amazon rainforest, a thawing of tensions between the US and China could see US soybeans reintegrated into Chinese demand. At the same time, African swine fever has reduced a key source of demand for Brazilian beans. Both of these factors could come together to reduce the incentive for Brazilian farmers to expand production in the short term. Longer term, however, demand from China is likely to remain strong, with Brazilian soybean production expanding to meet that demand.

As things currently stand, soybean markets remain finely balanced as we wait for more concrete details of what the Phase 1 trade deal could include. Initial promises of $50bn in agricultural purchases from the US would appear to tilt the balance of soybean production back to the US and lead to a substantial increase in prices; but details are light and China has indicated that $20bn is a much more reasonable number. This would move export markets back to where they were before the trade war. Brazil will remain a competitive part of the export markets and as such the world should remain oversupplied with soybeans, with demand lacklustre, which is likely to put downward pressure on the price for soybeans.