Subscribe

Sign up for timely perspectives delivered to your inbox.

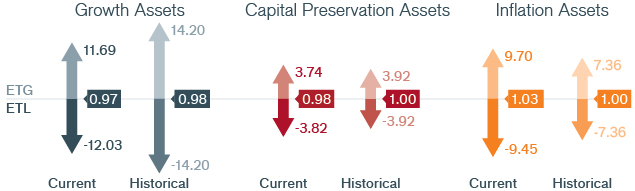

We remarked last month that inflation is not dead, and this month’s signals continue to tell us that we could see the coming of price increases. These signals are not indicating an inflationary break-out, but rather a forewarning to us that the risk of inflation should not be written off. The attractiveness of TIPS remains slightly above average levels, and the attractiveness of precious metals has been quite strong as well.

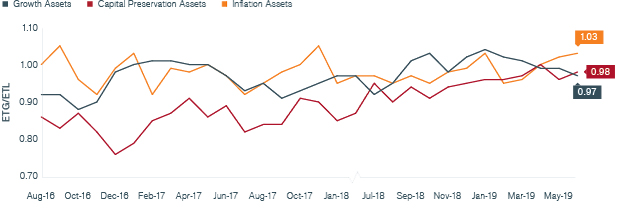

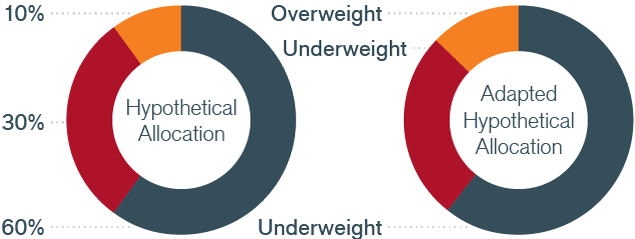

Our Adaptive Multi-Asset Solutions Team arrives at its monthly outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class. We view this ratio as a “Tail-Based Sharpe Ratio.” These tables summarize the current Tail-Based Sharpe Ratio of three broad asset classes.

This is a significant development because we remain convinced that inflation poses the most serious macro risk that can upend financial markets. While the Federal Reserve (Fed) pivoted to a more accommodative stance late last year to fend off concerns of a slowing economy, we believe the policy shift, in fact, increased the very risk they were aiming to dampen, namely accelerating inflation.

Inflation may appear to have disappeared, but we believe it is more likely latent. And if history is any indication, when inflation ultimately wakes up, it will be “fast and furious.” This binary distribution of outcomes makes it very difficult to gauge the threat of inflation using backward-looking data, which is why the coming of inflation has surprised each and every Fed leader over the decades, forcing a quick pivot to tighter monetary policy and pushing the price of money too high. This succession of events ultimately tips the economy into a recession.

The risk that Chairman Powell and his fellow FOMC members mistakenly conclude the lack of accelerating prices means inflation risk is low is the greatest risk to the real economy and financial markets. Even though our forward-looking signals are not flashing DEFCON 1 as it relates to inflation – and have not done so for a very long time – this does not mean monitoring inflation should not be front and center on an investor’s risk radar – it is quite the contrary.

Because of the significance of the risk posed by inflation, particularly at this stage of the monetary cycle, we will continue to pay special attention to price levels and share any important insights with our readers.

In addition to our outlook on broad asset classes, Janus Henderson’s Adaptive Multi-Asset Solutions team relies on the options market to provide insights into specific equity, fixed income, currency and commodity markets. The following developments have recently caught our attention: