Subscribe

Sign up for timely perspectives delivered to your inbox.

In this short question and answer session Nick Maroutsos, Co-Head of Global Bonds, looks at the macroeconomic landscape and how it is shaping their investment decision-making within their strategies.

In this short question and answer session Nick Maroutsos, Co-Head of Global Bonds, looks at the macroeconomic landscape and how it is shaping their investment decision-making within the Absolute Return Income strategies.

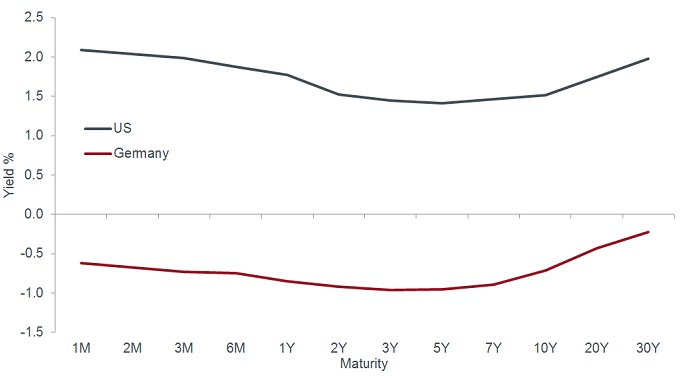

We are mostly avoiding Europe in both the rates and credit space. As interest rates move lower and become more negative, Europe is the epitome of dysfunction. We are five years on from its supposedly temporary shot in the arm for the euro area, and yet the European Central Bank (ECB) still has not achieved its goals and will likely push rates even lower. The ECB is effectively out of ammunition, and further stimulus/negative interest rate policy (NIRP)/quantitative easing (QE) we believe will not help the economy, it will only distort markets further. The bond markets in Europe (particularly Germany) are telling us that the cycle is ending, that the ECB is behind the curve and looking increasingly ineffective.

Stresses in the euro region have increased, particularly with the emergence of an Italian coalition government focused on decreasing taxes and increasing spending with little concern over growing deficits. With Italian risks increasing, we believe it will be difficult for the ECB to avoid further stimulus. We expect 2019 European growth and inflation to continue to be below expectations amid structural rigidities in labour and product markets. From a positioning standpoint, our focus has been to identify better opportunities elsewhere, that not only provide higher yields, but also better risk adjusted opportunities in regions such as the US, Australia, and Asia ex-Japan. In the UK, we are allocating to the region on a tactical basis. We believe there are a number of opportunities but with the overhang of Brexit, we are being conservative so as to not add undue volatility to the strategies.

Source: Eikon from Refinitiv, US government benchmark yield curve, German government benchmark yield curve, 30 August 2019. M=months, Y=Years[/caption]

Source: Eikon from Refinitiv, US government benchmark yield curve, German government benchmark yield curve, 30 August 2019. M=months, Y=Years[/caption]

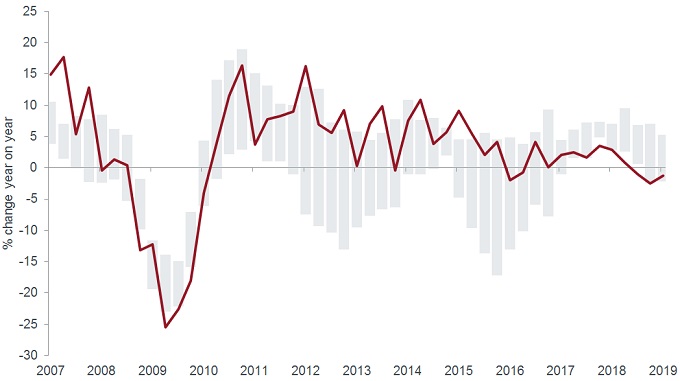

Political uncertainty has risen rapidly as the US acts with greater unpredictability. This is something that is outside of central bankers’ control and so businesses have less confidence about the environment in which they are operating. We have seen business investment in the UK steadily decline since the Brexit referendum. The US trade disputes are having a similar effect with evidence that companies globally are foregoing investment until some clarity exists. This has second-round effects, which, together with weak monetary data, mean global growth is likely to be subdued until Q2 2020.

Source: Bank of England Inflation Report, August 2019. Eikon from Refinitiv, Japanese Cabinet Office, OECD, ONS, Oxford Economics, Statistics Canada, US Bureau of Economic Analysis and Bank calculations. G7 business investment: UK business investment, range of G7 countries excluding UK.[/caption]

Source: Bank of England Inflation Report, August 2019. Eikon from Refinitiv, Japanese Cabinet Office, OECD, ONS, Oxford Economics, Statistics Canada, US Bureau of Economic Analysis and Bank calculations. G7 business investment: UK business investment, range of G7 countries excluding UK.[/caption]

Some market observers have likened the US-China dispute to the decade-long US-Japan trade war of the 1980s. While the current trade war could end up taking a while to resolve, both China and the US have far more to lose by not reaching an agreement than Japan and the US had a few decades ago. We are not of the belief that the trade tensions are structural, rather they are near term noise.

Bonds, however, are less sensitive than equities to trade and short-term earnings fluctuations. An extended period of low economic growth and low inflation can be a relatively comfortable environment for corporate bonds. The volte face by central banks towards more accommodative monetary policy should make it easier for companies to refinance, so we would expect the credit cycle to be elongated further and defaults to remain contained.

We believe corporate earnings will hold up better than the market expects, although much relies on global trade. Where we are seeing pressure on creditworthiness is in those areas that are facing structural problems, such as retail, energy and auto components. We are also seeing differences geographically, with leverage (debt divided by earnings before interest, tax, depreciation and amortization) rising in European high yield and US investment grade but declining in US high yield and European investment grade from levels two years ago.

We had been more dovish than market consensus in terms of the future path of short-term rates, but markets are now pricing in multiple cuts by the Fed over the next year. The Fed reduced rates by 0.25% in July 2019 as expected, but disappointed markets by telegraphing diminished prospects for additional cuts. Ultimately, we believe the market will force the Fed into further interest rate cuts, although we think talk of zero interest rates in the US in the near term is wide of the mark.

President Trump’s goal is to further his economic agenda, so he will do everything in his power to achieve lower rates and higher equity markets. We see the trade volatility as part of the political stand-off between Washington and the Fed (evidenced by the recent article from Bill Dudley, a former New York Federal Reserve President, who openly suggested the Fed should not enable Trump in his trade war). Market gains are driven by central bank expectations so there is little room for disappointment. We are not sure the Fed has the stomach to disappoint the market so they will likely cut when the market tells them to do so.