Subscribe

Sign up for timely perspectives delivered to your inbox.

Guy Barnard and Nicolas Scherf, Co-Managers of the Janus Henderson Horizon Pan European Property Equities Fund, highlight that, while newsflow in Europe and the property sector has been mixed over recent months, the fundamentals for the European property equities market remain robust, with increasing value to be found for the active investor.

Given the mixed macroeconomic news and lack of positive political developments out of Europe in recent months, it is no surprise that European equities have been low on the priority list for many investors. In addition to the broader macroeconomic backdrop of slowing European growth and political uncertainty, the listed property sector has its own specific issues to contend with. Retail property faces structural challenges from the growth of ecommerce, the UK property market continues to bear the brunt of ongoing Brexit uncertainty and more recently, in Berlin, a populist backlash against residential landlords has led the Berlin state government to propose a five-year rent freeze for landlords.

Still a compelling asset class

Despite these obstacles, the European property sector has delivered attractive returns to investors, with the FTSE EPRA/NAREIT Developed Europe Total Return EUR Index returning 8.7% in the first half of 2019 and 6.5% per annum over the last five years to 30 June 2019.1

1Source: Thomson Reuters Datastream. As at 30 June 2019. The index returns are provided to represent the investment environment existing during the time periods shown. For comparison purposes, the index is fully invested, which includes the reinvestment of dividends and capital gains. The returns for the index do not include any transaction costs, management fees or other costs, and are gross of dividend tax withholdings unless otherwise noted. Past performance is not a guide to future performance.

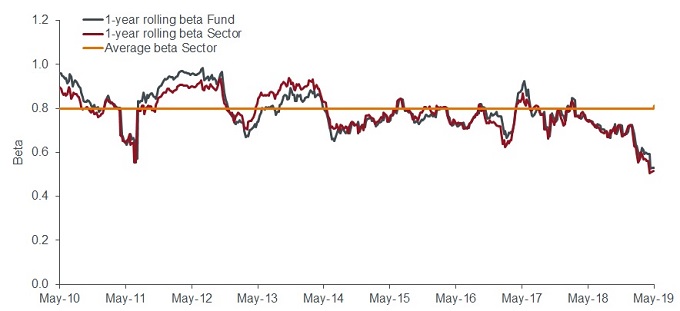

The sector is also currently showing more defensive characteristics ‒ the beta of the real estate sector and the Janus Henderson Horizon Pan European Property Equities Fund to the wider equity market has been decreasing significantly in recent years. This strengthens the sector’s appeal to investors given today’s more uncertain backdrop.

Beta for European property equities versus European equities has been decreasing

An active approach for added value

With both structural and cyclical forces at play, we continue to expect a wide spread of returns across the property sector going forward. This brings the importance of active management into perspective. By adhering to a selective and targeted approach, we can take advantage of the current market backdrop to try to create significant additional value for our investors.

Early last year we said that ‘boring can be rewarding’ [INSERT LINK], highlighting that a lower growth and interest rate environment should be a positive backdrop for sectors capable of producing reliable income that can be compounded over time. With action from the European Central Bank (ECB) and other global central banks in recent months once again highlighting the need for extended loose monetary policy, coupled with the German 10-year Bund yield back in negative territory, we find ourselves asking if property yields could go lower still.

While the lower interest rate environment is generally supportive for property assets, weaker economic growth and structural change have led us to place greater emphasis on the sustainability of underlying income streams and the strength of companies’ balance sheets.

How is the fund invested?

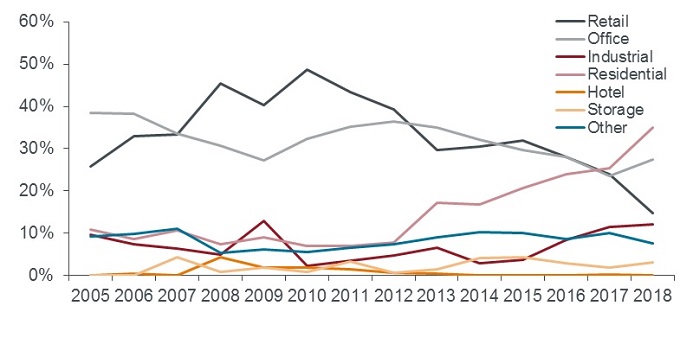

We have been cautious on retail property for many years now and, as the following chart depicts, we have significantly reduced our exposure to the sector over the past five years. We believe the growth of ecommerce and low consumer confidence in Europe will continue to put pressure on rents and values. The Janus Henderson Horizon Pan European Property Equities Fund therefore currently has limited exposure to the sector. With valuation declines accelerating and several companies cutting earnings and dividend guidance over recent months ‒ we do not expect to reverse this stance anytime soon.

Janus Henderson Horizon Pan European Property Equities Fund: historical sector breakdown

Source: Janus Henderson Investors. Sector exposure breakdown for the Janus Henderson Horizon Pan European Property Equities Fund from 31 December 2005 to 31 December 2018. For illustrative purposes only.

Note: The sum of the sectors + cash may not equal 100% due to rounding. Others includes data centres, cell towers and student accommodation.

Our focus has been on those cities, sectors and companies that can benefit from cyclical or structural up-cycles or those capable of steadily growing income, even in a period of slower economic growth. We continue to maintain exposure to German, Spanish, French and Nordic office markets where we expect further rental growth for better quality space given current low vacancy levels. In the UK, we still have no real clarity on the Brexit outcome but we believe our selective approach and focus on areas of structural growth, such as logistics, student accommodation and self-storage will continue to work well.

Berlin residential‒moving from growth to value?

The fund’s largest exposure by property type is to residential rental apartments, mainly in the highly-regulated German market, which has seen consistent growth in recent years. However, the sector has come under significant pressure lately following the surprise decision by the Berlin Senate to impose a five-year rent freeze on residential rents, the so-called ‘Mietobergrenze’ (rental cap). While the ultimate ability of this proposal to be enacted remains to be tested, given that rental law in Germany is governed at a federal, rather than state, level, we do expect a significant slowdown in the level of organic rental growth either way. Shares have reacted quickly and dramatically to the greater risks, with several Berlin-focused landlords now trading at discounts of 25-30% to last published portfolio values.

[caption id=”attachment_220602″ align=”alignnone” width=”680″] Source: Getty Images[/caption]

Source: Getty Images[/caption]

While we see value in German residential rental and have maintained exposure, we must acknowledge that newsflow will remain volatile in the near term. Looking further out, these measures are likely to further reduce new construction in an already undersupplied market and ironically, may ultimately result in higher apartment values.

Look beyond the headlines

In summary, while the backdrop across Europe remains weak, listed real estate offers diversification and the potential to reduce risk in a balanced portfolio, as well as provide an attractive and more predictable level of income in a market where investors are starved of yield.

We would therefore say to investors: “don’t you, forget about me.”

Note: Beta is a measure of a portfolio’s (or security’s) relationship with the overall market or any chosen benchmark. The benchmark always has a beta of 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portfolio with a beta of more than 1 will be expected to move more than the market, but in the same direction. A beta of 0 means the portfolio’s returns are not linked at all to the market returns. A negative beta means the investment should move in the opposite direction to the market.