A colleague has an old Barron’s cartoon hanging in his office showing two large people, both smoking and one holding a mondo (extremely large) cola. The caption reads, “This whole damn healthcare system is a mess”. In their book

Mistakes Were Made (but not by me), social psychologists Carol Tavris and Elliot Aronson give some fascinating insight into the theory of cognitive dissonance and the many aspects of life to which it applies, including politics, law and marriage. Holding two ideas that are psychologically inconsistent produces mental discomfort and will motivate a person to find a way to reduce the dissonance, typically in a self-justifying manner.

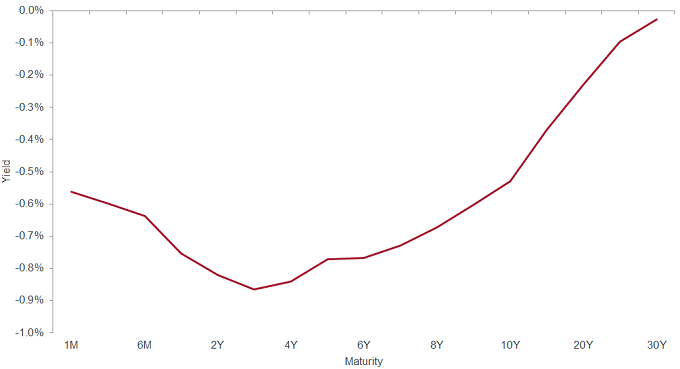

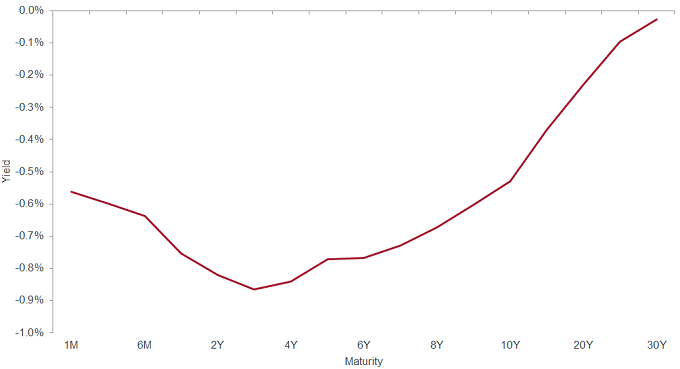

A casual reading of recent headlines makes clear that many market participants are worried. Slowing global growth, trade wars and political tensions are a few of the key concerns, set against the backdrop of an ageing bull market and protracted period of economic expansion. Bond yields have been dropping dramatically since late 2018. Globally, more than $15 trillion of government and corporate debt yields less than zero, and recently the entire German government bond yield curve turned negative. The threat of recession and the related desire for ‘safety’ seem to loom large on the minds of many investors.

German government bond yield curve: The land of make believe*

Source: Bloomberg, as of 6 August 2019.

*Willem Buiter, Special Economic Adviser at Citi, referred to current global monetary policy as a ‘land of make believe’ in a Bloomberg Surveillance interview on 12 July 2019.

In this context, growth stocks have surged: technology stocks are up more than 120% over the past five years, double the next best-performing sector (consumer discretionary) and nearly triple the gain of the broader MSCI World Index (MSCI data, 31 July 2014 to 31 July 2019. Past performance is not a guide to future performance). There has also been a bull market in stocks of companies with perceived stability. The price-to-earnings premium of the MSCI World Minimum Volatility Index over the broader benchmark reached 4.0 multiple points on 31 July 2019, up from 0.3 points on 31 July 2014. Many investors seem to harbour the thought that if they can be sure of some amount of growth, or even just stability, then their portfolios will be able to weather any economic turbulence.

Growth and stability at any price? GASP? Not another acronym…

As the excitement builds in these hot areas of the stock market, investors would do well to remember the experience of the 1970s. Analysts at Exane BNP Paribas note that from their peak in early 1973, the Nifty Fifty underperformed the S&P 500 Index by 48% through to the end of the decade, even though earnings-per-share growth for the Nifty Fifty was far higher than that of the broader market index over that span. High valuations act as a weight, depressing forward returns even when fundamentals are strong. Beware falls should the perceived growth/stability of earnings for high-flying stocks not materialise.

On the other hand, investors are deeply sceptical of value/cyclical stocks. The global financial crisis of 2007–2009 was formative for many that experienced it, animating thoughts of what could go wrong today. This seems particularly true when assessing the prospects of companies that fared particularly poorly during the crisis, such as banks and autos. Meanwhile, a generation of younger market participants is learning to loathe value investing. Value stocks, as measured by price-to-book ratios, trailed growth by 5.5 percentage points a year between April 2007 and May 2019, their worst showing in 80 years, according to data compiled by Dartmouth professor Kenneth French (source: Nir Kaissar,

Don’t Count out Value Investing Despite Growth’s Spurt, Bloomberg, August 2019).

The stark divergence between growth/stable stocks and value/cyclicals may be best understood as a matter of investors’ cognitive dissonance about which type of equities are likely to outperform in a recession. It is proving difficult for many to simultaneously consider (1) a recession is looming, and (2) owning value/cyclical stocks. Instead, investors seem to feel much more comfortable pairing a portfolio of growth/stable stocks with their worried economic/market outlook.

All of which presents a narrow – though potentially attractive – opportunity. The global economy may, in fact, continue to weaken from its strong showing in 2018 and could even tip into recession. There are good reasons to worry about how such a scenario might unfold, given already-stretched monetary policy from the world’s main central banks. Still, the fear seems overdone, in our view. Our analysts and portfolio managers are researching value/cyclicals, many of which, in addition to having in our view, inordinately cheap valuations, are also financially well capitalised and competitively more likely to endure. Valuations that imply improbably weak outcomes, all relevant factors considered, tilt the odds in buyers’ favour.

For example, many US banks offer double-digit shareholder returns when combining dividends and buybacks. Small-cap stocks provide more opportunity than large caps, and value opportunities are increasingly plentiful outside the US, in our view. Thinking a bit longer term, should the economy rebound, these companies have the potential for tremendous earnings growth upside and, eventually, multiple expansion.

We think giving careful consideration to ‘the other side of the trade’ is a crucial component to successful investing. Going beyond the fundamentals to gain a broader understanding of relevant factors driving stock price movements may help a discerning investor identify favourable reward-to-risk opportunities. Focusing where others feel discomfort is a good place to start.