Knowledge. Shared Blog

June 2019

Mid-Year Market GPS: Geopolitical Tensions

Jim Cielinski, CFA

Jim Cielinski, CFA

Global Head of Fixed Income

Which themes are shaping the 2019 investment landscape? Read our investment teams’ thinking in the Janus Henderson Mid-Year Market GPS.

EXPLORE THE MID-YEAR MARKET GPS

Global Head of Fixed Income Jim Cielinski explains why filtering the noise is key to navigating the current geopolitical environment.

Key Takeaways

- As attitudes toward globalization shift, geopolitics has re-emerged as a significant factor to consider when making investment decisions.

- While the list of geopolitical threats is growing, the majority of these events will dominate markets and fade quickly, presenting investors with opportunity.

- The challenge for investors is being able to filter meaningful signals from the noise and capture opportunities suited to long-term investment horizons.

Geopolitical risk tends to lull investors into complacency before suddenly erupting, often resulting in overreaction. Key to navigating geopolitical risk, then, is to separate truly systemic events from those that are merely noise. Of course, this is easier said than done, as the nature of these events ensures that they surprise markets and dominate headlines.

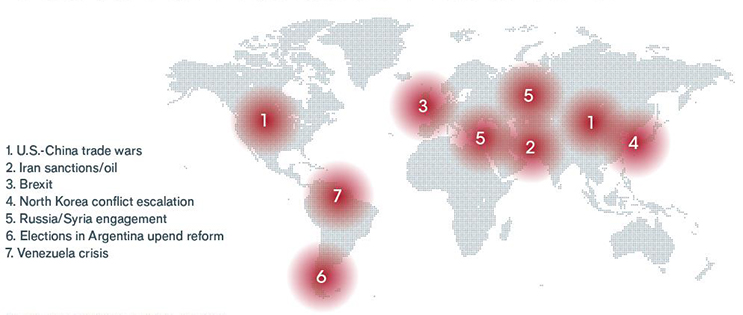

As shown in the image below, the list of geopolitical threats is long and getting longer. Of these, we believe that only the first two – U.S.-China trade wars and Iran sanctions – are likely to create true systemic global risks. And while odds are high that one or more of these events will erupt in 2019, most will dominate markets for a short time and then fade quickly, presenting investors with opportunity.

Global Threats to Geopolitics

The map below pinpoints the potential hot spots for geopolitical activity that could impact markets in 2019

Source: Janus Henderson Investors, May 2019

A good example was President Trump’s threat in late May to impose tariffs on all goods imported from Mexico. The prospect of another trade war – one that would have a far-reaching, deleterious impact on the broad economy, as well as business and consumer confidence – caused a major panic in the markets.

Just days later, however, the president suspended the tariffs “indefinitely,” declaring that Mexico had agreed to take immediate action to stem the flow of Central American migrants into the United States. The Federal Reserve also said it would cut rates should trade tensions impair the economy. Markets, in turn, rebounded.

Clearly, coping with this ongoing uncertainty is a challenge, even for the most level-headed among us. Market participants will need to make a conscientious effort to filter meaningful signals from the noise. But investors should also remain alert enough to avoid getting caught out. One of these times, a major global threat will inevitably go awry, and investors will need to know when to take cover.

Investment Themes that Matter – Market GPS Discussion

Janus Henderson experts Alex Crooke (equities), Michael Ho (multi asset/alternatives) and Jim Cielinski (fixed income) explore the key themes for the second half of 2019. Aligning with the Janus Henderson Mid-Year Market GPS outlooks, the discussion will assess potential impacts and opportunities for investors in the months ahead.

Listen Now

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox