Subscribe

Sign up for timely perspectives delivered to your inbox.

In this short view from the Secured Credit desk, Oliver Bardot, Associate Portfolio Manager within the Secured Loans Team, briefly outlines the distinctive aspects of the European and US loan markets, exploring the impact of negative interest rates in Europe on loan prices in this market.

The leveraged loan market has been in the crosshairs of regulators and central bankers across the globe in 2019. Despite that, both the US and European loan markets have remained stable and delivered healthy returns year-to-date, up 5.4% and 4.7% respectively in the first half of 2019 (hedged to USD). Although the two markets are closely related, there are areas in which the two diverge to some extent. With this in mind, we thought it worthwhile to highlight a peculiar feature of the loan market that is currently benefiting investors in European loans.

It is well-known that the US loan universe is significantly larger and more diverse than its European counterpart. At the end of June, the US market was made up of 1,657 issues totalling almost $1,250bn of outstanding loans. This is around four times the size of its European counterpart on either measure. While there is some overlap between the two markets, many of the issuers are unique to the European universe, increasing diversification for global loan investors.

Crucially, while Europe is an ‘institutional’ only market — collateralised loan obligations (CLOs) and credit funds dominate — the US market is also open to retail investors, who currently account for around one fifth of that market. This additional source of demand can lead to increased volatility. In mid-August, leveraged loan mutual funds (investing in loans that enable retail investors to access the loan market) were in the middle of a 36-week streak of outflows, the longest period of consecutive withdrawals the asset class has experienced.

One of the drivers of these outflows from US loan mutual funds has undoubtedly been the dramatic shift in expectations around the trajectory of US interest rates as the US Federal Reserve (Fed) pivoted to a more accommodative stance. As loans typically pay a fixed spread over Libor, a decline in interest rates expectations will likely feed through into lower loan coupon payments.

On the other hand, and somewhat counterintuitively, European loan investors are currently benefiting from the negative interest rate environment across much of Europe. This is due to the language in loan documentation setting a zero per cent floor on Euribor for the purposes of calculating loan coupons. As the European Central Bank’s main interest rate (the deposit facility) is at -0.4%, European loan investors are benefiting from almost 40 basis points of additional spread because of the floor. For non-euro investors hedging back into their local currencies the effective spread is therefore increased once the floor benefit is factored in.

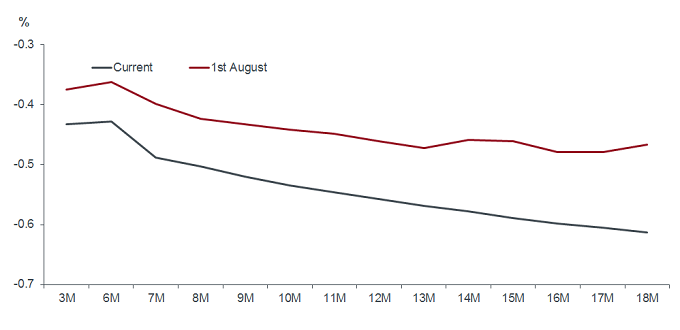

While US loans also benefit from floors, typically set between zero and 1%, given that US Libor currently stands above 2%, the floor does not benefit loan coupons at present. Looking at current expectations for interest rates in Europe in the chart below, this floor is likely to become increasingly valuable.

Source: Bloomberg, futures curves drawn from 3-month Euribor and 6-month standard forward rate agreements (FRAs) for various tenors, data as at 1 August and 20 August 2019 (current)[/caption]

Source: Bloomberg, futures curves drawn from 3-month Euribor and 6-month standard forward rate agreements (FRAs) for various tenors, data as at 1 August and 20 August 2019 (current)[/caption]

There are of course other differences to be aware of, including differences in credit and covenant quality, as well as the varying insolvency regimes across Europe. However, the benefit of the interest rate floor, as well as the aforementioned restrictions on retail investment, have contributed to the lower historic volatility of the European market. When looking at risk-adjusted returns, the 5-year Sharpe ratio in Europe stands at 1.81 versus 0.96 for the US market (as at 30 June 2019). While past performance is no guide to future performance, we believe investors could benefit from the increased diversification that an allocation to European loans brings.