Subscribe

Sign up for timely perspectives delivered to your inbox.

Jay Sivapalan, Head of Australian Fixed Interest, discusses the Janus Henderson Tactical Income Fund’s active duration management in response to the evolving investment landscape.

The Janus Henderson Tactical Income Fund (Fund) was established in mid 2009 in the aftermath of the Global Financial Crisis (GFC). At that time, we felt that a fund that was a true-to-label defensive strategy, offering a more flexible approach to managing interest rate risk, would be appealing to investors.

Following the GFC, there was a reluctance to invest in more traditional fixed interest funds managed against longer term benchmarks, with investors fearful of getting caught in longer term securities at the low point of the interest rate cycle.

In this article, I wanted to describe how the Fund actively manages duration, aiming to maximise returns while potentially mitigating interest rate risk and preserving investors’ capital.

Understanding duration

To begin, let’s define the concept of ‘duration’ in simple terms – what it means, how it affects fixed interest portfolios and why it may be longer or shorter at a particular point in time.

Duration, expressed as a number of years, is a measure of the sensitivity of the price of a fixed interest investment, such as bonds, to changes in interest rates. As a general rule, for every 1% increase or decrease in interest rates, a bond’s price will change approximately 1% in the opposite direction for every year of duration.*

If an investor held a bond with a duration of 10 years and interest rates rose 1%, the bond’s price would decline by approximately 10%. The opposite case also applies.

In a fixed interest fund, the overall duration for a portfolio of fixed interest instruments identifies the level of interest rate risk for the fund as a whole.

Whilst adding duration can lead to greater volatility in short term returns, it brings two important benefits to a fixed interest portfolio. First, it can improve the return opportunities for a portfolio on the basis that, in most circumstances, investors can achieve higher rates of return if they are willing to invest their funds for longer periods. Second, and most importantly, it enhances the defensive role that fixed interest can play in a broadly diversified portfolio. During periods of economic or financial market stress, high quality bond yields typically fall, boosting the value of fixed interest securities. In such conditions having more duration improves the defensive qualities fixed interest can provide to a balanced investment portfolio.

The Australian bond market

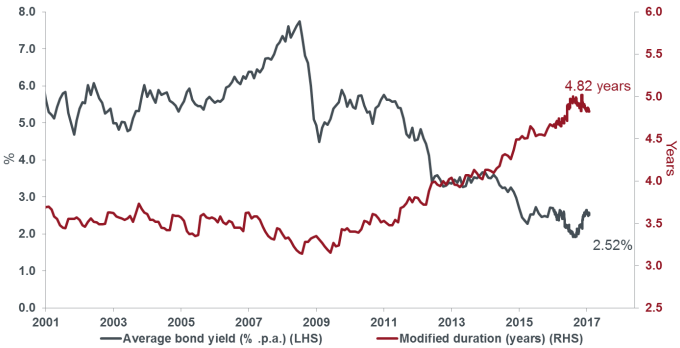

Chart 1 shows the average yield of the Australian bond market as measured by the Bloomberg AusBond Composite 0+ Yr Index (Index) (shown in grey), along with the modified duration of the Index (shown in red).

Despite the recent spike, bond yields remain at historically low levels, while modified duration has been steadily rising since 2009, driven mainly by large government bond issuance with a bias toward longer maturity terms.

In this situation, it is interesting to point out that a passively managed, or indexed fund, would be increasing the duration or interest rate risk of their portfolio to keep pace. From our perspective it makes little sense that the behaviour of borrowers, who logically have the opposite motives to investors, should determine the structure of an investment portfolio.

This being the case, does it make sense to be exposed to the highest level of interest rate risk at the same time that bond yields are at such low levels?

Chart 1: Australian bond market average bond yield and modified duration

[caption id=”attachment_226616″ align=”alignnone” width=”680″] Source: Bloomberg, as at 25 January 2017. Australian bond market based on the Bloomberg AusBond Composite 0+ Yr Index.[/caption]

Source: Bloomberg, as at 25 January 2017. Australian bond market based on the Bloomberg AusBond Composite 0+ Yr Index.[/caption]

How does the Janus Henderson Tactical Income Fund manage duration?

The Fund’s duration comes from three main sources:

The Fund’s strategy in practice

We believe the fixed interest landscape changed significantly during 2016 and in all likelihood the long term bull market in bond yields has ended. Our best judgement is that interest rates over the next few years will be on a gradually rising trend as the extreme levels of monetary accommodation applied during the post-GFC period is slowly unwound. However, the scope for yields to rise materially is relatively limited in our view given the headwinds facing the Australian economy, including high levels of household debt, fiscal tightening and a slowdown in residential construction. Given these factors, arguably bond yields don’t need to rise a great deal further than they already have at least in the short to medium term.

Reflecting this view, our approach to managing duration has changed over recent months. As shown in Chart 2, for much of 2016 we kept duration at relatively low levels (shown in red), reflecting our assessment that bond yields (shown in grey) were well below fair value. Looking back, this approach served investors well during the second half of 2016 and assisted with our objective of preserving investors’ capital from higher yields (falling prices).

We increased duration significantly during the latter stages of 2016. This reflected a much higher degree of comfort with valuations and that the conditions that would be necessary to push bond yields even higher were missing. Most notably, inflation remains very low and, in our judgement, monetary tightening in Australia is still a long way off. In addition, we were also mindful of the scope for disappointment about President Trump’s ability to implement his policy agenda as we move through 2017.

Since then we have been active in adjusting duration as yield levels have fluctuated within the ranges that we expect to prevail during this year. This approach has generally served investors well over recent months as yields have re-traced from their recent highs and volatility has created opportunities to capitalise on this higher trading range environment. The recent reduction in duration has reflected our view that the decline in yields is unlikely to go too much further.

Chart 2: Duration of the Fund versus 10 year Australian Government bond yield

Source: Janus Henderson Global Investors, Bloomberg. As at 30 March 2017.

March 2017: a case study in active duration management

Interest rate strategies added value in March 2017 by virtue of our decision to increase duration as bond yields approached their intra-month highs. This resulted in duration lifting from approximately 1.60 years to 2.20 years, which meant the Fund was well placed to benefit from the 20-25 basis point decline in yields that occurred late in the month. Subsequently, we unwound this position with duration closing the month at 1.17 years.

We anticipate the market environment will continue to provide opportunities to be active in managing the level of interest rate risk. Following the significant lift in bond yields late last year, we generally feel more comfortable with valuations and holding a higher level of duration, albeit at a much lower level than the Australian bond market (as shown in Chart 1). At the same time, we are mindful of the potential for yields to overshoot given the growing optimism about global economic conditions. In such an environment, our approach is to be quite active in managing duration as yields continue to fluctuate within expected trading ranges, an approach that has served us well over recent months.

*Example for illustrative purposes only and should not be relied upon.