Subscribe

Sign up for timely perspectives delivered to your inbox.

Previous quarterly commentaries suggested that global economic momentum would fall into a low around Q3 2019. Recent news is consistent with the scenario but money trends have yet to give a clear signal of economic recovery. A bottoming of momentum, however, may be sufficient to warrant rotating away from defensive investment strategies that have prospered over the last 18 months.

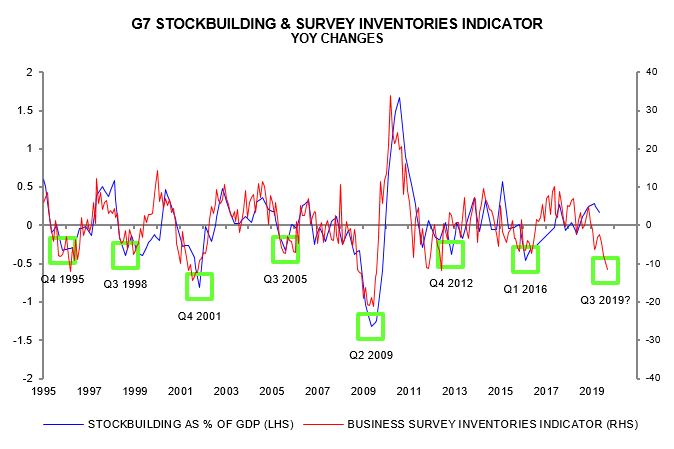

The expectation of a Q3 momentum low was based on monetary and cycle analysis. Global six-month real narrow money growth bottomed in late 2018 and leads economic momentum by nine months on average. The global stockbuilding cycle, meanwhile, last bottomed in Q1 2016 and has an average length of 3.5 years, suggesting another low in Q3 2019.

Incoming business survey data are consistent with the forecast. The global purchasing managers’ manufacturing new orders index recovered to a four-month high in September, while a survey-based indicator of the rate of change of G7 stockbuilding reached a seven-year low, consistent with the cycle being at or near a trough – see first chart.

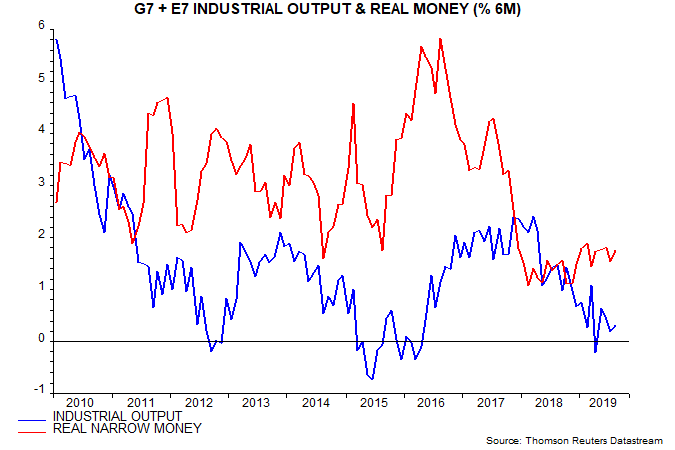

Economic momentum may be bottoming but money trends argue against a significant near-term recovery. Global six-month real narrow money growth stood at 1.7% in August, above a low of 1.1% in October-November 2018 but below the 3% level judged here to be consistent with a return to trend economic expansion – second chart.

From a cycles perspective, a prospective turnaround in the stockbuilding cycle may be offset by further weakness in the business investment cycle, which may not trough until early 2020 – the last bottom was in Q2 2009 and the cycle can stretch out to 11 years.

The baseline scenario is that economic momentum will remain weak into Q1 2020 before picking up more convincingly into mid-year. The latter forecast requires confirmation from a rise in real narrow money growth over the next three months but this is judged likely. Cycle analysis suggests that the global economy will grow solidly in H2 2020: the business investment cycle as well as the stockbuilding cycle should by then be in a recovery phase, while the upswing in the longer-term housing cycle is likely to have regained momentum in response to falling mortgage rates in 2019.

Real money trends are expected to strengthen in late 2019 for three reasons. First, narrow money usually responds with a lag to changes in long-term interest rates. Secondly, the global aggregate has been pulled down by US narrow money weakness but weekly US numbers for September indicate a pick-up. Thirdly, global six-month consumer price inflation is likely to moderate if commodity prices remain at current levels, implying a boost to real money growth unless nominal money trends weaken.

Readers have pushed back against the view that global economic momentum is bottoming because of an apparent recession signal from the inversion of the US Treasury yield curve. The 10-year / 12-month yield spread has an excellent forecasting record, turning negative before the last nine US recessions with only one false signal. Those recessions, however, were also preceded by a contraction of US real narrow money, which has expanded – albeit weakly – over the last 12 months.

The prior moves into inversion, moreover, were all at least partly driven by a rise in the 12-month yield. The current inversion is unusual because the whole curve has shifted down but with longer yields falling by more. This may disrupt the historical forecasting relationship.

Another push-back is that unemployment is likely to rise in lagged response to output weakness, depressing consumer spending and offsetting a turnaround in the stockbuilding cycle. This is valid but the effect is unlikely to dominate – economic recoveries have occurred historically despite rising unemployment as falling interest rates have stimulated spending on consumer durables and pushed down the saving ratio, cushioning the drag from slowing incomes.

How should investors position for the baseline economic scenario outlined above? Market trends over the last 18 months have in most respects been typical of historical behaviour during stockbuilding cycle downswings, with quality stocks and the defensive US market outperforming, commodity prices and emerging market equities weakening, the US dollar strengthening and Treasury yields falling. Historically, these trends have weakened or reversed following the stockbuilding cycle trough.

The case for the suggested portfolio rotation would be strengthened by a rise in global real narrow money growth, which would confirm a 2020 economic recovery scenario. A possible strategy is to start by adjusting exposures that have outperformed or underperformed by more than the historical average for stockbuilding cycle downswings. This would argue for adding to Euroland and emerging market equities at the expense of the US, and cutting back overweight quality exposure in favour of value.

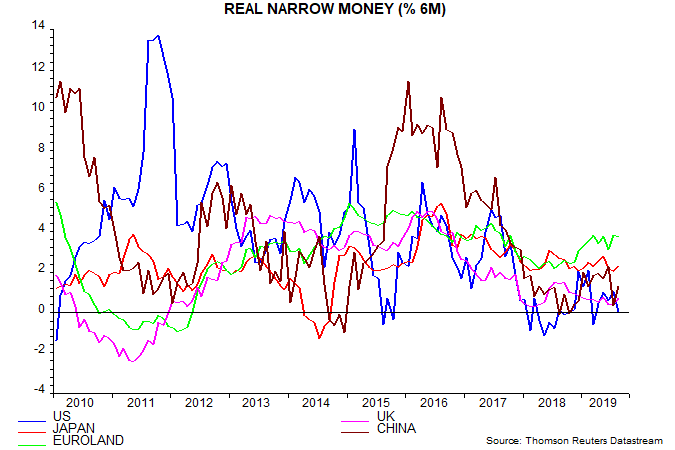

A more optimistic assessment of Euroland economic and market prospects is supported by regional monetary and cycle analysis: six-month real narrow money growth recovered first in Euroland and is relatively strong – third chart – while GDP stockbuilding data and business survey inventory responses are consistent with an earlier cycle trough than in the US.

In emerging markets, a recovery in Chinese narrow money growth in early 2019 stalled after the failure of Baoshang Bank in May, which disrupted interbank funding and credit supply to private firms. A food-driven inflation spike has dragged down real growth more recently, though is likely to reverse in late 2019. Money trends are solid or improving in most other MSCI constituent countries, with notable pick-ups recently in Russia, Mexico, the Philippines, Thailand and Chile.

One feature of recent market behaviour at odds with previous stockbuilding cycle downswings has been the resilience of global equities in aggregate, although the MSCI All Country World Index (ACWI) has made no progress since January 2018. This may reflect strong corporate demand for equities coupled with investors buying quality growth stocks as an alternative to low- or negatively-yielding government bonds. Value stocks have weakened in line with the historical average for cycle downswings – ACWI Value was down by 7.5% in the 18 months to end-August.

The corollary is that global equities may have less upside than usual as the stockbuilding cycle turns and could weaken if bond yields back up sharply, undermining the safety bid for quality stocks. Equity purchases by US non-financial corporations, meanwhile, are normalising after the boost from 2018 tax changes – Q2 buying was the least since Q1 2010.

The monetary backdrop, while improving, is not yet favourable for equities. The return on global equities relative to cash was highest historically when global real narrow money growth was above both industrial output growth and its long-term average. The former condition has been met, reflecting industrial output weakness, but real money growth remains low relative to history. Mixed signals were associated with lacklustre returns on average historically.