Subscribe

Sign up for timely perspectives delivered to your inbox.

Oliver Blackbourn, a portfolio manager on the UK-based Multi-Asset Team, comments on the departure of Mario Draghi as ECB President on 31 October 2019, as the central bank itself potentially reaches the limits of what can be achieved using the levers of monetary policy.

As Mario Draghi’s tenure as President of the European Central Bank (ECB) comes to an end, it is difficult not to recognise that the central bank is now reaching the limit of its monetary toolkit. Uttered at the height of the eurozone debt crisis, “whatever it takes” is quickly turning into “whatever they can do”. The truth seems to be that there is only so much a central bank, hemmed in by competing interests and ideology, can achieve with its monetary policy mandate.

Draghi’s consistent call for structural reform has gone unheeded but any future slowdown is likely to require government fiscal action, rather than yet further monetary policy easing.

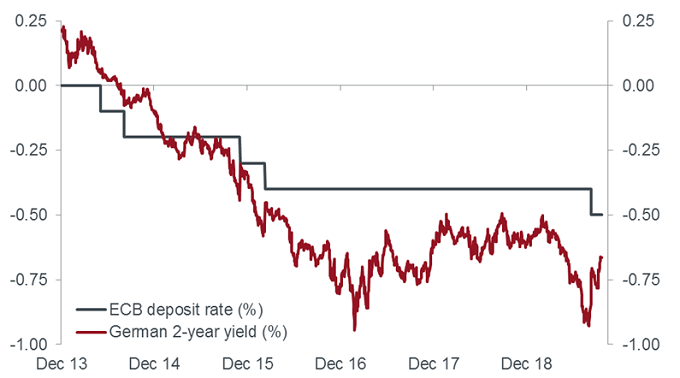

Despite the seemingly fractious end to his time in office, Mario Draghi is likely to be remembered as a dynamic central banker, prepared to push the boundaries when others stuttered. Whether you agree with the policy decisions or not, he was prepared to act to drag colleagues and politicians with him. However, he may be leaving at an appropriate time as it is difficult to see how much more innovative the ECB can be within the restrictions of its mandate. Interest rates sit well below zero and quantitative easing has already pushed various major European sovereign bond market yields into negative territory. The chart below shows the policy-sensitive 2-year German bund yield has moved within a fairly narrow range for the last three years, suggesting that policy has been reaching a limit. At the same time, concerns have risen about the negative consequences of such environments and whether continuing to ‘ease’ further would actually be helpful to the real economy.

Source: Janus Henderson Investors, Bloomberg, as at 22 October 2019

Past performance is not a guide to future performance.

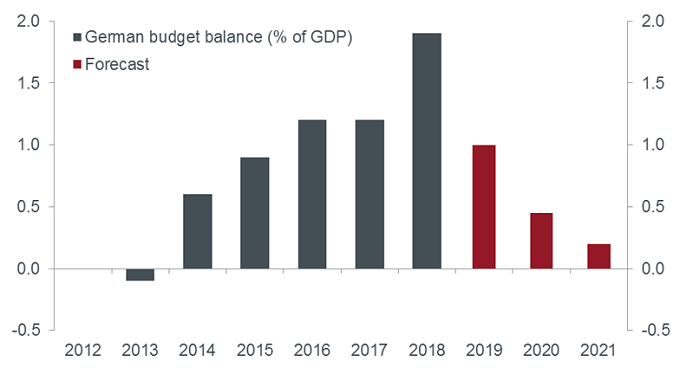

The start of ECB monetary policy decision press conferences has habitually seen Draghi call for eurozone governments to take action on structural reform to boost growth. Having fallen on deaf ears, fiscal stimulus may now remain the only meaningful action left to counteract a future slowdown in the eurozone economy. Whereas other central banks may look to help governments finance future fiscal stimulus via low borrowing costs, any suggestion of this within the strict boundaries of the eurozone’s rules would prove highly controversial. Added to this, the budget and debt limits set out under the Maastricht Treaty mean that many larger eurozone countries have limited room for manoeuvre on the fiscal front. Germany is an exception following its commitment to a budget surplus in recent years, as can be seen below in the chart. Attitudes appear to be changing but it is a slow process. Investments in infrastructure and environmentally-friendly projects are possible exceptions and may be the vanguard of a new regime of looser fiscal policy. Just don’t expect too much, too quickly.

Source: Janus Henderson Investors, Bloomberg, as at 22 October 2019

The implications of a shift to fiscal easing may be profound. Despite likely being anchored by low interest rates, bond markets could begin to move to price in greater future inflation and higher real yields, due to the expectation for stronger economic growth. With yield curves steepening as longer-term yields rise, we would expect to see more cyclical stock markets outperform, such as the eurozone. However, we are, at best, seeing the first signs of a change in attitude, there is still a lot of resistance to be overcome before this turns into reality. In the meantime, as Christine Lagarde replaces Mario Draghi, you have to wonder if the ECB has done almost everything that it can do in terms of monetary policy.