Knowledge. Shared Blog

September 2019

Active versus Passive in Retirement Plan Menus: Avoiding a Black-and-White Mindset

-

Ben Rizzuto, CRPS®

Ben Rizzuto, CRPS®

Retirement Director

Retirement Director Ben Rizzuto explains why he believes it may be time for plan sponsors to review their plan menus and consider whether participants might benefit from having expanded choice within certain asset classes.

Key Takeaways

- Plan sponsors often take a black-and-white approach to designing their plan menus, limiting active and passive fund options to certain asset classes.

- This approach may be detrimental to plan participants who could benefit from having expanded choices to help them navigate changing market environments and their own unique circumstances.

- Providing thoughtful, flexible options in key asset classes could offer participants the potential for a smoother long-term path to retirement.

In today’s hyperconnected world, we have effortless access to vast amounts of information. In theory, making decisions has never been easier – all the data we need is literally at our fingertips. In reality, we’re often so overwhelmed by the sheer number of choices that we adopt a black-and-white mindset in an effort to simplify our decisions (e.g., “carbs are bad/protein is good”).

In many cases, however, the answer isn’t so clear cut. Particularly in complex situations, compromise may produce the best outcome.

Piecing Together the Plan Option Puzzle

Retirement plan sponsors are all too familiar with information overload. When it comes to designing their plan menus, sponsors must navigate a litany of choices, including which asset classes to include, which funds to put in those asset classes and which plan design features to implement. They are also inundated with questions about how they will meet their ongoing fiduciary responsibility, which these days includes extensive diligence around fees and the threat of litigation.

Faced with these pressures, many plan sponsors take an overly simplified approach to choosing between active and passive funds for specific asset classes to make the decision-making process easier. For example, within efficient asset classes such as large-cap stocks, plan sponsors may select a low-cost, passive option. In the more inefficient asset classes such as small cap, international or fixed income, sponsors may offer actively managed options.

Unfortunately, just as banishing carbs may eventually derail dieters’ weight-loss efforts, this black-and-white approach to plan menu design may be detrimental to plan participants. It may be time to review plan menus and consider whether participants might benefit from having expanded choice within certain asset classes.

For example, large-cap blend is one of the most often used asset classes in retirement plans, but participants may be able to invest in it only through an S&P 500® Index fund. Passive large-cap blend strategies have outperformed active large-blend strategies over the last five years.

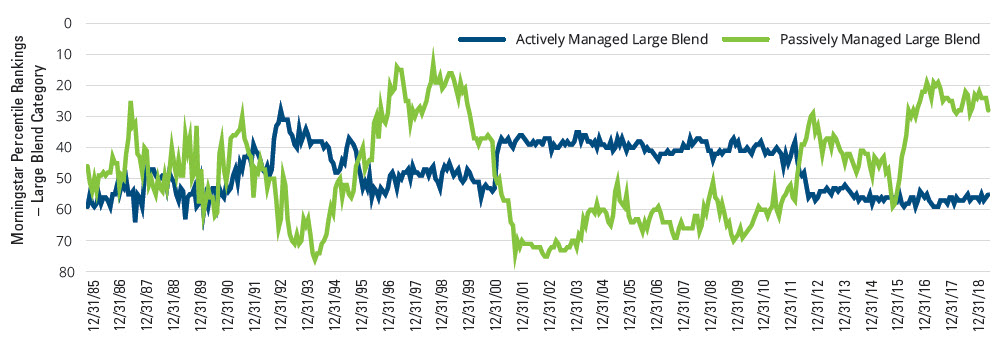

Active and Passive Outperformance Trends Are Cyclical Rolling Monthly 3-Year Periods, 12/31/1985 to 12/31/2018

[caption id=”attachment_230810″ align=”alignnone” width=”1007″] Source: Morningstar and Hartford Funds, 1/19[/caption]

Source: Morningstar and Hartford Funds, 1/19[/caption]

Based on this recent experience, one may think that a low-cost S&P 500 Index fund is all participants need. But a participant’s career and experience within a retirement plan clearly isn’t just five years long. And if we take a long-term perspective of the market, we see a different story: a story of cycles.

A Story of Cycles

During shifting market cycles, savvy investors have historically attempted to take advantage of market shifts by buying when everyone else is still bearish, and vice versa. As a result, it may be beneficial to provide plan participants a greater level of choice within certain asset classes, such as including in a plan both an active fund and a passive fund within the large-cap blend asset class.

In this scenario, it’s important to consider the difference in investment philosophy (active vs. passive) as well as how an active fund is “different” from an index. Active managers have the flexibility to strategically adjust asset allocations to try to capitalize on market shifts.

For example, does the fund focus on companies that are capable of growing dividends? In this case, not only does the active management philosophy provide flexibility, but the focus on dividends may also help plan participants endure periods of increased volatility. In fact, companies within the S&P 500 that are able to consistently increase their dividends have historically generated greater returns with less volatility compared to those that have decreased, kept static or not paid dividends.

Thus, by offering both active and passive funds in certain asset classes, participants have the flexibility to use an option or options that are better suited to their unique circumstances and the current market environment. This choice may be more significant as participants near retirement, as sustaining a downturn in the market may seriously affect an individual’s ability to retire comfortably.

The Question of Fees

One argument against this hybrid active-passive approach relates to fees. Plan sponsors may feel that in order to meet their fiduciary responsibility, they must offer the lowest-cost option – particularly in light of the multiple excessive-fee lawsuits that have ensnared plan sponsors over the last decade.

While many of these cases have centered around excessive-fee allegations, it’s important to remember that ERISA does not unequivocally require fiduciaries to offer the lowest-cost options to participants; options need only be reasonably priced.

Several court cases have underlined this guidance, for example:

- Hecker v. Deere Co. (2009) – In this case, the plaintiffs sued Deere Co. for violating its fiduciary duty under ERISA by providing investment options that required excessive fees and by failing to adequately disclose the fee structure to plan participants. In concluding that the plaintiffs failed to state a claim against the defendants, the judge noted: “Nothing in ERISA requires every fiduciary to scour the market to find and offer the cheapest possible fund (which might, of course, be plagued by other problems).”

- Patterson v. The Capital Group (2018) – Nearly a decade later, the judge in this case referenced the findings of Hecker v. Deere, noting that a fiduciary’s failure to offer the cheapest investment option is not enough by itself to state a claim for breach of fiduciary duty. The judge concluded: “Unquestionably, fiduciaries need not choose the cheapest fees available to the exclusion of other considerations.” Additionally, the courts have generally looked favorably upon those plan sponsors that have followed a prudent fiduciary process by documenting their reasons for making specific choices about the options they offer.

In conclusion, choice isn’t necessarily a bad thing, especially if it offers participants the potential for a smoother long-term path to retirement. Participants’ needs change. Markets change. Providing thoughtful, flexible options in key asset classes can help plan participants navigate those changes and is often in their best interest.

This document is not intended to be legal or fiduciary advice or a full representation of all responsibilities of plan sponsors and financial professionals.Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

When valuations fall and market and economic conditions change it is possible for both actively and passively managed investments to lose value.

A retirement account should be considered a long-term investment. Retirement accounts generally have expenses and account fees, which may impact the value of the account. Non-qualified withdrawals may be subject to taxes and penalties. For more detailed information about taxes, consult a tax attorney or accountant for advice.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe