Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Gillan, Head of Asia ex Japan Equities and Co-Manager of the Asian Growth Strategy, discusses the reasons why investors should be less preoccupied by the machinations of the trade war and instead focus on Asia’s long-term structural growth story, strong fundamentals and the diversification benefits that the region can add to a balanced portfolio.

Given the backdrop of the trade wars that have dominated headlines in 2019, we think it is important to take a step back and look at where Asia stands from a long-term investment perspective. First, let us acknowledge the near-term headwinds. President Trump’s trade policies are undoubtedly having a negative effect on fundamentals across the region be it in the form of companies deferring capital expenditure decisions or allocating costs to relocations, instead of growth or weaker consumer sentiment. China is being affected at a time when growth is already slowing down because of the government’s deleveraging efforts. The most open trading economies like South Korea and Singapore have posted lower economic growth as a result. Corporate earnings growth remains lacklustre in Asia and expectations at this stage are for very little earnings growth for 2019.

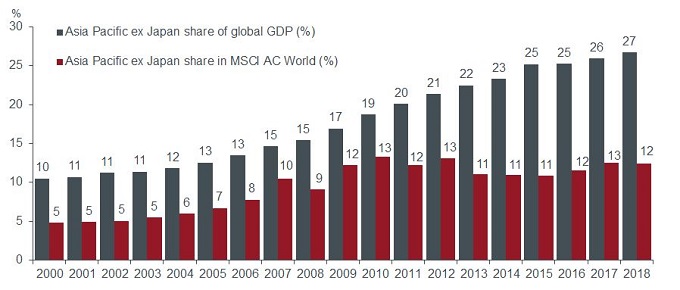

But will that be the case in the future? Asia Pacific ex Japan already accounts for 27% of global GDP as at the end of 2018, up from a mere 10% at the turn of the century (chart 1). This growth was driven by superior economic growth from countries such as China, India and Indonesia and looks set to continue in the years ahead.

[caption id=”attachment_226530″ align=”aligncenter” width=”680″] Source: FactSet, Worldbank data, Asia Pacific ex Japan share of GDP versus weight in MSCI World Index as at December 2018.[/caption]

Source: FactSet, Worldbank data, Asia Pacific ex Japan share of GDP versus weight in MSCI World Index as at December 2018.[/caption]

The US stock market has experienced an unprecedented bull market generating a 14.7% annualised return over the ten years to end June 2019. Asia Pacific ex Japan has delivered positive returns of 8.3% per annum over the same period. It is easy to see why Asia and emerging markets more broadly have been out of favour, given the superior returns available in the US, which has been buoyed by corporate earnings but also share buybacks and a market multiple re-rating since the Global Financial Crisis.

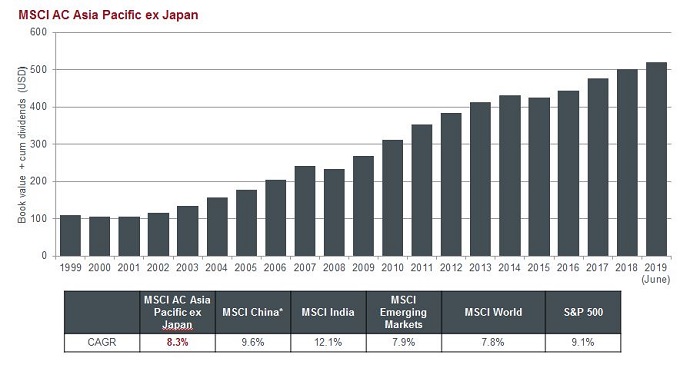

Asia’s relative underperformance means that the region offers a reasonable discount from a valuation perspective. But investors should ask: is this justified given the historical corporate fundamentals and longer-term outperformance of the region (chart 2)? It is important to note that the returns highlighted are in US dollars, which is likely to mask stronger underlying equity market performance as Asian currencies have weakened relative to the US dollar in recent years.

[caption id=”attachment_226563″ align=”aligncenter” width=”680″] Source: FactSet, data as at 28 June 2019.

Source: FactSet, data as at 28 June 2019.

Note: Annualised compounded returns are presented gross in US dollars. Includes reinvestment of dividends. P/E= price-to-earnings ratio. Past performance is not a guide to future performance.[/caption]

While corporate earnings growth remains subdued in Asia, the longer-term picture is much more positive. This is because Asian earnings growth has outpaced both global and US equities (MSCI World Index, S&P 500 Index) over the past 20 years to 30 June 2019 (chart 3, past performance is not a guide to future performance). Given the fact that the long-term drivers of Asian growth remain intact ‒ higher GDP growth, a rising middle class and the transition from lower stages of economic development, we believe it is reasonable to expect competitive earnings growth from Asian companies in the years ahead.

[caption id=”attachment_226552″ align=”aligncenter” width=”680″] Source: FactSet, data as at 28 June 2019.

Source: FactSet, data as at 28 June 2019.

Note: CAGR = compound annual growth rate. MSCI China data presented from December 2000 to June 2019. Other indices from December 1999 to June 2019. Past performance is not a guide to future performance.[/caption]

Asia also holds its own relative to other regions in terms of compounded growth of company book values over the same longer period (chart 4).

[caption id=”attachment_226541″ align=”aligncenter” width=”680″] Source: FactSet, data as at 28 June 2019.

Source: FactSet, data as at 28 June 2019.

Note: CAGR=compound annual growth rate. Book value per share + cumulative dividend per share. For MSCI China, data presented from December 2000 to June 2019. Other indices from December 1999 to June 2019. Past performance is not a guide to future performance.[/caption]

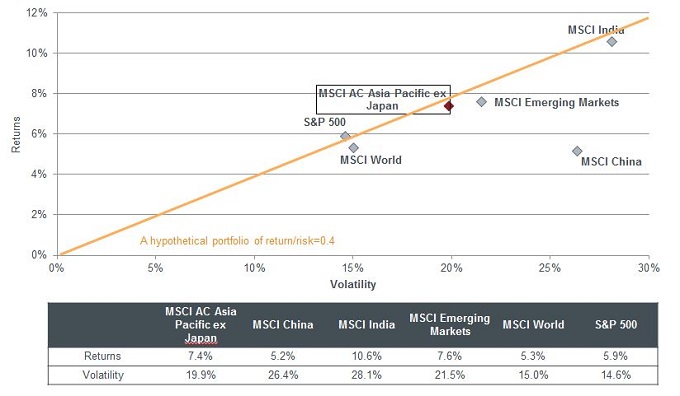

Certainly it is true that we have seen higher volatility from Asia ex Japan equities over the last 20 years but this has been compensated to some extent by higher returns (chart 5).

[caption id=”attachment_226574″ align=”aligncenter” width=”680″] Source: FactSet, data as at 28 June 2019.

Source: FactSet, data as at 28 June 2019.

Note: 20-year gross monthly returns and monthly volatility annualised in USD. Past performance is not a guide to future performance.[/caption]

Investing in Asia and emerging markets more broadly will generally come with more political and economic risk than developed markets but that also provides opportunities to buy into quality businesses at attractive prices. Concerns remain over the state of the Chinese economy and the historical reliance on debt to assist growth, but this has been the case throughout this century. The overall economy has continued to move forward while many companies have produced healthy financial and share price returns.

More recently, there have been increased concerns about the indebtedness of many corporates in India. While this is justified in some instances, there are also some fantastic success stories across sectors in India at the individual company level. It is worth highlighting that in terms of monetary policy across Asia Pacific ex Japan, there is ample room to cut interest rates if needed to stimulate economic growth, in contrast to many other developed regions currently. Those Asian economies with budget deficits have been under pressure to raise rates in recent years to defend their currencies against the strong US dollar but there are already signs of that changing with expectations of lower US interest rates or at the very least, a pause in rate rises.

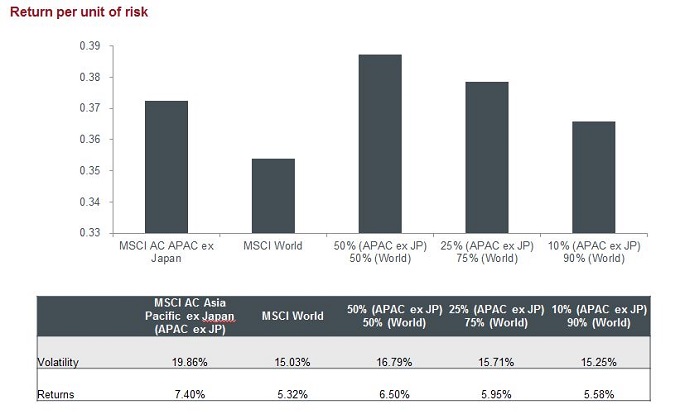

Investor needs and targets vary and an allocation to Asia ex Japan equities will not be for everyone but adding exposure to Asia within a balanced portfolio can potentially offer benefits both from a risk and return perspective (chart 6).

[caption id=”attachment_226519″ align=”aligncenter” width=”680″] Source: FactSet, data as at 28 June 2019.

Source: FactSet, data as at 28 June 2019.

Note: For illustrative purposes only. Reference to any specific index or asset class is for informational purposes only and should not be construed as a recommendation to buy or sell. Hypothetical portfolio allocations based on monthly returns for the period 20 years to 28 June 2019. Past performance is not a guide to future performance.[/caption]

In conclusion, while it is reasonable to expect more negative news around the trade wars and the impact on the region’s short-term growth is uncertain, we are confident that the long-term growth drivers will keep Asia ex Japan very relevant to investors through the rest of this century.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Anything non-factual in nature is an opinion of the author(s), and opinions are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to change at any time due to changes in market or economic conditions. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its us.