Subscribe

Sign up for timely perspectives delivered to your inbox.

Government bonds have been a key part of diversified portfolios for most investors for the last generation. Bonds have been expected to provide the twin benefits of capital gains as well as a measure of capital preservation in falling stock and property markets. With US 10-year government bond yields falling back below 2% this summer to almost historic lows (as at 7 October 2019), it reduces the attractiveness of the concept of ‘bonds for the long run’ when the expected returns are falling seemingly with each passing month. It also raises concerns as to whether bonds can provide the historically meaningful diversification and returns characteristics that they have been known for.

This may leave investors asking the question: are there strategies that can be applied in bond markets that offer the potential to generate returns in a manner that provides a differentiated return stream and adds value to a portfolio?

For many years, factor-based strategies have been used to construct robust non-directional portfolios.

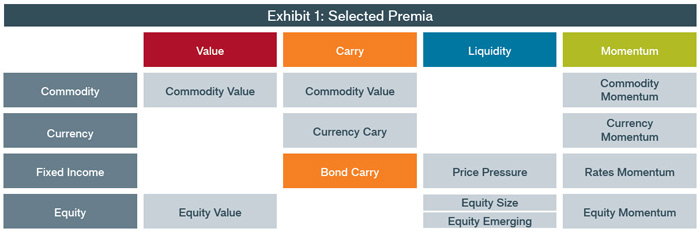

The use of well-known, academically verified, economically intuitive premia such as value, carry, momentum and liquidity can potentially add value to a traditional portfolio by providing exposure to an uncorrelated, diversifying absolute return stream. The table below is a summary of the risk premia and asset classes considered. In this paper, we focus on bond carry.

Carry can be defined as the return (or premia) accruing to an investor from holding (being long) a higher yielding security over a lower yielding security, assuming prices remain constant. The carry factor is well-documented academically and has been shown to be robust across all major asset classes over meaningful time horizons. More importantly, carry exhibits a return profile that is not explained by other well-known premia including value and momentum¹.

When applied through the lens of bond markets, bond carry is based on the notion that markets exhibiting steeper yield curves offer higher levels of risk premia than those markets that are less steep. A bond carry strategy seeks to harvest the yield differential between markets with steeper yield curves and those with less steep yield curves. As such, positive returns for a bond carry strategy are not driven by a reliance on rising bond prices, but provide another lens with which to view bond markets through the analysis of yields between bonds of different countries.

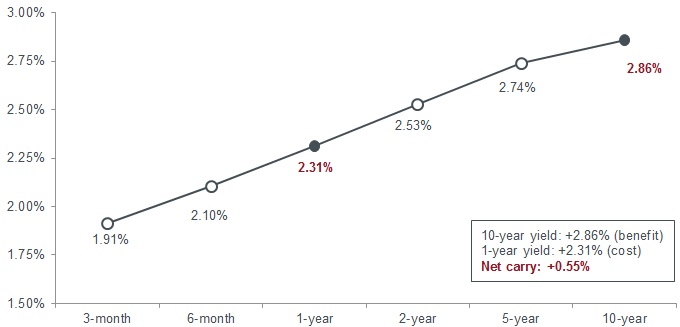

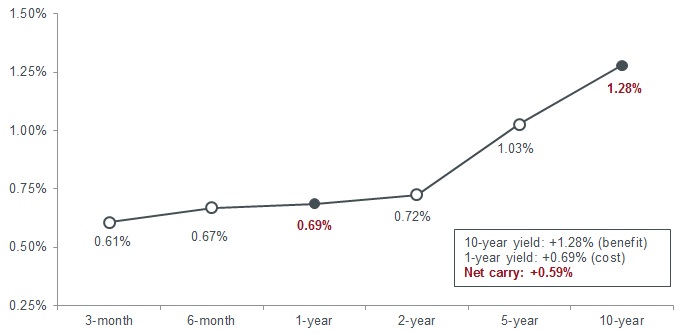

Exhibits 2 and 3 provide an overview of positioning for US and UK bonds based upon the yield curve and implied carry.

While small, all else being equal, there could be a benefit to being long the steeper UK yield curve versus the US yield curve, as it provided a higher carry at the time.

The US yield curve rose gradually and demonstrated positive carry when comparing the longer-dated 10-year yield to the shorter-dated yields.

Source: Bloomberg, as at 30 June 2018. For illustrative purposes only.

The UK yield curve also demonstrated a positive carry over time, but was slightly steeper when compared to the US yield curve.

Source: Bloomberg, as at 30 June 2018. For illustrative purposes only.

We can construct a simulated portfolio using major listed bond futures from the US, Germany, Japan, the UK, Australia, and Canada.

Each month, the simulated bond carry strategy allocates synthetic long exposures to the futures of the two markets with the highest levels of implied carry out of the six bond markets and synthetic short exposure to the futures of the two markets with the lowest levels of implied carry. Implied carry is estimated on a daily basis for each market as the difference between a generic 10-year bond yield and the 1-year note yield (as shown in Exhibits 2 and 3 for the US and the UK, respectively). In order to mitigate drawdowns and exposure to events with tail risk, a volatility target of 8% is applied.

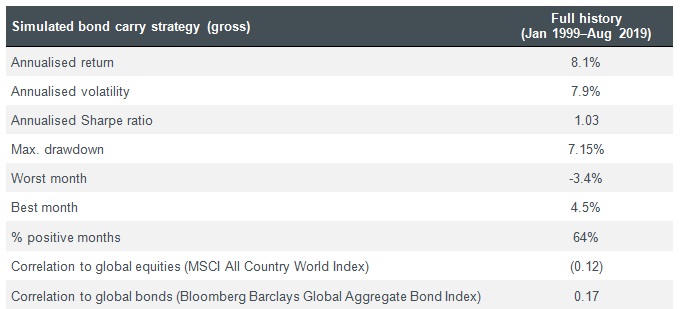

The results for this simulated portfolio are shown in Exhibit 4 for the period from January 1999 to August 2019.

Source: Janus Henderson, as at August 2019 in USD. This example is for illustrative purposes only.

On a standalone basis, the simulated carry strategy demonstrated consistent risk-adjusted returns over time, with reasonable volatility and drawdowns, and low to negative correlation to global stocks and bonds.

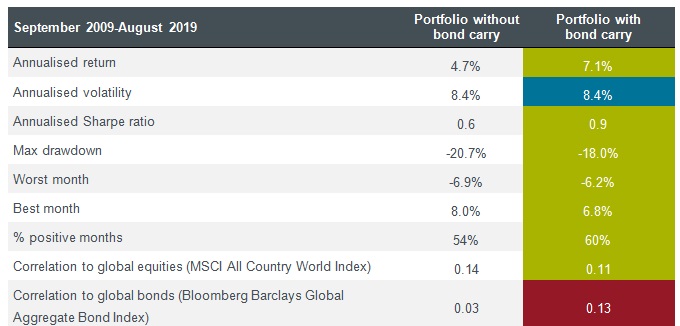

While this strategy provides a positive expectancy on a standalone basis, does it add value to a diversified portfolio of risk premia? Looking at the 10-year history of a model alternative risk premia portfolio in Exhibit 5, the answer would appear to be yes, with the addition of simulated bond carry providing a number of benefits.

Past performance is not a guide to future performance.

Source: Janus Henderson Investors, Bloomberg, as at June 2019. Note: Hypothetical back-tested performance of a model portfolio using the selected premia noted in Exhibit 1, with and without bond carry, gross of fees. Allocation within each model portfolio assumes a risk parity weighting and an 8% volatility target. See disclaimers for additional information on simulated performance.

The addition of bond carry had a positive effect on both the total return of the model portfolio as well as elements of its volatility, as shown in Exhibit 5.

The first observation is that the simulated inclusion of bond carry into the diversified portfolio increased the portfolio’s Sharpe ratio from 1.1 to 1.3, a valuable improvement by the addition of only one premia. This highlights the unique characteristics of carry as a strategy with the potential to generate returns that are different to other premia.

The second observation is that bond carry demonstrated a low correlation to the constituents of the portfolio, although it had a higher correlation to the Barclays US Aggregate Bond Index during the analysis period. The inclusion of bond carry mitigated left tail returns as shown by the worst months as well as the maximum peak to trough drawdown.

While the inclusion of bond carry slightly raised the correlation of the portfolio to fixed income markets, it lowered the correlation to equities.

The analysis of bond carry highlights the potential benefits of including this risk premia in both traditional and liquid alternative portfolios. One of the reasons for allocating to a diversified risk premia portfolio is the potential for capital preservation and a more unique and idiosyncratic return stream. In an investment world of ever-shrinking opportunities and the search for defensive, liquid strategies that potentially protect the left tail of a portfolio, bond carry meets the basic tenets of an explainable, robust, scalable and academically verifiable risk premia.

Footnotes

1 Ralph S.J. Koijen, Tobias J. Moskowitz, Lasse Heje Pedersen, Evert B. Vrugt, Journal of Financial Economics, 2018, vol. 127, issue 2, 197-225.

All simulated performance results shown herein were prepared by Janus Henderson and were achieved through the retroactive application of a model construed on the basis of historical data and designed with the benefit of hindsight.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.