Knowledge. Shared Blog

August 2019

Life in the Conflict Zone

Paul O’Connor

Paul O’Connor

Head of Multi-Asset | Portfolio Manager

Paul O’Connor, Head of the UK-based Multi-Asset Team and Portfolio Manager on the International Opportunities Strategy, reflects on the recent developments in the U.S.-China trade war and discusses the potential impact of geopolitical uncertainty on economic and market sentiment.

Key Takeaways

- Trade hostilities between China and the U.S. have resurfaced after a brief respite, with both parties announcing further blocks to trade.

- There is also growing concern that trade conflict may become a broader theme between other major global players.

- Against this backdrop – and alongside a weakening global economy – financial and currency markets have been shaken.

The ceasefire in the economic war between China and the U.S. was decisively broken last week, with a rapid exchange of hostilities from both sides on the trade front and the conflict seemingly now extending to the currency markets. Within the past week, we have seen President Trump announcing a plan to put a new 10% tariff on $300 billion of Chinese exports, reports that China is halting imports of U.S. agricultural products, the yuan weakening below 7 per U.S. dollar for the first time since 2008 and the U.S. labeling China a “currency manipulator.”

Prolonged Conflict

The nervy response from financial markets to these developments confirmed the heightened sensitivity of investor risk appetite to this deepening economic conflict. While many hoped that both sides would find a way to defuse tensions, the recent escalation of hostilities raises big questions about this scenario and points instead toward a prolonged strategic conflict fought on a number of fronts. This is now our base case.

While the immediate market focus is on the China-U.S. dispute, there is also a growing concern that trade wars are becoming a broader global theme. Investors are already struggling to understand the impact of the ongoing trade conflict between Japan and Korea as well as other disputes between the U.S. and India, Mexico and Vietnam. Investors are also on standby for any resumption of U.S. global actions on autos or a renewal of U.S.-European Union disagreements. Furthermore, the expansion of China-U.S. hostilities into exchange rates this week raises a general risk that trade wars might lead to currency wars, introducing another source of uncertainty and market instability.

Growth Concerns Persist

The key reason why markets are so sensitive to developments on these fronts is that they are taking place against the backdrop of a weakening global economy and in an environment in which central banks have limited scope to provide significant policy stimulus. While the direct economic impact of Trump’s latest proposed tariffs seems fairly small, the indirect impact on business sentiment and activity is a big concern. Although some key indicators in recent weeks have shown tentative signs of a stabilization in global macro momentum, corporate confidence remains frail, particularly in manufacturing.

The big risk here is that any further deterioration in business sentiment could undermine already-weakening capital expenditure and employment plans in manufacturing and spill over into the hitherto-resilient services sector and consumer spending. While the scale of these risks is hard to calibrate, the direction is clear – every escalation in trade tensions is rightly being interpreted as yet another threat to global growth.

Trade Trumps All

In the near term, we expect China to unveil some further stimulus measures in an attempt to cushion its domestic economy from adverse developments on the trade front. Beyond that, central banks in the major economies will do their best to ease economic tensions, although probably not for a month or two. As things stand, we do not expect any game-changing global stimulus measures in the near term. Until there is a plausible path to a meaningful de-escalation of the China-U.S. conflict, the sort of policy interventions we anticipate will probably only partially offset the negative impact of trade concerns on economic and market sentiment. For now, trade trumps all.

Gold Shines

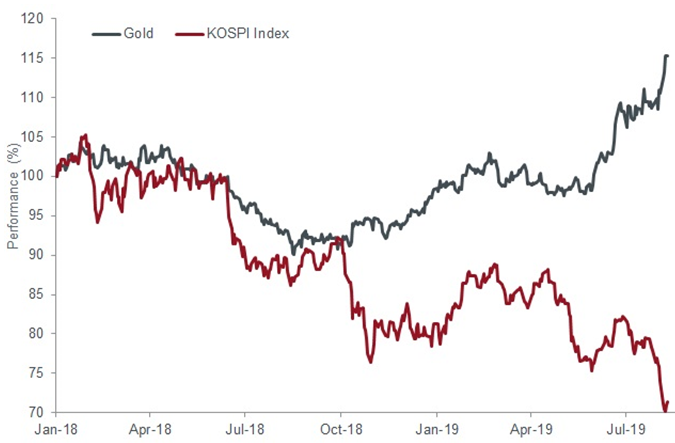

The influence of these themes is now, of course, very visible in financial markets. Gold is shining (see chart below), as would naturally be expected in an environment of heightened geopolitical uncertainty and declining real interest rates. On the other hand, growth-sensitive assets in more cyclical parts of commodity and equity markets are struggling as shown by the Korean equity market index (KOSPI). While such price action does suggest that trade wars and other geopolitical concerns are already priced into financial markets, it is hard to see a meaningful reversal of these market trends until a sustained rebound in macro momentum can realistically be expected.

Korean Equities and Gold

Source: Janus Henderson Investors, Bloomberg. Data from 12/31/17 to 8/9/19. Total returns indices in USD. Indices rebased to 100 on 12/31/17.

At this late stage in the economic cycle, deliberations about the health of the cyclical recovery and the timing of the next recession are usually difficult enough problems for investors to consider. The challenge is further complicated by a widening range of unprecedented and unpredictable geopolitical developments, from the broadening number of global trade disputes to Brexit.

With most financial assets having already delivered strong returns this year and visibility on the global macro outlook being unusually low, we see a strong incentive to sharpen the focus on capital preservation until market risk/return prospects improve or the global outlook becomes clearer.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox