Subscribe

Sign up for timely perspectives delivered to your inbox.

Paul O’Connor, Head of the UK-based Janus Henderson Multi-Asset Team, examines the outlook for multi-asset investors in Q3 in the latest issue of Multi-Asset Perspectives, our quarterly outlook for multi-asset investors.

Tired old bull

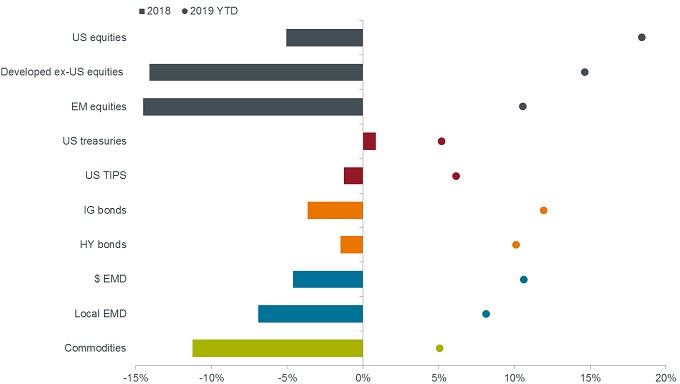

While the first half of 2019 was very rewarding for multi-asset investors, the gains in many assets were only compensation for losses incurred last year. In equities, for example, when we look beyond this ‘v-shaped’ recovery, we see that many of the major markets outside the US have actually delivered negative returns since the end of 2017. Despite this year’s broad-based bounce, the big picture remains one of an ageing bull market in equities and other risk assets.

Chart 1: Multi-asset returns in 2018 and 2019

Source: Janus Henderson Investors, Datastream, Bloomberg, 31 December 2017 to 30 June 2019. Total returns US dollars Indices: MSCI World ex USA. USA & Emerging Markets Indices; Bloomberg Barclays US TIPS and Treasury Indices, J.P. Morgan GBI-EM Index, JP Morgan EMBI Plus Index, Markit iBoxx US Investment Grade & High Yield Indices, Bloomberg Commodities Index. If you are investing in a different currency than shown, this may cause figures to differ from those shown.

End of the QE market regime

It is no coincidence that the equity bull market began to lose momentum in 2018, just as the multi-year stimulus from central bank quantitative easing (QE) came to an end. The US$5 trillion pumped into markets by the major central banks over the preceding four years had very investor-friendly effects, compressing yields and volatility in financial markets, and boosting investment returns. While these global asset purchases more or less ended in 2018, they are not going into reverse. Hence, we see the ending of QE as being the loss of a positive driver of risk assets, rather than anything more sinister. Still, it is probably right to think of it as marking the end of an easy era of strong returns and low volatility and the beginning of a more challenging market regime.

Growth-driven markets

As the thrust from QE has receded, financial markets have naturally become more closely connected to underlying growth fundamentals. In equities, for example, most of the major markets outside the US peaked in early 2018, just as growth forecasts in these regions began to weaken. The Trump fiscal stimulus allowed US equities to decouple from this trend for most of last year, but they too rolled over in Q4 as US macro momentum reconnected with the global weakening theme. The heightened sensitivity of investor risk appetite to changing perceptions of the China-US trade negotiations has been another example of this phenomenon.

Green shoots – dark clouds

After well over a year of downgrades to global growth, we are at last seeing some green shoots of recovery beginning to emerge. Still, the evidence is pretty tentative and our willingness to embrace the recovery scenario is tempered by a concern that some features of the current macro environment argue against expecting a meaningful lift in macro momentum in the months ahead:

No boom, no bust

At this stage, the balance of evidence seems to point towards a stabilisation of growth in the months ahead but questions remain about the strength of the cyclical upswing beyond that. Our base case scenario is one of growth, inflation and interest rates remaining lower than historical norms for a long time, but in some way being compensated for by the economic expansion being unusually elongated. It is important to recognise that many of these idiosyncratic features of the current macro environment make historical precedent a questionable guide right now and make forecasting more difficult than usual. Accordingly, we remain flexible in our views, diversified in our fund positioning and vigilant for anything that might shift the probabilities on the key outlook scenarios.

We tilt towards mid-risk assets

Current positioning on our multi-asset funds remains focused on mid-risk assets, which from a multi-asset perspective, includes corporate bonds, emerging market debt, the quality end of the equity market and some alternative assets. In our view, these are the sort of assets that should perform best in a world of sustained low growth and low rates. The strategy has worked well in 2018 and 2019, in an environment of fading support from QE and weakening growth momentum. Indeed it is notable that over the 18 months to the end of June, mid-risk assets such as investment grade bonds, high-yield bonds and quality equities have outperformed most of the major equity indices outside the US.

Too late for high-risk

An implicit view behind our strategy is that we feel it is too late in the economic cycle to have significant exposure to high-risk equities, value equities, cyclical sectors and smaller cap stocks. These areas of the market perform best when macro momentum is strong and bond yields are rising but have struggled since early 2018, when the opposite conditions prevailed. Although positioning and sentiment indicators suggest that a contrarian case can now be made in favour of these sorts of equities, we think the bar is high to rebuilding significant positions here, so late in the economic and market cycle. Macro scenarios involving stronger growth expectations and higher bond yields are the precondition for raising strategic exposure here.

Chart 2: Relative performance of higher-risk equities in 2018 and 2019

Source: Janus Henderson Investors, Datastream, 2 July 2019. Past performance is not a guide to future performance.

Note: Data show total return performance relative to MSCI World index. 31 December 2017 = 100.

Too early for low-risk

Just as it seems too late in the economic cycle to have major exposure to high-risk assets, to us it seems too early to make a wholesale move in the other direction, towards low-risk assets such as cash and government bonds. While we do naturally have some exposure to these sorts of assets for risk-management and diversification purposes, we would only expect to make a sizeable further shift in this direction if a significant slump in growth or rise in financial stress appear likely. While we can identify a number of frailties in the global economy and the financial system that could elevate these sorts of concerns, we also see pockets of resilience. Exceptionally accommodative monetary policy is working hard to subdue these sorts of risks and central bankers remain proactive in their approach.