September 2019

Combating Bond Market Volatility with Global Diversification Copy

Strategic Fixed Income

Nick Maroutsos | Follow Co-Head of Global Bonds | Portfolio Manager

Nick Maroutsos | Follow Co-Head of Global Bonds | Portfolio Manager

Co-Head of Global Bonds Nick Maroutsos explains why investors should be mindful of where they hold duration exposure in light of a flattening yield curve.

Key Takeaways

- With developed market interest rates considerably lower than last autumn, we believe the return potential of longer-dated debt is limited.

- In light of slowing global growth, we expect the Federal Reserve’s next move to be a rate cut, which, in our view, should add to the attractiveness of shorter-dated bonds.

- A slowing economy and an extended credit cycle is a recipe for possible bond market volatility, and should cause investors to prioritize defensive tactics such as a focus on quality.

The backdrop for global interest rates has changed significantly since last autumn, but that does not mean risks for bond investors have diminished. While the threat posed by interest rates may have subsided, an extended credit cycle, weakening corporate profitability and myriad geopolitical risks are all factors that could potentially spell upheaval for bond markets. Possibly aggravating the situation are real yields having reset to a higher level, which – as we saw in 2018 – can be an ingredient for increased market volatility.

But with real yields back below 1% in the U.S. and negative in much of the developed world, bond investors still face the challenge of generating sufficient income. Consequently, we again find ourselves in an environment in which a fixed income strategy must work harder to identify attractive risk-adjusted opportunities. This challenge, in our view, is most acute within core bond strategies, especially in regions where benchmark rates hover near 0%. We believe one tactic that merits consideration under such conditions is increasing one’s allocation to short-duration strategies not tethered to traditional bond benchmarks. The combination of greater flexibility in calibrating duration and credit exposure, along with the potential for geographical diversification, may aid a portfolio in absorbing another round of elevated market volatility. And given the risk factors delineated above, such an eventuality would not surprise us.

Flattening U.S. Treasury Curve

The recent yield curve inversion means that Treasury bills up to 1-year in maturity yield more than many longer-dated notes, but with lower duration risk.

Source: Bloomberg, as of 3/27/19.

Not Your Parent’s Duration

With last autumn’s concerns about wage-driven inflation a distant memory and the yield on the 10-year U.S. Treasury now back below 2.5%, one may be tempted to increase duration. Reinforcing this view is the Federal Reserve (Fed) dialing back expectations for a 2019 rate increase and inferring that it would likely cease its balance sheet reduction program. We are not alone in expecting the Fed’s next move to be a rate cut. The reemerging dovish bias of global central banks is further illustrated in the European Central Bank’s (ECB) recent decision to introduce a new round of loans to financial institutions.

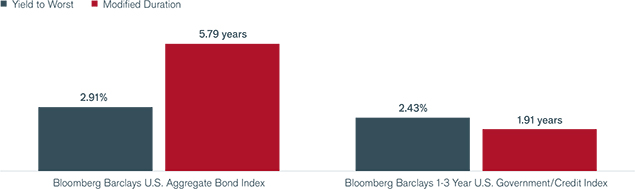

Despite these temptations, we see little upside in increasing longer-dated duration. Our caution is based on the current shape of the U.S. Treasuries yield curve, which is the flattest it’s been in the post Global Financial Crisis era, as measured by the spread1 between the 2-year and 10-year notes. With this term structure, we see little incremental advantage to be gained per unit of risk when extending maturities. When comparing the Bloomberg Barclays U.S. Aggregate Bond Index with the Bloomberg Barclays 1-3 Year U.S. Government/Credit Index, the latter’s yield to worst – at 2.43% – offers 84% of the yield of the broader index with only 33% of its interest rate risk as measured by modified duration. In short, investors are not being sufficiently compensated for taking on additional risk.

