October 2019

Low yield is not no yield: Opportunities in structured credit

Securitised Products

Nick Childs, CFA

Nick Childs, CFA

Portfolio Manager | Securitised Products Analyst John Kerschner, CFA

John Kerschner, CFA

Head of US Securitised Products | Portfolio Manager Ian Bettney

Ian Bettney

Portfolio Manager

Our structured credit team highlights attractive aspects of the securitised market, including relatively short durations, high-quality credit ratings and attractive yields.

Key Takeaways

- Structured credit offers attractive yields with relatively short duration, high-quality credit ratings and low correlation to other fixed income assets.

- MBS has performed relatively well amid rising rates and benefited amid falling rates, providing income and diversity in uncertain environments.

- ABS and CLOs in both the US and Europe provide further diversity, with low correlations to corporate bonds.

Investors who want their bond portfolios to both provide diversity from more volatile markets and produce yield (income) should consider the structured credit markets. US mortgage-backed securities (MBS) and asset-backed securities (ABS), and US and EU collateralise loan obligations (CLOs) offer relatively short durations and high-quality credit ratings, while still offering attractive yields.

Low (and increasingly negative) government bond yields accompanied by slowing global growth justify a closer look at where investors can find a blend of the “defensive” exposure they expect from bonds, while still having the potential for attractive return. As tempting as it may be to add duration, move down the credit curve, or take larger and more concentrated security or country-specific positions to improve returns, none of these options are very “defensive.”

For investors that are not looking to add risk to their portfolios, the options may appear limited: buy US T-bills, keep their money in a money market account, or stash it in a savings account. But none of these options provide much income. We think investors have another option to hold defensive allocations while earning yields greater than the prevailing cash rates: structured credit.

High-quality, defensive assets

Structured credit markets are credit markets in the sense that they are loans to non-government entities, whether companies (ABS and CLOs) or people (MBS). Agency MBS securities are backed by the U.S. government, and thus share the same high-quality credit rating, and both ABS and CLOs can be bought across a range of credit ratings, including AAA. Thus, an investor can build a diverse portfolio of structured credit that is all rated AAA – the highest credit rating available.

Structured credit has been defensive in relation to other “riskier” fixed income asset classes such as investment-grade corporate bonds, high yield corporate bonds, and emerging markets. While the absolute return may not be as high as is available in high yield or emerging markets, the volatility is typically lower. As such, structured credit offers investors a more “defensive” carry (the excess yield over the benchmark) by providing a potentially higher risk-adjusted return.

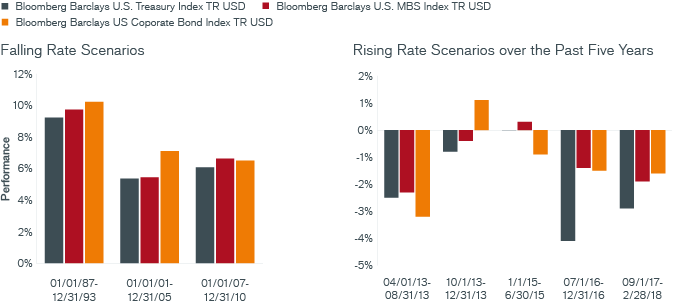

MBS has performed relatively well amid rising rates and benefited amid falling rates.

Source: Bloomberg Barclays

Notes: Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

An opportunity to add value

Structured credit often offers a wide opportunity set for active management. Within the mortgage-backed sector, the diversity of loan terms, loan sizes, property types, geographic regions, and numerous other variables driving the valuation of mortgages help provide more opportunity for active management. Similarly, the ABS and CLO markets are evolving with new and innovative structures while CLOs are serving a relatively small investor base, providing opportunities to find inefficiencies, and sometimes an attractive liquidity premium. In sum, structured credit provides more opportunity for generating incremental return (alpha) over the benchmark return (beta). Alpha opportunities not only offer an additional source of income, but often serve as a diverse source of income, which could help diminish portfolio volatility and improve risk-adjusted returns. In our view, structured credit is an asset class that offers a strong opportunity to add value, particularly through active management.

Asset-backed securities

While the ABS market contains both volatility and credit risk, the majority of ABS issuance is centered on the US consumer – in the form of credit cards and auto loans – which is welcome news insofar as the US consumer remains the strongest sector of the US economy. The fundamentals that matter most to this segment of the ABS sector remain strong: employment, income and household leverage.

Additionally, ABS structures have improved over the past decade, to the point where we believe the credit quality of ABS is often understated. The rating agencies are more conservative now than they were in 2008, having recalibrated their models to account for the extreme volatility seen in the Global Financial Crisis. However, credit enhancements or structures that provide increased buffers against losses are now more commonplace, and substantial improvements in underwriting at the origination phase generally raises the quality of the loans that comprise the structures. Finally, more securities have built-in “deleveraging” features, which can lead to the securities’ credit quality increasing over time. This deleveraging effect often results in rating upgrades in a relatively short span of time, such as within one to two years of issuance.

As a component of a broader portfolio, ABS’ low correlations to other credit markets offer welcome diversity: AAA Prime Auto, for example, has a 0.07 correlation to MBS and a 0.26 correlation to US investment-grade corporate bonds¹. These features may help the asset class dampen overall volatility in an investor’s global portfolio.

And the opportunity set extends outside of the US, with European asset-backed securities offering additional prospects for defensive carry. With an annualised 5-year return of 2.3% and annualised volatility of only 0.9%, EU ABS has an equally impressive Sharpe ratio of 1.3.² They also have historically been weakly correlated with other credit markets, as well as with US ABS. Negative Euro Interbank Offered Rate (Euribor) rates have made floating-rate EU ABS particularly intriguing at this juncture. Normally when the reference rate (Euribor in this case) becomes more negative, the yield on a security continues to decrease. But for these floatingrate securities that have a floor at 0%, their premium actually increases as government yields become further negative. For US investors, hedging the bonds back into US dollars currently results in a positive yield pickup, presenting another attractive characteristic.

Mortgage-backed securities

U.S. Agency MBS has demonstrated its defensive capabilities across a variety of market conditions, making it an attractive asset class in today’s environment. MBS have kept pace with US Treasuries over the last 10 years, generating an annualised return of 3.22% compared to Treasuries at 3.25%³, and in the major periods of declining rates⁴, MBS has outperformed.

MBS has also held up well in rising-rate environments, thus providing some comfort to investors worried Treasury rates could correct higher. MBS has performed well relative to U.S. Treasuries and investment-grade corporate credit in each of the rising rate scenarios over the past five years.

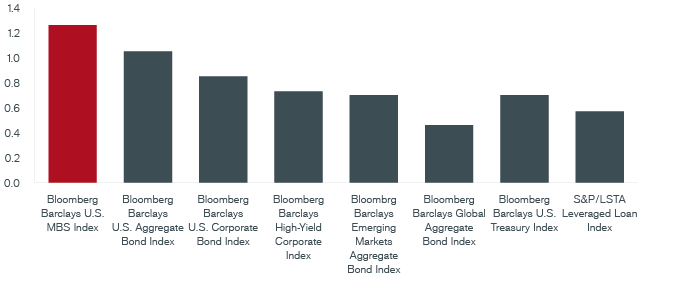

Mortgages, as measured by the Bloomberg Barclays US MBS Index, have also performed relatively well during periods of more severe financial stress, such as 2008 (MBS rose 8.3% that year), the 2011 European government debt crisis (MBS rose 2.4% during the worst quarter), and most recently in the final quarter of 2018 when many markets were volatile, MBS returned 2.1%. As such it should not be surprising that MBS has offered the highest Sharpe ratio among major fixed income asset classes since the Global Financial Crisis.

Fixed income sharpe ratios

MBS has offered the highest Sharpe ratio among major fixed income asset classes since the Global Financial Crisis. Source: Morningstar, Inc., 1 January 2008 through 30 June 2019

Source: Morningstar, Inc., 1 January 2008 through 30 June 2019

Note: Sharpe Ratio is a measure that indicates the average return minus the risk-free return divided by the standard deviation of return on an investment. Past performance is no guarantee of future results.

MBS is most susceptible to underperformance during periods of high interest-rate volatility, particularly sudden changes in volatility. However, these periods rarely last long because rate-of-change does, eventually, have to revert to the mean. And while it may feel like interest rate volatility has been high in recent years, Treasury volatility has been slowly declining over the long term.

We believe the decline in interest-rate volatility is structural, resulting from steady improvements in Federal Reserve (Fed) transparency – their communications about monetary policy are much more explicit, regular, and clarified now than they were in prior decades. This fundamental change in how the Fed manages the economy is not something we expect will change in the foreseeable future, and thus we expect long-term interest rate volatility will remain low relative to its long-term average, providing a favourable enviornment for MBS.

Collateralised loan obligations

The US CLO market is large – at near $600 billion – and growing. Yet the market is often overlooked by “fixed income” investors in both the U.S. and Europe because these pools of largely senior-secured corporate loans are all floating rate. This feature lowers the securities’ interest-rate duration, which tends to turn off those investors who see duration as a key reason to own bonds. However, we like US CLOs for their absolute yield, even if it is floating, and believe – particularly in a diverse portfolio of fixed income securities – there are many other instruments managers can use to lengthen their overall duration.

While CLOs contain credit risk, they come in a range of credit ratings, similar to ABS. The highest-rated AAA tranches tend to offer the most “defensive” yield, but AA tranches can provide more income for investors willing to take some additional credit risk.

Similarly to ABS, there are opportunities to be found globally. The European CLO market is smaller than in the U.S., currently at around $300 billion, but offers further diversification, primarily by providing access to origination managers that are not active in the United States. Additionally, the European CLO market is restricted to institutional investors, which helps mitigate the asset class’ volatility, as institutional investors tend to be longer-term holders. While the securities do have floating interest rates, they (like EU ABS) also have floors at 0%. As such, the trend toward greater negative interest rates in Europe is not concerning for the asset class, but rather makes the instruments steadily more appealing: Their interest rates cannot go negative, and will rise should government rates rise back above zero. And, when hedged back into U.S. dollars, European CLOs provide a further yield pickup due to the coupon floor. Both U.S. and EU CLOs are relatively defensive in terms of their volatility, with 5-year Sharpe ratios for U.S. CLOs near 1.0 and Europe closer to 1.8.

Structured credit offers defensive carry

The current “low yield” environment does not equate to no yield. We believe there are numerous areas within fixed income where yield can be found, without sacrificing the defensive nature of a traditional bond portfolio. Structured credit offers those attractive yields, with a number of other appealing characteristics: relatively short durations (which helps to mitigate volatility), high-quality credit ratings and low correlation to other fixed income markets. When held in a diversified portfolio, we think these securities provide “defensive carry.”

1 Source: JP Morgan Markets, as of 31 July 2019. Correlations are calculated on 10 years of data.

2 Source: Janus Henderson, and Barclays Pan European ABS Bond Index, as of 31 July 2019

3 Source: Morningstar, Barclays 10-year, as of 30 August 2019

4 Measured as periods of declining policy rates

Bond ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Alpha compares risk-adjusted performance relative to an index. Positive alpha means outperformance on a risk-adjusted basis.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Sharpe Ratio measures risk-adjusted performance using excess returns versus the “risk-free” rate and the volatility of those returns. A higher ratio means better return per unit of risk.

Basis Point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Global Fixed Income Compass

More from Our Investment Professionals

The perceived lunacy of negative yields

John Pattullo, Co-Head of Strategic Fixed Income, explores the phenomenon of negative-yielding bonds: how they came about, why anyone might buy them and whether they are here to stay. Energy: A sector in transition

The energy sector as a whole has been the weakest-performing global high-yield sector. Our corporate credit team delves into the challenges facing high-yield energy issuers today.