Subscribe

Sign up for timely perspectives delivered to your inbox.

Guy Barnard and Tim Gibson, Co-Heads of the Global Property Equities Team, provide a mid-year review of global REITs on the back of ongoing market turbulence. They also share their outlook for the remainder of 2019.

Global REITs have performed respectably year-to-date. According to the FTSE Global NAREIT Developed Index, the asset class is up 15.4% as of 30 June 2019. Not bad, considering global REITs’ lacklustre end to 2018.

In terms of sentiment change, perhaps the most apparent one that occurred since the beginning of the year has been towards US interest rates. To many in January 2019, interest rate cuts had seemed a long way off, but a Federal Reserve move towards ultra-low interest rates, today, seems imminent and appears to have now become consensus among pundits.

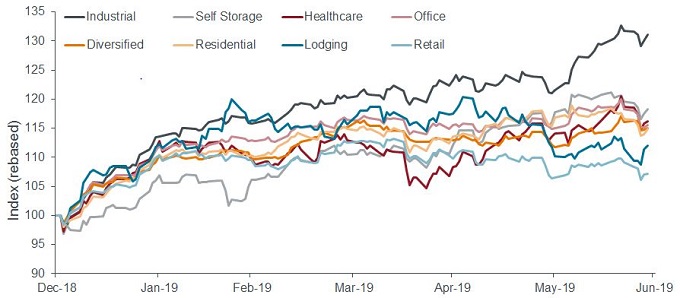

Industrial/logistics companies globally were boosted by news that one of the world’s largest private equity firms, The Blackstone Group, had acquired the US industrial portfolio of leading logistics solutions provider, GLP, for US$18.7bn. The deal, which Blackstone called “the largest-ever private real estate transaction globally”, was evidence of both strong investor demand and supportive pricing for industrial assets. Conversely, retail names remained at the bottom of the pile in most markets as underlying valuations trended lower.

[caption id=”attachment_224509″ align=”aligncenter” width=”680″] Source: Bloomberg as at 28 June 2019. US REITs sector indices in USD rebased to 100 at 31 December 2018. Past performance is not a guide to future performance.[/caption]

Source: Bloomberg as at 28 June 2019. US REITs sector indices in USD rebased to 100 at 31 December 2018. Past performance is not a guide to future performance.[/caption]

The global REIT sector also continued to grow, both through initial public offerings and private companies raising funds for future growth. This brought total assets in global REITs to US$1.8 trillion, as of 30 June 20191, with the vast majority of growth attributed to the faster-growing and non-traditional sub-sectors of real estate such as logistics, data centres, and manufactured housing.

This highlights not just the ability of REIT companies to grow organically, but also through acquiring assets to grow their platforms and further enhance earnings growth.

With Federal Reserve rate cuts now taken to be a given, the questions now seem to focus on how many and when. Slowing global growth has crept onto the top of the list of concerns for global investors, as Central Banks dial up levels the dovishness.

In this backdrop, we believe defensive growth will be a key area of focus for investors for the rest of the year. REITs have long been valuable providers of diversification and return enhancers to investors. While the asset class performance cannot always be described as living “life in the fast lane” and may face challenges in a rising interest rate environment, relatively defensive and predictable income-orientated companies may prove attractive to many investors as global economic growth slows and risk increase.

Notes:

1) Source: Bloomberg, FTSE EPRA Nareit Developed Index market capitalisation as at 30 June 2019.

Beta is a measure of a portfolio’s (or security’s) relationship with the overall market or any chosen benchmark. The benchmark always has a beta of 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portfolio with a beta of more than 1 will be expected to move more than the market, but in the same direction. A beta of 0 means the portfolio’s returns are not linked at all to the market returns. A negative beta means the investment should move in the opposite direction to the market.