Knowledge. Shared Blog

August 2019

The Case for Investing in Listed Property Equities

No bios have been selected to display.Investors looking to invest in real estate may find listed property equities such as REITs to be a liquid, low-cost way to enter the market. We believe that various emerging trends hold the potential for investment opportunities in the listed property sector.

Key Takeaways

- Property equities such as REITs offer the potential for predictable cash flow growth, enhanced returns, consistent income and diversification benefits, including exposure to the property sector and geographic diversification.

- Listed public real estate is also generally less expensive than private markets, giving investors the ability to buy assets cheaper on Wall Street than on Main Street.

- We believe that emerging trends such as technology advancements, urbanization and demographic shifts may also create new opportunities for investors in the real estate space.

Listed real estate stocks – including real estate investment trusts (REITs) – have the potential to offer investors a liquid, low-cost and transparent way to invest in property. Long-term returns from listed real estate have historically exceeded those from direct (physical) real estate.1 While the compromise in the short term tends to be greater volatility, this is often more than offset in the longer term by the potential for higher returns and greater liquidity compared to investing in direct real estate.

Following are four reasons why we believe investors may want to consider adding property equities to their portfolio:

- Predictable Cash Flow Growth Potential. Many lease contracts feature rents that are indexed to grow annually with inflation. A strong economy increases the demand for space, allowing landlords to increase rents as leases mature. This cash flow growth supports REIT dividends, which have historically outpaced inflation. With inflation and interest rates expected to remain low, income and continued earnings and dividend growth are in high demand, and we believe REITs are well placed to deliver this.

- Favorable Risk-adjusted Returns and Low Correlation vs. General Equities and Bonds. Listed property has historically delivered higher returns and lower correlation compared to general equities and fixed income alternatives, offering investors the opportunity to diversify their investments to potentially reduce risk and boost long-term returns. The sector’s differentiated return profile comes from a combination of a high starting yield, inflation-linked earnings growth and price appreciation from a real physical asset.

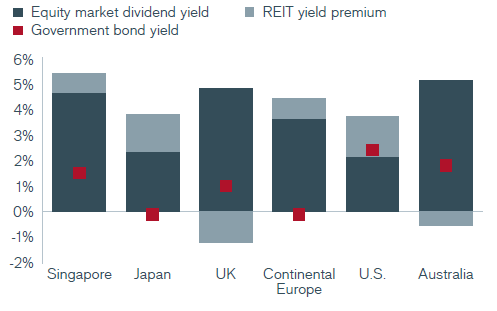

- Consistent Income. Like bonds, REITs can offer a consistent income stream. However, REIT income is uniquely characterized by consistent earnings and dividend growth, offering an element of resiliency and the potential to increase cash flows. As shown in the chart below, REITs offer an attractive income return potential compared to major government bond yields and most global equities.

Global REITs Offer Higher Dividend Yields than Government Bonds and Most Global Equities

Source: UBS, Bloomberg as of 3/31/19. 10-year government bonds. Past performance is not a guide to future performance.

4. Public Real Estate Is Cheaper than Private Markets. A key metric for the valuation of the sector is where listed property companies trade relative to the private market value of the underlying property they own. This metric is known as net asset value, or NAV. Since 2017, listed real estate has consistently traded at a discount to estimated private market NAVs. This current discount may represent an attractive entry point, effectively giving investors the ability to buy assets cheaper on Wall Street than on Main Street.

The points outlined above demonstrate how REITs and other listed property equities have historically offered investors the potential for higher returns and dividend yields. But there are also some current and emerging trends investors should be aware of when considering adding property equities to their portfolio.

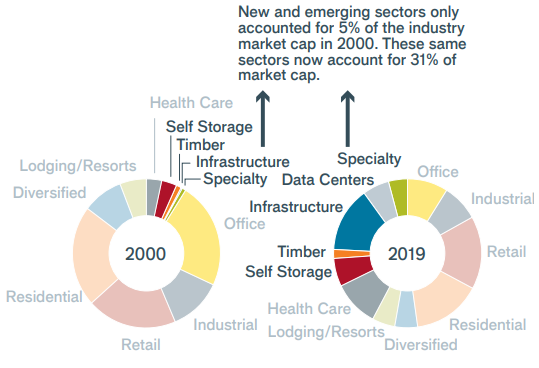

Increasingly sophisticated technology, rapid urbanization and shifts in demographics have fundamentally changed consumer behavior and altered the needs and uses for real estate. As shown in the figure below, new and emerging sectors have captured an increasingly larger share of the real estate industry’s market cap since 2000. We believe these changes present opportunities to invest in listed real estate companies that could benefit from long-term secular tailwinds, while avoiding those that may ultimately find themselves on the wrong side of history.

The Evolving Nature of Real Estate

Source: FactSet, FTSE NAREIT All Equity REITs Index as of 3/31/19.

For more insights on this topic from our Global Property Equities Team, read our white paper, The Case for Global Property Equities.

1Source: European Public Real Estate Association (EPRA). Global listed real estate 9.5% vs. global physical real estate 7.4%, 15-year annualized total returns as of 6/30/18.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe