Knowledge. Shared Blog

October 2019

When Evaluating Small-Cap Stocks, Capital Efficiency Is Key

-

Scott M. Weiner, DPhil

Scott M. Weiner, DPhil

Head of ETP Quantitative Strategy

Head of ETP Quantitative Strategy Scott Weiner explains why assessing a company’s ability to invest capital wisely is a critical part of evaluating the long-term growth potential of small-cap stocks, particularly as capital efficiency has become more volatile among small caps in recent years.

Key Takeaways

- The distribution of return on invested capital (ROIC) among small-cap stocks has become volatile in recent years, with bottom-decile performers generating ever-larger losses.

- We believe the era of easy money has contributed to this phenomenon. Should the economy weaken or funding conditions become more stringent, we could see even greater underperformance among these bottom-performing stocks.

- Insights such as these highlight the importance of focusing on resilient companies that have invested capital wisely and appear poised for sustainable growth.

Efficient use of capital is a cornerstone of strong small-capitalization (small-cap) stock performance. After all, a company’s ability to invest capital wisely and translate those investments into profitability and growth is what enables small-cap companies to grow into mid- and large-cap companies over time.

Careful assessment of a company’s capital efficiency, therefore, is critical to managing the risks associated with investing in these small, growing companies. But increased volatility in this area has made this assessment more challenging in recent years.

We would expect the distribution of return on invested capital, or ROIC, to remain somewhat constant over time, so that companies that have historically produced double-digit positive ROIC would remain in that range. By the same logic, companies with middle-of-the-road ROIC would stay in the lower single-digit range, while the bottom tier would consistently produce negative ROICs.

The data, however, show a telling bifurcation in the market: While the ROIC of top performers has remained fairly consistent (i.e., ROIC in the positive double-digit range) over the past several years, the bottom-tier stocks’ ROIC has gotten markedly worse over the same time period.

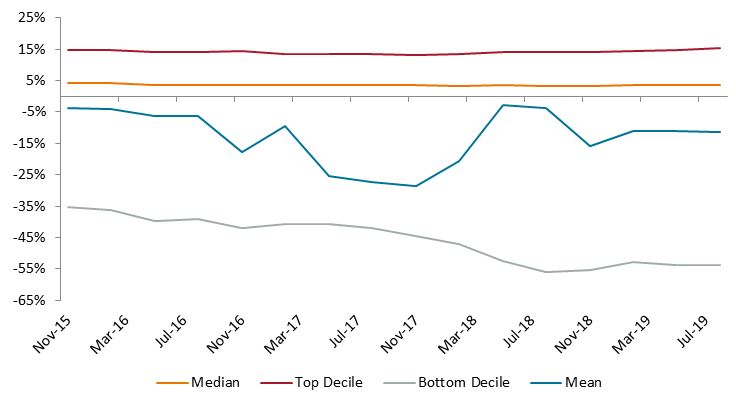

Figure 1 below shows ROIC data for the 2,000 small-cap stocks comprising the Solactive U.S. Small Cap Index over the past three and a half years. The top decile, bottom decile, median and mean ROICs are presented on a quarterly basis. The data show that both the median and top decile one-year ROIC for small-cap stocks have remained steady over this time frame. Meanwhile, the mean one-year ROIC for small-cap stocks has varied widely over the same time frame, while the bottom decile one-year ROIC shows a steady decline.

Figure 1: ROIC for Small-Cap Stocks in Solactive U.S. Small Cap Index

[caption id=”attachment_240887″ align=”alignnone” width=”736″] Source: FactSet, 8/31/19[/caption]

Source: FactSet, 8/31/19[/caption]

The consistency of the median and top decile performers is rather remarkable, but that’s where the consistency in the data ends. Poor ROIC performers have gotten worse and worse at deploying capital: The bottom decile performers now exceed losses of 50%, whereas only a few years ago that figure was around 35%.

A 50% loss represents an astonishingly weak use of invested capital for the poor performers, and the mean has seen considerable movement over time, from highs of negative (but approaching zero) levels to averages as low as -29%.

Focus on Sustainable Growth

We believe that an environment of easy money – coupled with relatively benign economic conditions – has contributed to this phenomenon, as unprofitable companies have been able to raise money on relatively favorable terms. If the economy worsens or the funding environment becomes more stringent, it is likely that many of these businesses that are not earning their cost of capital and that depend on the market for funding will face a day of reckoning, resulting in even more severe underperformance of their stocks than we have seen in recent years.

Insights such as these support the need for a consistent investment approach that relies on top-decile ROIC performers for its fundamental analysis. For example, Janus Henderson has developed a proprietary index, the Small Cap Growth Alpha Index, that uses this type of fundamental information to score companies and is designed to outperform the broader small cap growth asset class.

In our view, a focus on resilient companies – those that have invested capital wisely and appear poised for growth that can be sustained through a variety of market environments – can lead to consistent outperformance relative to a benchmark over time.

Janus Henderson Indices LLC is the licensor of certain trademarks, service marks and trade names, and is the provider of certain indices which are determined, composed and calculated by Janus Henderson Indices without regard to the issuer of any securities which may be linked to such indices. Neither Janus Henderson nor any of its affiliates guarantees the accuracy and/or the completeness of the indices or any data included therein. Janus Henderson disclaims all warranties of merchantability or fitness for any particular purpose with respect to the indices or any data included therein.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe