Subscribe

Sign up for timely perspectives delivered to your inbox.

Witnessing the extended run of out performance by growth stocks over the past decade, investors may be led to believe the present will repeat itself in the future. George Maris, Co-Head of Equities – Americas, urges investors to focus on fundamentals and consider opportunities that exist in both growth and value stocks.

Market cycles can last for years, even decades. So it is easy to extrapolate recent experience as the template for a new norm. Consider growth stocks. Since July 2006, growth stocks have outperformed their value peers in one of the longest stretches of relative style outperformance in recent history (see chart 1). The performance arose as growth companies leveraged technology to change consumer and client behaviours, upend industries and take market share – all at a time when the annual rise in gross domestic product (GDP) cooled from 5.4% globally in 2010 to a forecasted 3.3% in 2019.1 Consequently, the MSCI World Value Index currently trades at a multi-decade discount to the MSCI World Growth Index.2

Chart 1: Growth stocks enjoy a long run of outperformance

Source: Bloomberg, as at 31 May 2019. Standard Deviation (Stdev) measures historical volatility. Higher standard deviation implies greater volatility.But we caution investors against thinking the present will persist unabated into the future. For one, value stocks still make up a significant portion of global equities. Investors who ignore such stocks are overlooking opportunities to invest in a number of high-quality, attractively priced companies. In addition, value stocks are often cyclically oriented, with their share prices rising and falling with the health of the economy. To be sure, global GDP faces headwinds, such as ageing populations and the maturation of major economies. But economic growth is not forecasted to turn negative any time soon. As long as GDP expands – even if slowly – value companies on the whole should be able to increase revenues proportionately. Yet, we believe many of today’s value stocks do not price in even a low-growth outlook.

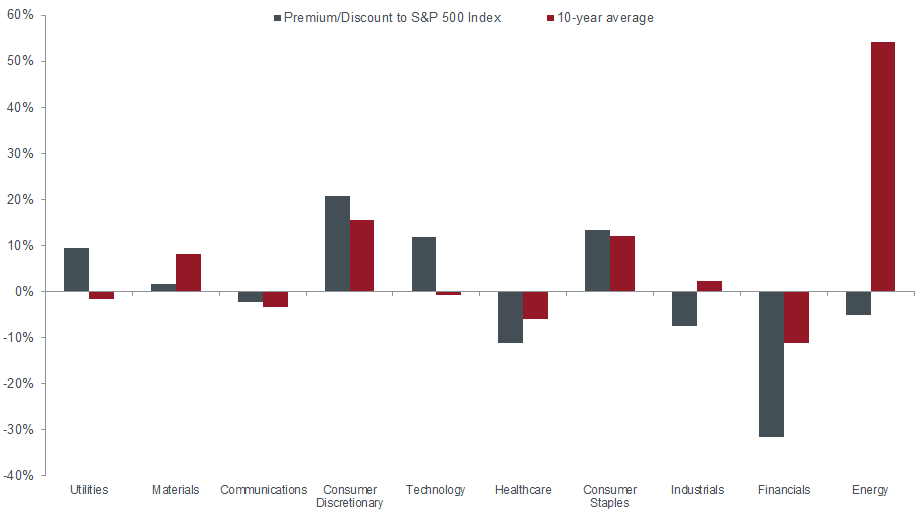

Does this mean investors should favour value over growth? Not necessarily. Some growth companies boast elevated valuations, but those multiples often reflect the firms’ potential to deliver rapid innovation and, consequently, faster earnings and revenue growth. Likewise, not all value stocks are deeply discounted. Looking at the S&P 500 Index, stocks that generated the best returns over the past year include real estate investment trusts (REITs), utilities, telecommunications and consumer staples.2 These traditionally defensive companies do not fall into the growth bucket given relatively low earnings growth but currently possess lofty price-to-earnings (P/E) ratios.

Chart 2: Expensive defensives – some of the slowest-growing sectors within the S&P 500 trade at a premium to the index, relative to the long-term average

[caption id=”attachment_220748″ align=”alignnone” width=”920″] Source: Bloomberg, as at 20 June 2019. Data reflect the ratio of each sector’s P/E to that of the S&P 500, as well as the 10-year average ratio. P/Es are based on estimated, forward 12-month earnings. Some of the slowest-growing sectors within the S&P 500 trade at a premium to the index, relative to the long-term average. Real estate is omitted as it only became a sector in 2016.[/caption]

Source: Bloomberg, as at 20 June 2019. Data reflect the ratio of each sector’s P/E to that of the S&P 500, as well as the 10-year average ratio. P/Es are based on estimated, forward 12-month earnings. Some of the slowest-growing sectors within the S&P 500 trade at a premium to the index, relative to the long-term average. Real estate is omitted as it only became a sector in 2016.[/caption]

Consequently, we believe investors can find opportunities in both growth and value stocks if they focus on companies where the shares trade below their long-term intrinsic value. In our opinion, such an approach has never been more important. We think investors, reflecting the market as a whole, are still operating on the 2008 mentality that they do not know when the next financial crisis will hit. With geopolitical tensions reaching a fever pitch once more, investors are willing to pay significant premiums for the assurance of investing in utilities, REITs and other companies perceived as steady businesses. Such an approach might be appropriate if life expectancies were 70 or 75 years, as it was when the paradigm of risk investing was established in the 1930s. Today, with people routinely living to 80, 90 or even 100, we do not think it is prudent to pay a premium for companies whose earnings are expected to grow below the market average. The longer we live, the more growth we are likely to need from our investment portfolios – and the more we should keep recent experience in perspective.

1Bloomberg, as at 31 May 2019

2Bloomberg, as at 20 June 2019