Subscribe

Sign up for timely perspectives delivered to your inbox.

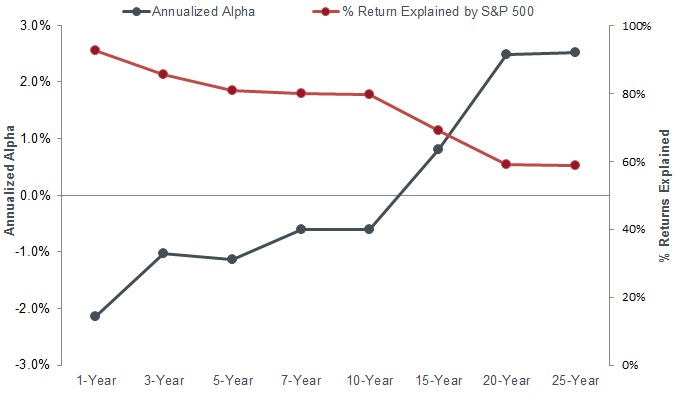

After 10 years of quantitative easing, we find ourselves in a world very different to the one that existed pre the Global Financial Crisis. Today, it is harder for active investment managers to outperform their benchmarks. Recently, even Warren Buffett acknowledged that he had found it difficult to outperform the S&P 500® Index in the short to medium term.

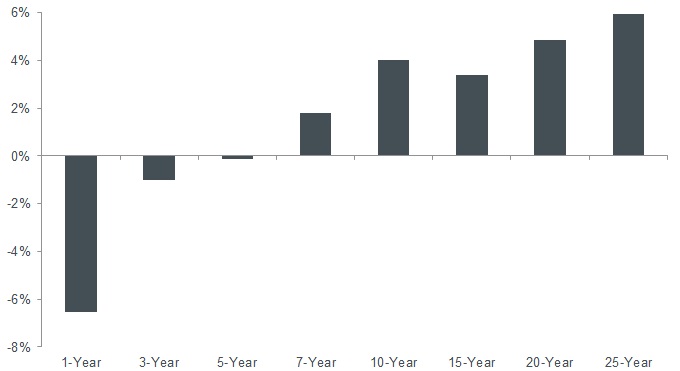

Source: Bloomberg and Datastream. Based on Berkshire Hathaway A shares to 30 August 2019. Janus Henderson makes no representation as to whether any illustration/example mentioned is now or was ever held in any portfolio. Illustrations are only for the limited purpose of analyzing general market or economic conditions and demonstrating the research process. References to specific securities should not be construed as recommendations to buy, sell or hold any security, or as an indication of holdings.

Source: Bloomberg and Datastream. HFRI Fund Weighted Composite Index data to 30 August 2019. Past performance is not a guide to future performance.

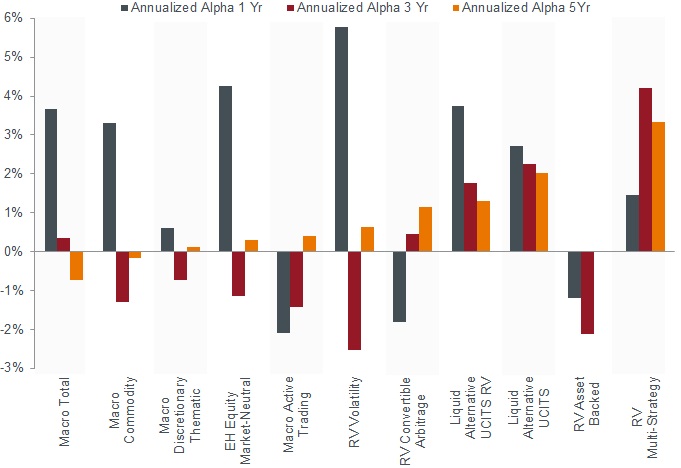

At Janus Henderson, we invest across a diversified suite of alternative risk premia and hedge fund strategies, rather than relying on equity beta. Over time our strategies aim to realise close to zero net exposure to traditional equity and fixed income markets.

Hedge Fund Research Indices show that an approach based on lower equity beta can prove beneficial. Exhibit 3 shows estimated alphas of hedge funds with equity exposures of less than 25%. Over a five-year period, many of these strategies have delivered reasonable alpha.

Source: Janus Henderson analysis using Bloomberg and Datastream data on Hedge Fund Research Indices, five years to 30 August 2019. Note: EH = Equity hedge, RV = Relative value. Past performance is not a guide to future performance.