Knowledge. Shared Blog

July 2019

Are Markets Heading Toward a Binary Outcome?

-

John Fujiwara

John Fujiwara

Portfolio Manager, Diversified Alternatives

Portfolio Manager John Fujiwara explains how equity and bond views of the U.S. economy are at odds with each other following the Fed’s dovish pivot.

Key Takeaways

- The bearish view of the U.S. economy implied by falling longer-term interest rates, in our view, is irreconcilable with the bullish outlook stocks have taken.

- If the bears are proven right, we expect higher stock volatility as earnings expectations are revised downward. Should growth find a new spurt, inflation could send bond yields higher.

- Given the risk of material drawdown in either asset class, investors should pay heightened attention to lowering correlations across their portfolio holdings.

Investment management tends to be a field of specialization, with much time spent conducting in-depth research into a particular asset class. Yet it also can prove advantageous to take a more holistic view of the broader market to glean insight into its future trajectory and that of the economy. When looking at markets through this lens, our concern that we are nearing a tipping point has intensified over the past few months. Pushing us toward this potential maelstrom are global central banks doubling down on highly accommodative monetary policy. In the wake of the Federal Reserve’s dovish pivot and other central banks not even starting their move toward normalization, both riskier assets and safer government debt have rallied.

We believe that the diverging views reflected in equity and bond markets are coming close to being irreconcilable. The return of very low yields implies that bonds see a pronounced economic slowdown. Record high equity benchmarks seem to contradict that. Soon, we may find out which view is right.

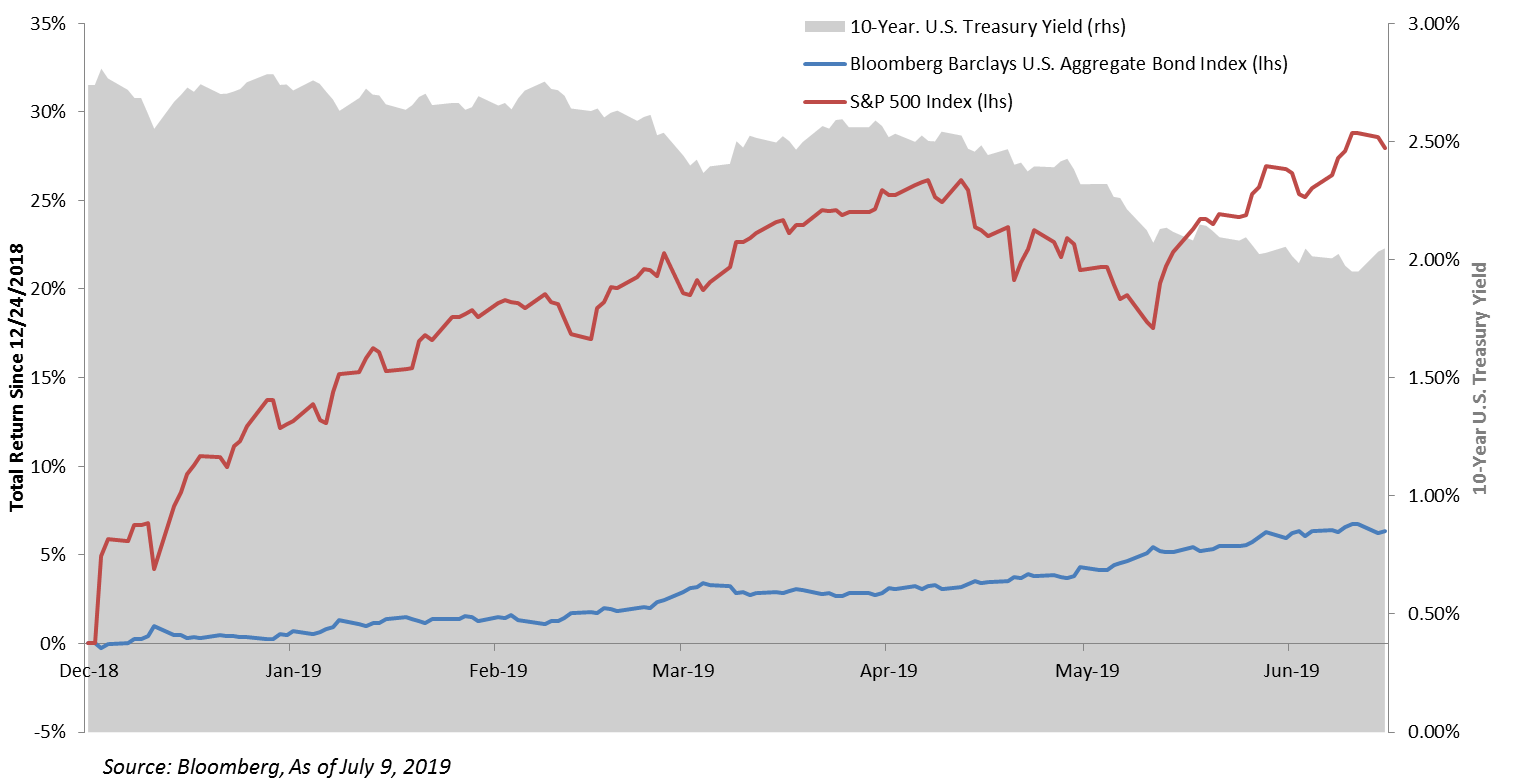

Exhibit 1: Financial Market Rally after Federal Reserve’s Late-Year Pivot

U.S. equities and bonds have rallied more than 25% and 6%, respectively, since the Fed’s December pivot as the yield on 10-Year Treasuries slid 74 basis points in anticipation of more dovish monetary policy.

The Expansion’s Next Leg or the End of the Cycle?

If increasingly accommodative policy portends another leg of economic growth, we’d expect long-dormant inflation to emerge and bonds to come under pressure. If, however, we are nearing the end of an extended economic cycle, we would expect investors to cull their exposure to riskier assets in the expectation that corporate financial performance comes under pressure. Another wrinkle arises under the latter scenario given how crowded the trade is for quality, growth and certain defensive stocks. These are the market segments one would expect to be hurt the least in an economic slowdown. Yet with them being key drivers of recent record closes in some U.S. stock indices, they could be hurt the most as investors sell what they hold in a race to safety.

No Middle Ground

We doubt there is a muddling, middle ground between these two potential outcomes, and consequently, we expect volatility to increase in one or more asset classes as the market seeks a resolution to this conundrum. With the U.S. Treasuries yield curve being inverted between 3-month and 10-year maturities since late May, the chatter of an impending slowdown – if not recession – is growing louder. At the least, we would not be surprised if corporate earnings estimates are downgraded and equities market volatility increases. Yet, with bond market-based 5-year inflation expectations at a paltry 1.5%, it would not take a large uptick in consumer prices to trigger a sell-off in the fixed income universe.

Finding the Right Ingredients for Diversification

Given the potential downside in each of these outcomes, we more than ever believe that investors should take steps to increase portfolio diversification. The belief that stocks and bonds may serve as sufficient counterbalances could be tested given how richly valued pockets of each of these asset classes have become. Alternatively, investors may consider strategies constructed to have low correlations to both stocks and bonds. These may prove their worth by helping investors navigate elevated volatility and potentially avoiding the steepest drawdowns.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe