Subscribe

Sign up for timely perspectives delivered to your inbox.

Incoming narrow money data for July have been disappointing, suggesting that a global economic recovery will be delayed until Q2 2020.

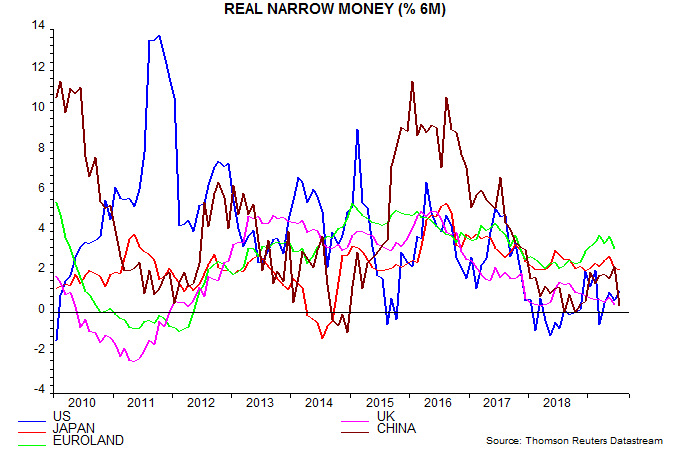

The US, China, Japan, India and Brazil have released July monetary data, together accounting for two-thirds of the global (i.e. G7 plus E7) aggregate tracked here. Incorporating near-complete CPI data, six-month growth of global real narrow money is estimated to have fallen from 1.8% in June to 1.4%, the weakest since March – see first chart.

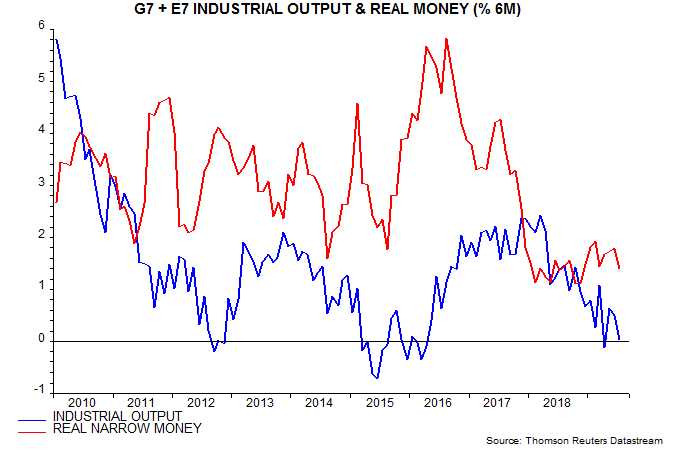

The July estimate is only slightly above a low of 1.1% reached in October / November 2018. Allowing for an average nine-month lead, the suggestion is that global six-month industrial output momentum will bottom in the current quarter but then bounce around at a weak level through April 2020.

The July reading is far below the 3% level judged here to be necessary to signal an economic recovery, in the sense of a return to trend growth or higher.

The July setback reflected a sharp fall in Chinese real narrow money growth, discussed in a post last week – second chart. Japanese and Brazilian readings were also softer, while US real money growth edged up but remains weak. The July outturn will depend importantly on Euroland and UK data released on 28 / 29 August.