Subscribe

Sign up for timely perspectives delivered to your inbox.

Nick Maroutsos and Daniel Siluk, Portfolio Managers on the Absolute Return Income Strategy, discuss the recent negative sentiment in global credit markets and remind us that not all credit is the same; sometimes it pays to delve more deeply into the reasons behind a particular rating.

There has been a barrage of negative rhetoric around credit markets for some time now. Bad news sells but we believe the balance has been lost in the often-blunt assessments from market observers and participants. Here, we aim to provide more context to the debate, while acknowledging that certain sub-sectors of global credit markets are best avoided. But hasn’t that always been the case? The skill of a good active manager is choosing which stock to be in and which to avoid over time.

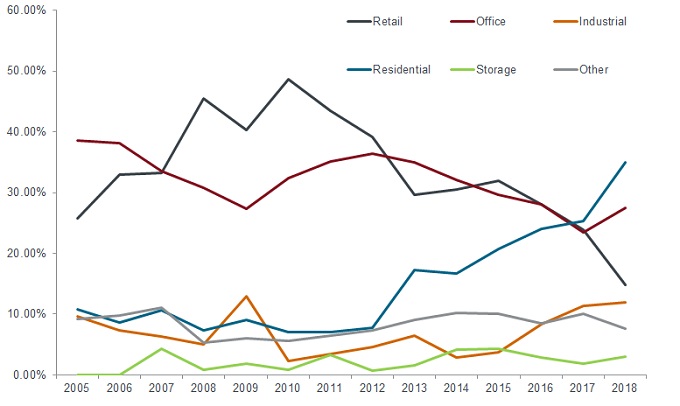

In 2018, the volume of bonds rated BBB increased from around 30% of the US investment grade universe to almost 60%. A worrying trend, yes? Perhaps; but the drivers are clear and unless as an investor you are obliged to blindly track the investment grade index within your portfolio — which our strategy is not — the trend is simple to circumvent. Cheap money (through low rates) made it a better environment to borrow to leverage, often for share buyback or merger and acquisition (M&A) activity. So, a lot of US companies in particular took advantage of this; notably corporates in the commodities, healthcare and telecoms sectors. However, for the risk budget that our strategy permits, we prefer to avoid these instances of financial engineering.

Source: Bloomberg, ICE BofAML US Investment Grade Index (C0A0), ICE BofAML US Investment Grade BBB (C0A4), as at 31 December 2018.[/caption]

Source: Bloomberg, ICE BofAML US Investment Grade Index (C0A0), ICE BofAML US Investment Grade BBB (C0A4), as at 31 December 2018.[/caption]

Absolutely not. While we do not discount the guide that credit ratings provide us, it pays to delve more deeply into the reasons some issues have such a rating.

Areas long favoured by the Absolute Return Income Strategy where there are compelling BBB-rated investment opportunities are infrastructure, utilities and parts of the financial sector. Many issuers in the infrastructure sector are rated BBB, for example Sydney Airport. But these are stable entities with monopolistic features, which can tolerate more leverage in their structures. Other examples include toll roads and ports; and while banks generally have come under greater regulation and rating methodology has become tougher, we think they are certainly no riskier today than before.

It is also worth noting that not all BBBs are the same. For example, there is a material difference in credit quality between a BBB+ credit versus a BBB credit. Currently, the higher quality segment of BBB+ is double the size of the lowest ratings band BBB in the global corporate bond index. If we do see some downgrades in the investment grade space, naturally the latter segment are likely to suffer the most.

A continuing theme in our Absolute Return Income Strategy has been to shorten the average maturity of assets. Typically, we have favoured issues with a 4-7 year maturity where the yield and risk/return intersection has been the most appealing. However, in late 2017, with credit spreads nearing post financial crisis tights, we elected to replace some of those longer dated bonds (in the 4-7 year range) with bonds in the 2-3 year range. Why? Well, if a risk-off event triggers further credit spread underperformance, shorter dated bonds should be less impacted. Further, if no ‘snapback’ rally occurs immediately after the widening episode, the ‘pull to par’ period is far shorter.

There’s always a chance and it certainly pays to keep a hedging card or two up your sleeve in the event that the thesis breaks down. Today, there is a good negative correlation between interest rates and credit risk. That is, if spreads widen, rates will rally. Thus holding some positive duration exposure acts as a positive counterbalance to credit risk. Further, right now, with little chance of hikes in the near to medium term, a long outright duration position adds to the absolute return. It is rare to have periods where you are effectively getting paid carry to hold insurance.

No. While there are clear pockets of the credit market smorgasbord that should certainly be given a wide berth, the Absolute Return Income Team maintains its view that you still get well paid to take the risk inherent in a diversified portfolio of investment grade fixed income assets, where the real likelihood of credit default is materially unchanged and arguably more sustainable today, with higher interest rates pushed even further back into the future. However, we believe a sensible approach would be to:

– monitor and actively manage the maturity profile — shorter is typically sweeter in uncertain times

– use duration exposure tactically and selectively be more defensively positioned in low beta sectors and high quality credits

– focus on issuers in developed markets, including first tier Asian markets (such as Korea and Singapore).