January 2019

The Conundrum Within Core Fixed Income Portfolios

-

Adam Hetts, CFA

Adam Hetts, CFA

Head of Portfolio Construction and Strategy

What is the path forward for diversified fixed income portfolios? Our Portfolio Construction and Strategy team discusses how the simplest solution for navigating the asset class may be rooted in a goals-based approach.

Following an unprecedented period of falling interest rates, coupled with a wave of new products and strategies, it’s no secret that the typical fixed income portfolio of today bears little resemblance to that of even a decade ago. The size and complexity of the fixed income universe has grown considerably in the last decade as investors look to simultaneously dial down duration risk and achieve higher returns. This conundrum exposes investors and their clients to wide dispersions within fixed income – which has, until recently, remained the risk-managing anchor of most investment portfolios.

A recent analysis of more than 5,000 advisor portfolios by our Portfolio Construction and Strategy (PCS) team underscores just how much this universe has changed – and the growing divide between how advisors approach fixed income.

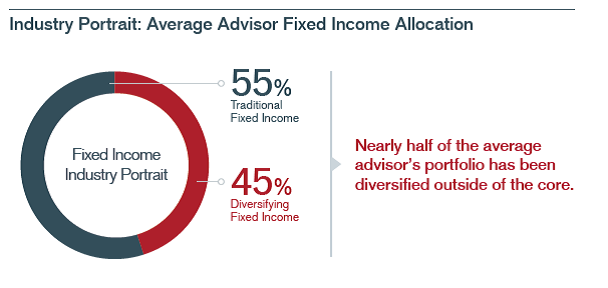

The average fixed income portfolio is now 55% traditional and 45% diversifying, with the latter including dynamic and single-sector strategies that own securities whose risk/return profiles can be vastly different than core fixed income. Meanwhile, this average masks a significant dispersion in the data between investors who are on the hunt for higher yield and those who seek safety. Many of the former are loading up on fixed income securities and alternatives that may prove too risky for volatile markets. On the other end of the spectrum, many of the latter have become so conservative with fixed income that these portfolios present a different danger – being overly sensitive to rising interest rates.

Not Your Father’s Fixed Income

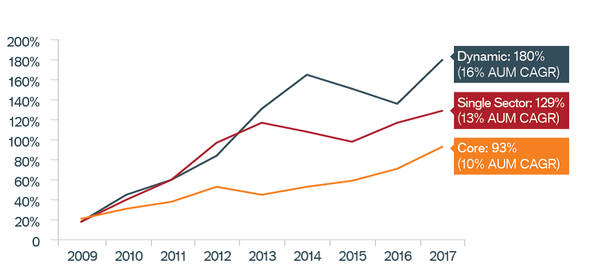

Since 2009, cumulative flows into relatively new dynamic solutions have increased at a much higher rate than traditional core solutions (2.8x vs.1.9x). Single-sector fixed income investments have also shown higher growth than core (2.3x).

2009-2017 Flows as % of 2009 AUM: Core vs. Single Sector vs. Dynamic

The average advisor portfolio now has almost half of its fixed income asset allocation outside the core, with 23% of its assets in single-sector fixed income investments and 22% in dynamic strategies. At first glance, these portfolios appear to be adequately diversified. In reality, this diversifying fixed income often more closely resemble equities than traditional core fixed income.

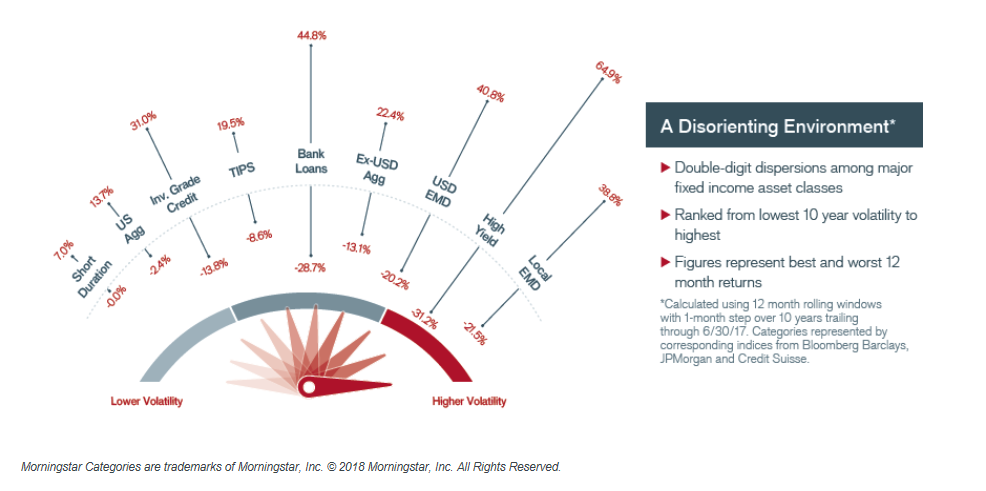

Consider single-sector credit investments. Within this group, high-yield bonds are the most popular strategy. Yet, during the best and worst rolling 12-month periods from the start of the Global Financial Crisis*, this asset class swung from losses greater than -31% to gains of more than 65%. The same can be said for bank loans, where extreme 12-month returns were -29% and 45% over the same period.

While these diversifying assets may check the boxes on higher yield and more potential to outperform during rising rates, they might defy one of the key reasons to own fixed income in the first place: to add ballast to an overall portfolio during equity market sell-offs.

The best solution may be the simplest: Identify the client’s primary goals and allocate accordingly. While the world of fixed income appears overly complex, each investment’s objective generally aligns with one of three client goals: defense, diversification or income.

We partner with thousands of advisors on a customized basis to design portfolios that reflect their clients’ goals. Using a proprietary framework that organizes and analyzes the vast universe of fixed income investments, Janus Henderson helps advisors map out a clear and forward-looking approach to fixed income.

Click here to read more.

Empowering You to Perform at a Higher Level

Our Portfolio Construction and Strategy Group is designed to help you keep your clients on track while giving you a distinct competitive advantage. Ongoing, 100% objective, forward-looking portfolio consulting, customized to work with you based on a singular purpose: helping your clients achieve their goals.

Portfolio Construction and Strategy

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe