Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Gillan, Head of Asia Pacific ex Japan Equities and Co-Manager of the Asian Growth portfolio, discusses why he believes investors should remain invested in Asia despite the short-term challenges. He also reflects on the five years he has been managing the portfolio.

Global equity markets have been swayed one way or the other by the continuing trade talks between the US and China. At the time of writing, the markets have responded positively in the hope that a trade deal can be struck. My belief is that investors should look through the short-term noise and accept that the relationship is damaged and that there will be repercussions, regardless of any future trade agreements. One thing is for certain, more tariffs will be bad for the US economy, global growth and Asian exporters at a time when there are already warning signs about a global economic slowdown.

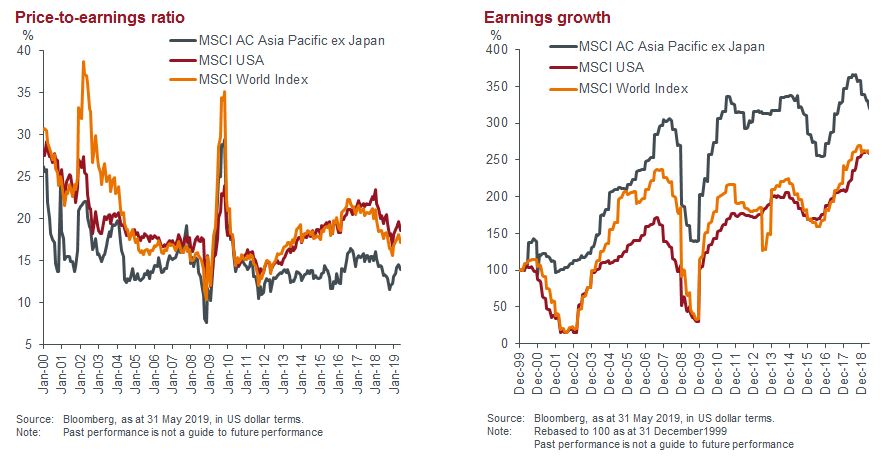

I believe that over time Asia will continue to deliver superior economic growth relative to much of the rest of the world, regardless of trade tariffs, as favourable demographics, the current relatively lower state of development and rising income levels should dictate this. Since 2000, corporate earnings growth in Asia has been significantly higher than that of both the US and MSCI World indices, yet valuations (price-to-earnings) remain at an attractive discount.

Short-term earnings revisions are still negative in Asia because the trade issues have affected both corporate investment and consumer sentiment. Additionally, certain significant areas of technology hardware, such as memory, have seen pricing declines. But in the longer term, more likely than not, I think it is possible for superior earnings growth to continue for the region as a whole. While the stronger US dollar has been a headwind for global investors allocating to Asia, the recent change in tone from the US Federal Reserve with regards to the direction of interest rates means this could change.

I began managing the Asian Growth portfolio on 1 June 2014. Reflecting back on the last five years, there has been market leadership from a few select large caps, particularly in the information technology and communication services sectors (in common with the US markets and the FAANG – Facebook, Apple, Amazon, Netflix, Google stocks).

On a country level, the largest economies of China and India have also led the way in stock market returns. Both markets produced similar annualised returns over the last five years (to 31 May 2019*) but China had two more distinct cycles. The challenge for fund managers was capturing enough of the positive momentum during periods of significant outperformance in a brief period in 2015 and a more prolonged period in 2016 and 2017, while then trying to reduce the downside during subsequent declines.

The portfolio was consistently underweight to China but had enough exposure to the structural winners in information technology, communication services and life insurers to aid performance against the MSCI AC Asia Pacific ex Japan Index over the five-year period. The portfolio continues to be a highly focused portfolio of around 40 companies or less and, if anything, this could be sharpened further to closer to 30 companies in the years ahead to deliver a truly active, high conviction proposition to our clients.

*Source: Thomson Reuters Datastream. MSCI China Index 6.6%; MSCI India Index 6.3% annualised total returns in US dollars for the five years to 31 May 2019. Note: past performance is not a guide to future performance.

[caption id=”attachment_227065″ align=”alignleft” width=”150″] Image credit: iStock.[/caption]

Image credit: iStock.[/caption]

Flexibility has been one of the key lessons learned and the need to take a pragmatic approach to a volatile market such as China. I didn’t expect China to dominate the narrative quite as it has with government stimulus (which is not new but is meaningful for equity markets), the decision to include China A shares in the MSCI Emerging Markets Index and the high profile US-China trade dispute. These events have underlined the need to have enough flexibility in the investment process to benefit from the positive moves, which have been more pronounced than in previous cycles. The core portfolio will continue to be structured around what the investment team believes are the highest quality franchises within the region, supplemented with an allocation to improving companies at an attractive price.

Given current lacklustre corporate earnings in Asia and signs of slowing global growth, there is reason to be cautious in the short term. The good news is that many of these factors appear to be already priced into stocks, at least relative to many other equity markets given Asia’s underperformance in the last year. I believe that any weakness should be viewed as an opportunity to gain exposure to Asian stocks in light of the region’s compelling long-term investment rationale.

The prospects for the information technology, consumer and financial services sectors in Asia are exciting. This is because they all offer attractive, long-term structural growth because they benefit from the region’s strong demographics and rising income levels, increasing product penetration and growing financial inclusion, which provides companies with good opportunities to deliver profitable growth. India, China and Indonesia are good examples of countries offering investment opportunities in these sectors.

Within China, the investment universe is extremely wide, which should present investment opportunities even in times of weaker headline growth. The Chinese economy and how successfully the government can transition future growth towards a more sustainable, consumption-based model will undoubtedly continue to dominate news flow but I would encourage investors to look at opportunities across the whole region and not to simply focus on China.

This article was published on 1 July 2019.

Note: Janus Henderson Investors makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any portfolio. Illustrations shown are for the limited purpose of highlighting specific elements of the research process. The examples are not intended to be a recommendation to buy or sell a security, or an indication of the holdings of any portfolio or an indication of performance for the subject company.