Consistent with signals of the last two months, we see mild inflationary pressures emerging. Until April and May, our forward‑looking options-based measures had been showing no signs of inflation. But we are starting to see clues of a change of course with the options markets shifting their pricing from no inflation to some inflation. Currently, the attractiveness of inflation-sensitive assets sits at average levels, rather than the lower-than-average levels where they had mostly resided.

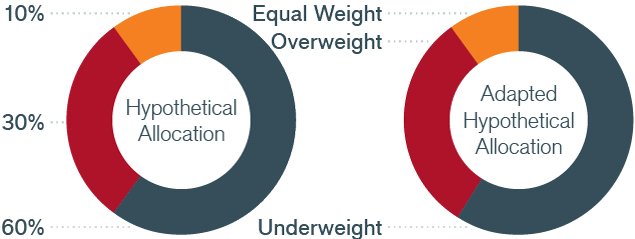

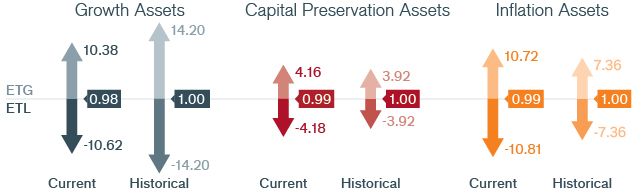

Impact of Tail Risk Signals on Hypothetical Asset Allocation

Using proprietary technology, Janus Henderson’s Adaptive Multi-Asset Solutions Team derives tail risk signals from options market prices on three broad asset classes. Given our current estimates of tail risks, we illustrate how those signals would impact a 60/30/10 allocation.

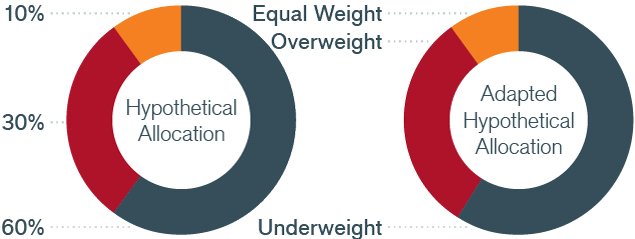

Impact of Tail Risk Signals on Hypothetical Asset Allocation

Using proprietary technology, Janus Henderson’s Adaptive Multi-Asset Solutions Team derives tail risk signals from options market prices on three broad asset classes. Given our current estimates of tail risks, we illustrate how those signals would impact a 60/30/10 allocation.

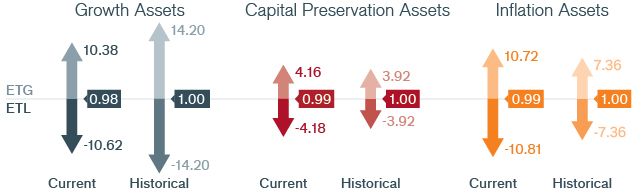

Current Tail-Based Sharpe Ratio (Expected Tail Gain/Expected Tail Loss*)

The “Tail-Based Sharpe Ratios” have been normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

*We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.

Our Adaptive Multi-Asset Solutions Team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

So by no means are we suggesting an imminent breakout in inflation, but the steady move higher in the attractiveness of inflation-sensitive assets to normal levels is important to watch, particularly because we believe inflation is one of the most pronounced risks to financial assets, which have rallied sharply in response to a return of a more dovish stance by the Federal Reserve. Should inflation come out of hiding, the doves likely will be chased away by hawks.

Because of the significance inflation risk poses, particularly at this stage of the monetary cycle, we will continue to pay special attention to price levels and share any important insights with our readers.

In addition to our outlook on broad asset classes, we rely on the options market to provide insights into specific equity, fixed income, currency and commodity markets. The following developments have recently caught our attention:

- Growth: Global equities are showcasing an average level of attractiveness, as measured by their expected upside to downside (Tail-Based Sharpe Ratio). Asia Pacific equities are globally the most attractive region both on the developed markets side with Japan and Australia, and on the emerging markets side with India, China and Taiwan appearing attractive. In Europe, Italian equities also are reflecting a high Tail-Based Sharpe Ratio.

- Currency: Options markets are continuing to price in U.S. dollar weakness. And to our point on inflation risk, dollar weakness is inflationary – should it unfold.

- Commodities: Gold continues to reflect a very high Tail- Based Sharpe Ratio that is sitting well above the 75th percentile measured over the last three years. Oil, on the other hand, is not in favor, according to signals emanating from the options markets.

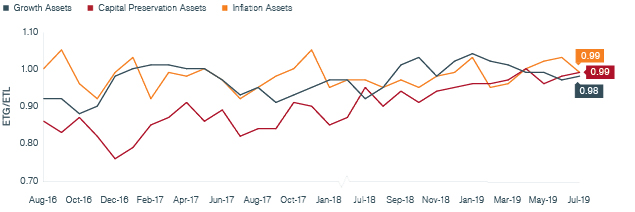

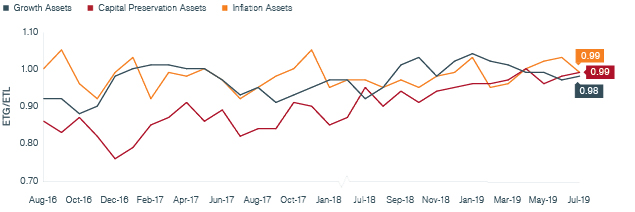

Historical Monthly Tail-Based Sharpe Ratios

(ETG/ETL)

Source: Janus Henderson Investors, as of 6/28/19

Data was not calculated for all months.