Subscribe

Sign up for timely perspectives delivered to your inbox.

Markets right now are complicated – and bifurcated. This is the result of a bizarre combination of highly elevated political and economic risk, which at the moment is not reflected in stock pricing. In a normal world, the current level of uncertainty would naturally have led to market volatility and increased hedging costs (elevated risk premiums) but so far this has not been reflected in widely used measures of risk.

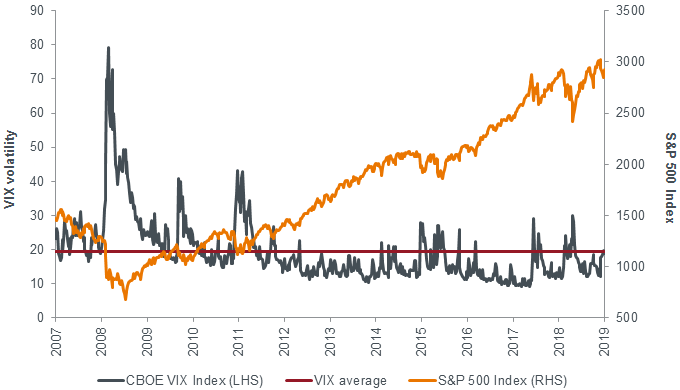

As such, we believe that the potential for large moves in the market have been underpriced. If we look at the level of implied volatility in the US market, where the Chicago Board Options Exchange Volatility Index® (VIX® Index) is a leading measure, the expectation for risk seems extremely low (see Exhibit 1). Considering its 12-year average, low yields globally, the high fiscal deficit in the US and, in our view, elevated stock market prices, we would expect this to be notably higher. We believe that the substantial short volatility exposures now common in many risk premia portfolios is partially responsible for this.

Source: Chicago Board Options Exchange (Cboe), Thomson Reuters Datastream, 31 August 2007 to 31 August 2019. The VIX is a calculation designed to provide a measure of constant 30-day expected volatility in the US stock market, derived from prices of stocks listed on the S&P 500 Index and put options.

While it is likely we will see some resolutions to current risks in markets – take your pick from Brexit uncertainty, ongoing trade tensions, recession risk in Germany or the Hong Kong protests – to us, volatility still looks cheap. Based on this view, investors might consider adding protection features to their strategies, holding positions that would react positively if risk premia widen and volatility spikes, which usually coincides with sharp market falls. This would add long convexity exposure to a portfolio.

Our current worst case is that markets tread water, which is reflected in the current levels of implied volatility in the VIX Index. An environment of low volatility and small market moves would be the least positive outcome for a protection strategy, but it is not one we expect. It is worth keeping in mind the common financial market axiom that ‘in times of extreme stress, all correlations go to one’. Periods of acute market stress can cause pricing for otherwise seemingly diversified assets to synchronise. In our view, purchasing explicit protection is the right thing to do in the current market environment.

Recent years have seen a dramatic change in the structure of the market. High frequency traders (HFTs) are increasingly acting as market makers, and accounting for an increasing share of market volumes. In terms of risks on our radar, if markets get stressed, there is the potential that liquidity could dry up should HFTs withdraw from the market to avoid being adversely impacted by uncertainty. Liquidity constraints come with a number of potential consequences, including higher market volatility. We saw that in December 2018, when US equities saw their biggest monthly decline since the Global Financial Crisis.

So where does the opportunity lie? Currently we see potential signs for a more significant resetting in markets ahead, keeping in mind the failure of markets to accurately price in downside risk. We can see the evidence, but timing the market is virtually impossible: at a push, we would expect this narrative to play out at some point over the next 12 to 18 months. That is why we have permanent, systematic ‘always on’ protection, plus some discretionary convexity within our multi-strategy portfolios.

The multi-strategy team operates as a single global unit within the Diversified Alternatives team, with a good overlap in terms of time zones. The broader team has regular meetings, supplemented with discussions with individual strategy managers to consider ideas in more detail, ensuring a more rounded exposure. The team currently has a steady defensive bias, utilising an explicit protection strategy with the aim of providing diversification benefits for investors’ portfolios, while netting gains and losses in a single outcome when protection pays off. The aim is to deliver a very low correlation to both bonds and equities, sourcing returns from very different areas. The use of in-house expertise, with a strong pipeline of research, is complemented by the flexibility to buy ‘best in class’ external research providers.