Subscribe

Sign up for timely perspectives delivered to your inbox.

The US Federal Reserve lowered interest rates for the first time in more than a decade. Co-Head of Global Bonds Nick Maroutsos explains why this may be the first of many cuts, and which assets could benefit.

As expected, the US Federal Reserve (Fed) lowered its benchmark rate today, its first rate cut since the Global Financial Crisis in 2008. Although some market participants were expecting a reduction of 50 basis points (bp), the Fed took a more moderate approach and cut by only 25 bp, leaving the benchmark rate ranging from 2.0% to 2.25%. The Fed also decided to end – two months earlier than planned – the reduction of its balance sheet, but said today’s rate cut did not mark the beginning of a “long cutting cycle.”

We believe the Fed is trying to thread the needle, balancing market jitters about slowing global growth with robust consumer spending and a strong jobs market in the US. In other words, by cutting just 25 bp, the Fed is trying to bolster market confidence while also keeping some dry powder in reserve in case of an economic shock.

Immediately following the Fed’s announcement, US stocks sold off on concerns that further rate cuts may not be in the offing. But make no mistake, we think the trajectory for future Fed moves is down. One reason, in our view, is that the US cannot stay insulated from the global economy’s deceleration forever. Last week, the European Central Bank, noting a worsening outlook for the region’s manufacturing sector, suggested that a potential rate cut and/or additional quantitative easing could come as early as September. Slowing domestic growth has already prompted two quarter-point cuts in Australia this year, and other major central banks facing tepid rates of growth and inflation are expected to keep their benchmark rates near record-low levels.

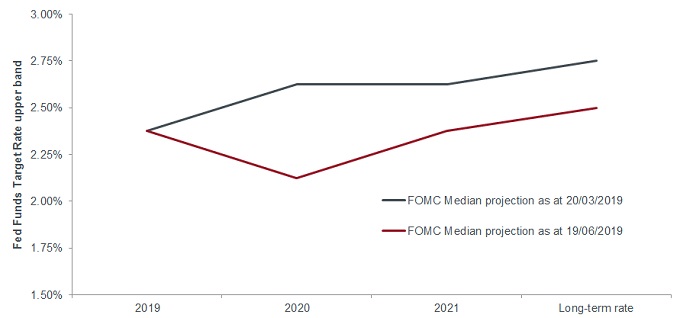

Chart 1: FOMC median rate path projections

Although still not near the low levels the futures market expects, Fed officials have lowered their projected interest rate path.

Source: Bloomberg, as at 19 June 2019.

In turn, global bond yields have retreated, causing demand for the relative attractiveness of 10-year Treasuries to climb and the US dollar to appreciate. If trade uncertainties and persistently weak inflation – to say nothing of demographic headwinds, excess leverage and low productivity – continue to weigh on global growth and, as a result, keep a lid on global rates, the Fed may have no choice but to respond in order to keep the US market competitive.

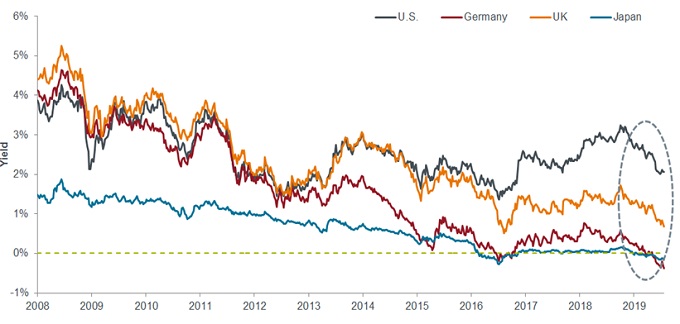

Chart 2: Yields on 10-Year government bonds

While yields on 10-Year Treasuries have slid from 3.24% to just above 2% since last autumn, US bonds are still among the highest yielders globally, which may keep upward pressure on the dollar.

Source: Bloomberg, as at 26 July 2019.

We think this backdrop is supportive of stocks, as low rates help fuel risk taking. We also believe that sovereign debt in regions where yields remain positive but could have further room to fall, such as Australia, appears attractive. In the US, we can envision a scenario in which the 10-year Treasury yield tracks to as low as 1%, down from the current 2.06% (as at 30 July 2019). We also see total return potential on the short end of the curve as the Fed embarks on this next, rate-cutting chapter.