Knowledge. Shared Blog

August 2019

Inflation Risks in a Distracted Market

Ashwin Alankar, PhD

Ashwin Alankar, PhD

Head of Global Asset Allocation | Portfolio Manager

The U.S. inflation rate has remained stubbornly low. Still, Ashwin Alankar, Head of Global Asset Allocation, says a combination of factors is helping set the stage for a potential inflationary shock.

Key Takeaways

- Worries about a stalling global economy may lead some investors to believe that the risk of an inflation surprise in the U.S. is low.

- But a combination of factors, from a decline in excess reserves at the Federal Reserve to additional tariffs, could lead to a sudden jump in prices – and shock markets.

- As such, we believe investors should carefully monitor price changes and build a diversified portfolio to help minimize any potential fallout.

As concerns rise about a global economic slowdown, investors may be tempted to push worries about inflation out of mind. In June, the Federal Reserve’s (Fed) preferred measure of inflation, the core personal consumption expenditures (PCE) price index, rose only 1.6% year over year, well below the central bank’s 2.0% target. The data were part of a long-running pattern of subdued inflation in the U.S., which the Fed has been unable to change despite years of quantitative easing.

But we believe the headline numbers belie a growing number of underlying inflationary risks. For one, after years of quantitative easing, the U.S. money supply has multiplied dramatically. Until recently, these “excess reserves” were held in deposit at the Fed, minimizing the velocity of money, or the speed at which currency circulates through the economy – a key contributor to inflation, along with the absolute amount of money available.

Today, however, those reserves are moving off the Fed’s balance sheet and back into the economy at the same time that the central bank is cutting rates. In other words, the cost of credit is declining, which could lead to an uptick in transactions and a spike in inflation – the kind that can eventually kill equity rallies due to subsequent Fed tightening.

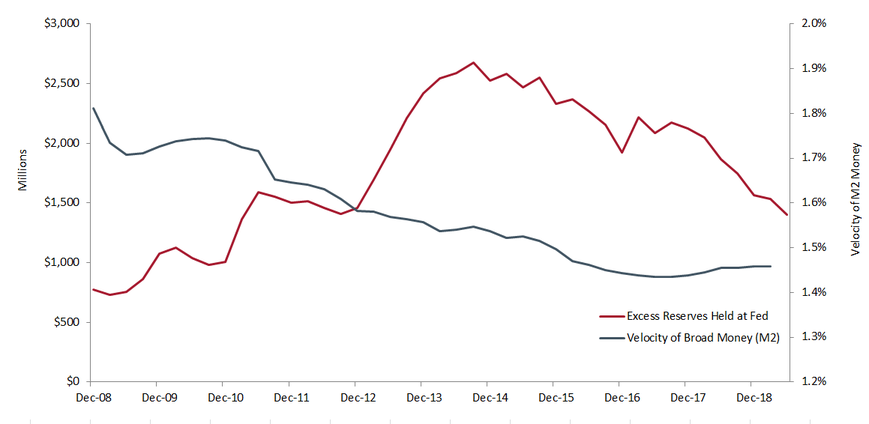

Exhibit 1: Excess Reserves Held at the Fed and Velocity of Money: The recent decline of excess reserves held at the Fed may spark an increase in the velocity of money and – given the volume of liquidity in the system – create an inflationary surprise.

Source: Bloomberg, as of 3/29/19 (velocity) and 6/28/19 (excess reserves)

Meanwhile, an additional $300 billion in Chinese goods could be hit with 10% tariffs before year-end. The new tariffs would impact mostly consumer goods, where inflation already is percolating. Recent analysis, for example, shows that the average trip to a leading U.S. retailer costs 5% more today than it did a year ago. July U.S. retail spending numbers were very strong, as were unit labor costs – a consumer making more money and willing to spend brings inflation. We worry that such anecdotal evidence is appearing in other sectors but will only make its way into official metrics once an acceleration in prices takes hold.

For investors, we think it is important to carefully monitor price changes while also building a diversified portfolio. Among equities, for example, valuation becomes key, with options prices indicating that non-U.S. developed market equities, particularly in Asia Pacific, look relatively attractive. Within fixed income, we think investors should focus on duration given the dovish stance taken by central banks globally that will pressure yields down and bond prices up. We’d also suggest that investors consider gold. In recent months, gold has experienced a sharp rally, but the commodity could help minimize the potential downside of an inflationary shock.

To learn more about what options markets are signaling for today’s financial market trends, read the latest Tell Tail Signs.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox