Knowledge. Shared Blog

August 2019

Don’t Discount a 2020 Rebound

Simon Ward

Simon Ward

Economist

After being overly optimistic in their 2019 outlooks, many economists are now warning of an impending recession starting next year. However, economist Simon Ward explains why he believes that certain key signs point to a possible recovery in the second half of 2020 – with the U.S. housing market standing out as a potential source of strength.

The immediate global economic outlook remains weak, but cycle analysis suggests that 2020 may be a recovery year.

Growth, indeed, could be strong in the second half of next year. The inventory and business investment cycles are expected to bottom by the second quarter of 2020 at the latest, while the upswing in the longer-term housing cycle should regain momentum in response to current declines in mortgage rates and as the drag from the other cycles is lifted.

This optimistic scenario requires confirmation from a rise in six-month growth of global real narrow money (i.e., currency in circulation and demand deposits, adjusted for inflation) – currently still below 2% – to well above the 3% level judged to be a necessary condition for an economic recovery. This could occur in late 2019 or early next year.

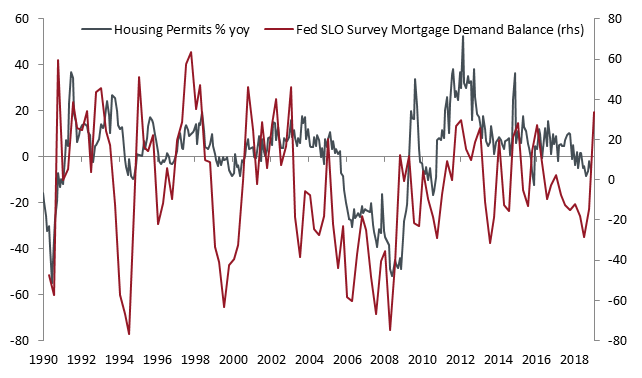

The suggestion that U.S. housing will be a source of economic strength next year is supported by the latest Federal Reserve Senior Loan Officer (SLO) survey, which shows the net percentage of respondents reporting stronger mortgage demand surging to a 16-year high (see chart below). The survey was conducted in July before the recent further decline in U.S. Treasury yields, which has yet to feed through to mortgage rates.

U.S. Housing Permits & Fed SLO Survey

Source: Thomson Reuters Datastream

Economists were overly optimistic about 2019 global economic prospects, but many are now warning of a recession in 2020-2021. Monetary and cycle analysis, by contrast, indicates that economic weakness should reach a maximum peak during the second half of this year.

Assuming monetary trends continue to improve, some investors may want to consider tactically using “risk-off” market moves (when riskier assets become cheaper as investors sell them to buy “safer” assets that are typically less vulnerable to a weakening outlook) to reduce defensive positioning and increase exposure to potential 2020 recovery plays.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox