Knowledge. Shared Blog

October 2019

Bond Market Dynamics Highlight Importance of Diversification

-

John Lloyd

John Lloyd

Co-Head of Global Credit Research | Portfolio Manager

Portfolio Manager John Lloyd explains why he believes investors should embrace diversification in their fixed income portfolios given the current dynamics of the global bond market and the likelihood of continued volatility.

Key Takeaways

- Most major sectors in the Bloomberg Barclays Global Aggregate Bond Index are trading within just 15 basis points of their five-year average spread. With the exception of MBS, which look attractive, the opportunities in asset allocation look limited today.

- However, sector-level spreads can mask significant volatility within industries and securities; we recommend investors prioritize fundamentally based security analysis.

- In our view, absent a compelling fundamental argument to be over- or underweight any of these fixed income asset classes, investors should focus on staying diversified – particularly as bond market volatility looks set to increase in the months ahead.

Global bonds have generated relatively strong returns in 2019, with corporate bonds nearing a 9.75% total return year to date and high-yield bonds not far behind at roughly 9.25%.1 Meanwhile agency mortgages, commercial mortgages and asset-backed securities have all generated positive returns so far this year. The strength of 2019 year-to-date bond returns, however, is in part a response to the generally weak returns seen in the fourth quarter of 2018, when sharply rising U.S. Treasury yields sparked volatility throughout the bond universe. If weakness in 2018 begat strength in 2019, could 2019’s strength signal weakness ahead?

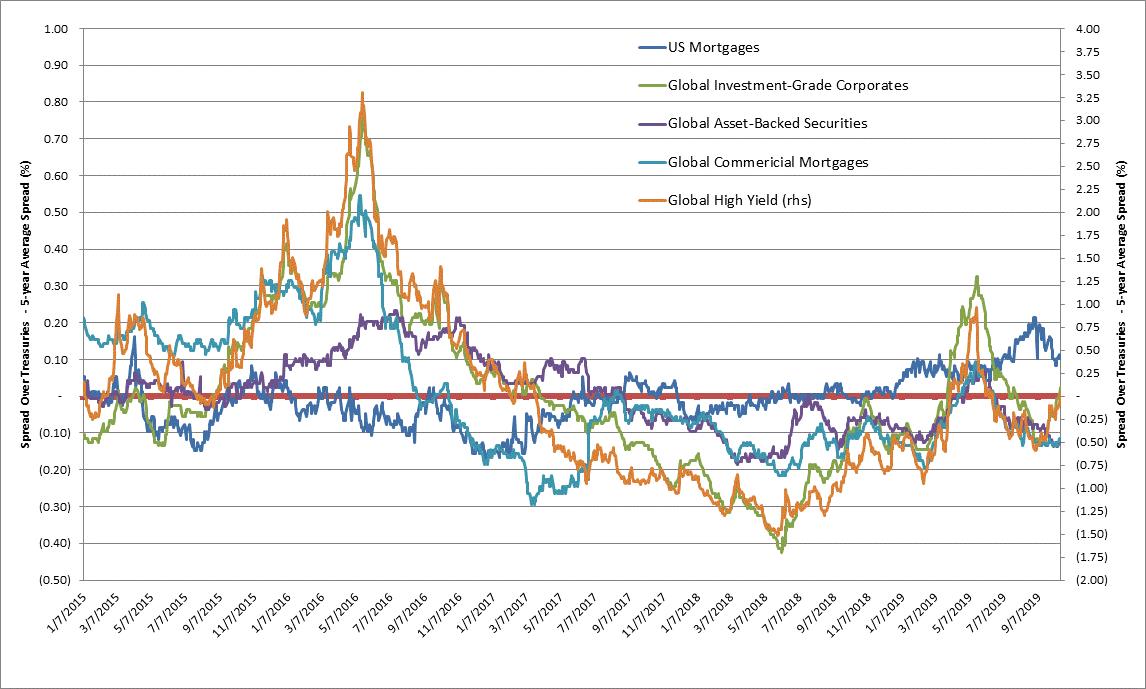

In an attempt to answer that question, we charted the spread over treasuries for the major credit components of the Bloomberg Barclays Global Aggregate Bond Index relative to each asset class’ five-year average spread. The chart shows the deviation from the average to illustrate whether the asset class is particularly weak (like the high deviation seen in 2016) or strong (such as the spring of 2018) relative to its own history. The weakness we mentioned in late 2018 – and the subsequent strength in 2019 – can be seen as the period when all of the asset classes, with the exception of mortgage backed securities (MBS), saw spreads rise relative to their five-year average in late 2018, only to fall back over the course of 2019.

Source: Bloomberg, as of 10/16/2019.

Currently, all the asset classes except MBS are trading within just 15 basis points of their five-year average spread. Thus, only MBS, which has followed its own path over the last year, looks attractive relative to its five-year history. This divergence prompted us to write recently about how MBS may provide defensive diversification as bond volatility rises, given its generally low correlation to corporate bonds spreads.

Other than MBS, current spreads make it difficult to call any of the asset classes clearly “expensive” or “cheap.” Unlike the significant deviations from the mean spread seen in 2016, when corporate bonds, high yield and commercial MBS (CMBS) all traded at significantly wider spreads than their five-year averages, or the summer of 2018, when corporate and high-yield bonds traded well through their five-year averages, the opportunities in asset allocation appear limited today.

However, it’s important to note that sector-level spreads can mask significant volatility within sectors, and even within industries. We recently wrote about how investors may be able to find opportunities in crossover credit due to the significant dispersion of returns in the U.S. high-yield market. And the swift collapse of the Argentine bond and stock market in August served as a vivid reminder of why it’s important to take a measured approach to risk taking and not allow an individual position to dominate returns. Then and now, we recommend investors seek a balance of duration and yield – as well as income and total return – in their fixed income portfolios.

Until a compelling fundamental argument to be over or underweight any of these fixed-income sectors emerges, we encourage investors to stay diversified. Should volatility increase – which seems increasingly likely in the months ahead – investors may appreciate the volatility-dampening effects that can come from a more diversified portfolio.

1The Corporate Bond sub-index of the Bloomberg Barclays Global Aggregate Bond Index returned 9.74% year to date as of October 16, 2019. The High Yield sub-index returned 9.23% as of October 16, 2019.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe