Subscribe

Sign up for timely perspectives delivered to your inbox.

Nick Watson, a Fund Manager on the UK-based Multi-Asset Team, observes the hidden risks and relationships lurking in quality investment styles and the potential benefits of adding some complementary (but unloved) value styles to a UK portfolio.

All fund selectors can think of pure ‘stock pickers’, those portfolio managers (PMs) who are fixated on fundamental bottom-up company research and are wary about the idea of macro investing or asset allocation. Generally speaking, those strategies labelled as having a ‘quality/growth’ stance focus on really strong businesses with robust visible earning streams, defendable margins and high barriers to entry.

The ‘stock pickers’ will tell you that buying these steady compounders removes the macro, or market risk, from the equation. In theory, this may be the case. In practice, however, the market treats such an investment approach as a macro trade itself.

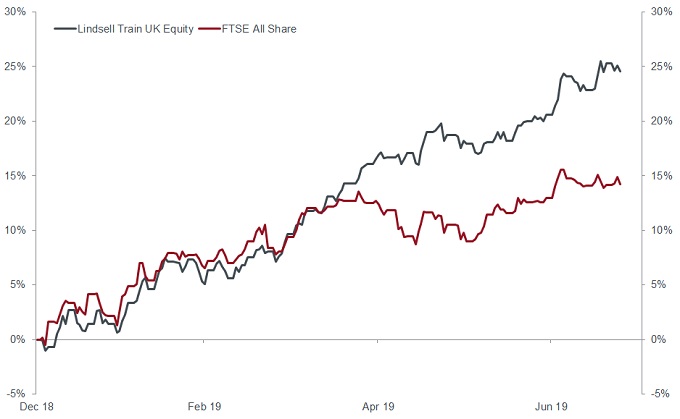

As a case study, let’s take the performance of one of our highest conviction UK equity holdings – the Lindsell Train UK Equity Fund – over the period YTD in 2019.

Lindsell Train UK Equity Fund vs FTSE ALL Share Index 2019 YTD

Source: Morningstar Direct, 31 December 2018 to 24 July 2019.

Until mid-April, Lindsell Train was performing in line with the FTSE All Share index.

Pretty much every single asset rallied over this period, as risk appetite rebuilt across markets following the mass risk asset sell-off of Q4 2018.

Over this period, government bond yields stayed relatively flat as investors were not yet pricing in aggressive rate cuts from the Federal Reserve and further monetary stimulus from the European Central Bank.

Since mid-April, however, investment grade and government bond yields have collapsed, prompting yet another rally in fixed income prices.

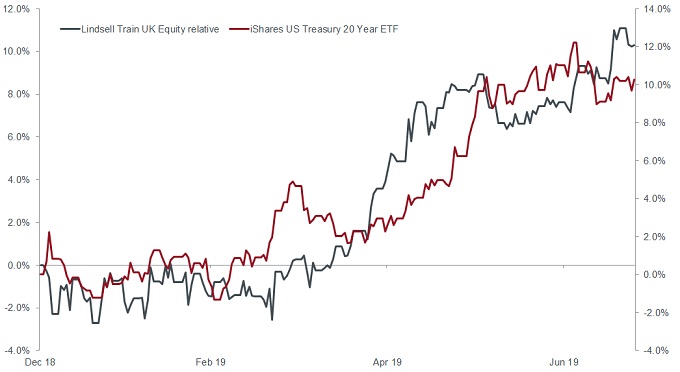

Lindsell Train UK Equity Fund vs US Treasury 20 Year ETF 2019 YTD

Source: Morningstar Direct, 31 December 2018 to 24 July 2019.

The chart uses the US Treasury 20 Year ETF to demonstrate the timing and impact of the rally in higher quality fixed income.

This has coincided with a very strong period of outperformance from the Lindsell Train fund and quality/growth investment styles in general.

The chart illustrates this point over a shorter time period, but the longer term narrative is consistent. The relative long-term performance of the quality/growth investment style is very strongly correlated with:

In terms of portfolio construction, we need to recognise the risks we are taking on behalf of clients. Whilst on the surface it may seem that holding quality/growth equities alongside investment grade bonds in the context of a balanced portfolio offers diversification given that they are different asset classes; the reality is that it is not very balanced at all. The two asset classes are the same bet on the same macro trend – specifically the cessation of the concept of an economic cycle and the establishment of a new paradigm of structurally lower growth and lower inflation in the decades to come.

In that macro scenario of “lower for longer”, the UK 10-year Gilt yielding 0.7% would look attractive value and expensive quality/growth stocks would have the room to rerate even further. However, if underlying economic conditions change, causing yields to creep higher, not only will higher quality bonds deliver negative total returns but as a result, quality/growth equities would also be likely to underperform.

So where can we find attractive opportunities and diversification in this backdrop? The cyclical value PMs have suffered amid the market environment of the past decade. However, it is this value style that stands to benefit from any uptick in either economic growth or bond yields, whilst arguably offering genuine diversification within a balanced or multi-asset portfolio.

Despite the negative headlines, it is not hard to identify green shoots emerging from the already steady levels of global economic activity – a story that could argue for fewer rate cuts than the current dovish levels priced into bond and equity markets.

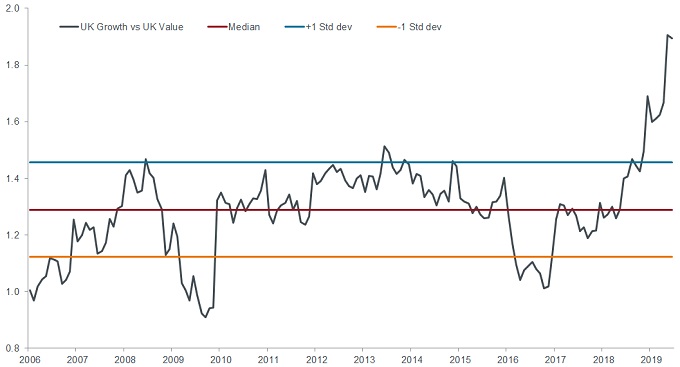

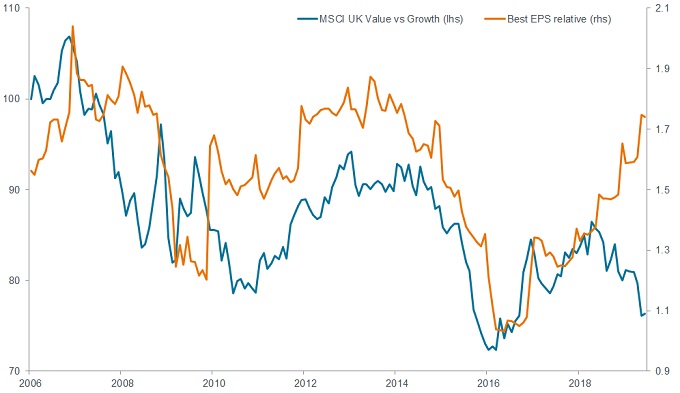

Given the potentially more constructive backdrop, investors are crowding into quality/growth trades, while the valuation gap between quality and value stocks continues to grow and is reaching extreme levels; all this despite stronger relative EPS (earnings per share) growth from those unloved value stocks.

UK Growth vs Value P/E dispersion at extreme

Source: Bloomberg, 28 February 2006 to 28 June 2019.

UK value/growth performance is undershooting its relative EPS momentum

Source: Bloomberg, 31 January 2006 to 28 June 2019.

Understanding how different assets, investment styles and instruments work together within a Multi-Asset portfolio is the primary responsibility of the fund manager.

Taking binary bets on the market backdrop is reckless risk management, so our approach is to seek out a blended and balanced approach that can be navigated through the market cycle to deliver attractive risk-adjusted returns in a wide range of market conditions.

We are not arguing for a huge positive macro surprise prompting a sizeable mean reversion. There is an ongoing role for quality/growth equities within a portfolio and Lindsell Train UK Equity remains one of the largest holdings within the JH Multi-Manager Fund range. However, we have to recognise the strength of returns that quality/growth investing has delivered, driven in large part by the macro tailwind of falling bond yields. We want to build the rest of the portfolio to withstand and also take advantage of the winds of change, should the market regime of the past decade come to an end.