Furthermore, with the Fed’s next move likely to be a cut, we believe that the front end of the curve has greater room to rally than longer-dated securities. Given the low yields on longer-dated government debt, especially in the eurozone, UK and Japan, we see little impetus for prices on these maturities to rise, unless one believes we are on the cusp of a global recession – a potential outcome that has likely decreased due to the recent dovish pivot by the Fed and ECB.

Yield-to-Worst & Duration of Core Bond Market Segments

At this juncture, we see little incremental advantage to be gained per unit of risk when extending maturities.

Source: Bloomberg, as of 3/26/19.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Yield to Worst represents the lowest yield that an investor could receive on a bond without the issuer defaulting. Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based measure of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. Bloomberg Barclays 1-3 Year U.S. Government/Credit Index measures Treasuries, government-related issues and corporates with maturity between 1-3 years.

Not Out of the Woods – By Any Means

A low-growth, low-inflation environment at first glance may appear conducive for bonds. Unfortunately, it’s occurring during an extended credit cycle and one in which riskier assets appear richly valued; after last autumn’s spike, the spread on both investment-grade and high-yield corporate credits have returned to levels well below their post-crisis average. Should central bank – and market – prognostications of slower economic growth come to fruition, the highly levered balance sheets of the corporate sector may come under pressure as revenue growth slows. A potential warning sign is aggregate revenue growth of S&P 500® Index2 component companies only reaching 6%, year over year, in the fourth quarter of 2019.

A Global Opportunity Set

With interest rates low, however, credit becomes an ever more important factor in generating sufficient yields. Here, too, a greater reliance on an unconstrained strategy may help investors achieve their objectives. While elevated corporate debt levels are prevalent in the U.S., and Europe is flirting with recession, there are compelling credit stories in other regions that can be accessed when stepping away from regional benchmarks. These stories often encompass robust secular themes such as the growth of banking in emerging Asia and infrastructure spending – often government backed – in several regions. As important, an unconstrained approach allows investors to avoid, rather than just underweight, segments of a benchmark – either a sector or a region – that may be structurally challenged.

Last autumn, we highlighted the need for focusing on regions where monetary authorities were likely to pause, or even cut, interest rates. The U.S. now fits into that camp. Yet, a flat Treasuries curve dissuades one from holding longer-dated duration in the U.S. So too does the country’s involvement in the ongoing trade spat with China and political risk emanating from Washington. Other countries, in our view, offer similar interest rate profiles with considerably less baggage.

With an Eye Toward Volatility

Last autumn’s volatility – after an extended period of tranquility – served as a reminder for bond investors that capital preservation is no sure thing. Our greatest concern remains market liquidity. While late 2018 may have caught investors’ attention, the post-crisis market-clearing infrastructure has yet to be truly tested. Given the array of risks in the marketplace, any number of scenarios could lead to a liquidity event in which price dislocations are pronounced. Therefore, investors must remain on high alert for signs of potential market stress. In addition to monitoring liquidity, we believe sufficient respect must be paid to traditional volatility metrics such as interest rate volatility, credit default swap pricing and foreign currency movements. The latter takes on elevated importance as exposure to foreign currency-denominated securities increases.

Vigilance with regard to these metrics may give investors the advanced notice needed to dampen portfolio volatility, but portfolio construction may also further the cause. In an environment marked by low growth and high debt, and with central banks remaining a swing factor in markets, a globally diversified portfolio can help moderate volatility by targeting maturities, regions and issuers with the most attractive risk-adjusted return profiles and avoiding those where the risk asymmetry is too great.

- Spread is the difference in yield between securities with similar maturity but different credit quality.

- S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Global Fixed Income Compass

More from Our Investment Professionals

Have We Returned to a Goldilocks Economy?

Jim Cielinski, Global Head of Fixed Income, provides his perspective on some of the key macroeconomic factors that are driving fixed income markets. Fed Pivot Slows Advent of Cycle’s End

The U.S. Fixed Income team discusses how the Fed’s newfound patience could help stabilize the U.S. economy and extend the economic and credit cycles.