Subscribe

Sign up for timely perspectives delivered to your inbox.

Investors have continued to favour US equities throughout much of the current long bull market, leaving Europe very much the unloved cousin for global investors. In this article, Portfolio Manager Nick Sheridan considers the value opportunity in European equities as we move further into 2019, against a contrasting backdrop of rising global trade tensions and further measures to stimulate European economies.

As we came into the year most market commentators expected rising US interest rates and liquidity to be removed from the system by the US Federal Reserve (Fed), and most probably by the European Central Bank (ECB) too. January saw the Fed reign in these expectations for further rate rises but more importantly turn the auto pilot off on quantitative tightening (the ongoing reduction in the Fed’s asset portfolio accumulated during and after the Global Financial Crisis). Thus, the expectation of liquidity to the tune of $400 billion being automatically drained from the financial system was removed. Although it is difficult to quantify, most commentators would agree that credit ease boosts equity markets and credit restraint does the opposite.

In March, the ECB joined the Fed in easing concerns of credit tightening by announcing measures to stimulate European economies, which included a new round of targeted lending to banks. Europe had faced its own quantitative tightening conundrum in the shape of maturing targeted longer-term refinancing operations (TLTROs) which were used to refinance Europe’s ailing banks to the tune of more than 700 billion euros – a third of which was lent to Italian banks (originally due for repayment in 2020 and 2021). Sadly, the reason for these measures was a significant downgrading by the ECB of expected growth and inflation.

In our opinion, while economic data in Europe is mixed, it does not warrant the current low level of investor exposure. Slower growth is not just a European problem but rather seems to be a global phenomenon. Some European data, such as manufacturing Purchasing Managers’ Indexes (PMIs), indicate weakness, but services activity, for example, has picked up. This has not been reflected in the flow of investor money. Sentiment towards Europe has lagged other regions, with rotation into cash at its highest level since Jan 2009. Europe has seen continual equity outflows for more than a year – the longest trend for a decade.

More economically sensitive stocks and those companies exposed to emerging markets were among the most targeted by these outflows during the past 12 months (to 30 April 2019), although the resilience of the current bull market thus far in 2019 has taken many by surprise. At a sector level, banks and the automobile/automobile parts industry have lagged. Conversely, utilities and healthcare have shown resilience.

Looking beyond the gains of early 2019, 90% of sampled assets showed a negative total return in US dollar terms in 2018, topping the previous peak of 84% in 1920 (Sources: Deutsche Bank, Bloomberg Financial, GFD). Looking at monetary supply, data remains weak, but suggestive of a trough, indicating that we may start to see a pickup in the economy in the second half of 2019. This is particularly relevant in China – an important trading partner for Europe. A pickup in new order activity in China is yet to be reflected in Eurozone PMIs.

Recent developments in the US/China trade war represent a potential risk to this view. Stock markets globally lost ground at the start of May as China responded to Trump’s decision to impose tariffs of 25% on $200 billion of Chinese imports. China announced new tariffs on $60 billion worth of US imports, including food, machinery and consumer goods. An escalation in rhetoric could fuel fears of a potential US recession, given historical signals from the yield curve, which is likely to have a broader impact on investor sentiment.

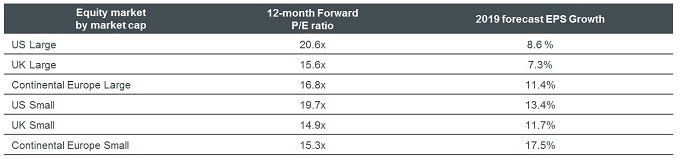

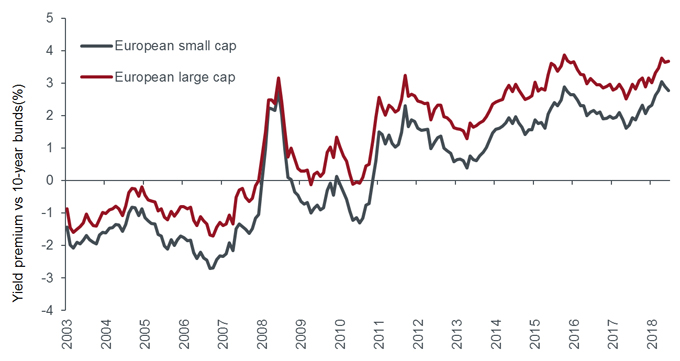

In summary, while we believe that the Eurozone currently represents good value for investors, the fallout between the US and China is likely to dominate sentiment over the shorter term. Nonetheless, relative valuations for continental Europe are currently much cheaper than in the US, with better forecasted earnings-per-share (EPS) growth than both the US and UK – see chart 1. Yields on European equities remain at very attractive levels, given the current spreads versus the benchmark 10-year German bund (chart 2). At some point, we believe that this is going to be attractive enough to support investor interest, given the potential for long-term aggregate gains.

Chart 1: Forecasts for EPS growth in 2019 favours Europe

Source: Janus Henderson Investors, JP Morgan Research, March 2019. Based on equal-weighted indices. P/E is price-earnings ratio. EPS is earnings per share growth (%).

Chart 2: An attractive yield premium on European equities

Source: Janus Henderson Investors, Thomson Reuters Datastream, March 2019. Shows dividend yield premium versus 10-year German bunds yield.