Subscribe

Sign up for timely perspectives delivered to your inbox.

The sudden rise of populist presidential candidate Alberto Fernández shook the Argentine markets and raised alarm bells among global bond investors. Portfolio Manager Seth Meyer discusses the lessons this volatility raises for bond investors, reminding them of the importance of trying to balance income and total return.

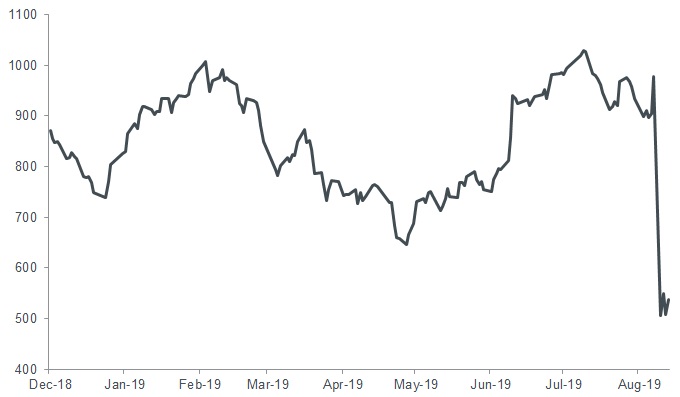

The presidential primary election in Argentina on Sunday 11 August sent shockwaves through local markets. The country’s stock market fell by nearly half (the second-largest drop in any country in 70 years) in US dollar terms, 10-year government bond prices fell by up to 20 points, and the Argentine peso – the worst-performing currency in the world this year – fell a further 24% relative to the US dollar.

The swiftness and severity of the market collapse is largely explained by how unexpected the results were: opposition candidate Alberto Fernández garnered a whopping 47% of the vote, propelling him to front-runner status. Fernández now has a commanding lead and the financial markets’ severe reaction suggests the vote signals the end of the current administration and a big change in economic policy. Indeed, a Fernández presidency would be a significant shift from the more pro-market, reform-oriented policies of the sitting president, Mauricio Macri, to more populist and protectionist policies. Consider that Fernández’s running mate is former President Cristina Fernández de Kirchner, a leader who famously nationalised pension funds and implemented currency controls.

Source: Bloomberg, as at 15 August 2019[/caption]

Source: Bloomberg, as at 15 August 2019[/caption]

That such a swift change (literally overnight) could happen to one country highlights the importance of knowing which asset classes your fixed income portfolio is using to seek yield and return. Knowing where your investment managers are taking risk and how they try to mitigate those risks – particularly in asset classes such as emerging markets – is paramount. When choosing a bond portfolio, we encourage investors to consider not just the investment objectives, but to understand how those objectives are sought and what risks the approach entails.

Argentina’s market collapse also highlights the importance of fundamental credit research and carefully selecting companies and countries that are expected to add, or at least maintain, value. Consider the alternative, in which a passively managed portfolio held the benchmark weight of Argentina’s bonds. At the start of 2019, Argentina’s weight, a proxy for the bonds’ value, in the Bloomberg Barclay’s Global High Yield benchmark was 3.7%. By 9 August (the Friday before the vote), it had fallen to 3.2%. When the market closed the following Monday, it was just 2.3%, down nearly 40% year to date and down 30% in one day.

We believe a measured approach to risk taking is warranted, letting no individual position dominate returns and think that investors should seek a balance of duration and yield, as well as income and total return, in their fixed income portfolios. Most importantly, we encourage investors to consider what the goal of owning bonds is in their portfolio. We think it is to provide income and to help dampen volatility – not add to it.