Knowledge. Shared Blog

June 2019

Finding Value in Small-Cap Bank Stocks

-

Craig Kempler, CFA

| Follow

Portfolio Manager

Craig Kempler, CFA

| Follow

Portfolio Manager

Small-cap bank stocks have been trading at a deep discount to the broad market. Craig Kempler, Portfolio Manager at Perkins Investment Management, discusses why the sub-sector may be worth investors’ consideration.

Key Takeaways

- Small-cap bank stocks often underperformed in 2018, pricing in a weaker economic outlook than other cyclical companies.

- The sub-sector has since rebounded but still remains deeply discounted to the broad market.

- We believe this valuation gap could create downside protection, especially among small-cap banks with strong growth drivers and for investors focused on building a diversified portfolio.

Last year, as the Federal Reserve (Fed) hiked interest rates, small-cap bank stocks – which normally benefit from a rising-rate environment – often lagged the broader equity benchmark, the Russell 2000® Index.

What explained the performance gap? In our opinion, many banks were pricing in a weaker economic scenario than other cyclical companies. This pessimism led to relatively attractive valuations, with small-cap banks trading at little more than half the market’s multiple by the end of last year, based on forward, 12-month earnings estimates.

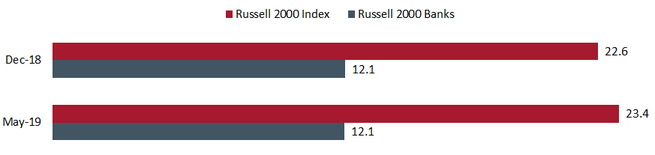

Forward Price-to-Earnings Ratio

Source: Bloomberg, as of 12/31/18 and 5/28/19.

Despite this discount, we found that many banks offered above-average reward to risk, were well capitalized and would likely benefit if the economy avoided a recession. Even if the economy decelerated significantly, banks appeared to be pricing in much of the potential weakness, with less absolute downside than other cyclical areas of the market.

In short, small-cap banks appeared mispriced – a theory later borne out as the group rebounded during the first quarter of 2019. The sub-sector has since experienced volatility as a result of the Fed’s dovish pivot, falling Treasury yields, and renewed worries about trade and economic growth. Consequently, banks still remain deeply discounted. But we think the sub-sector could have attractive growth drivers while providing investors with the potential for diversification.

Relative Underperformance

Source: Bloomberg, data indexed to 100 as of 7/2/18 and through 5/28/19.

A Multi-Step Investment Approach

The first step in analyzing small-cap banks: start at the industry level. For example, over the past few years, many banks have benefited from strong loan growth. With that backdrop in mind, investors should assess the reward to risk of each company by asking: Is a bank well capitalized and does it employ strenuous underwriting standards? If the answer is yes, a bank could likely withstand an uptick in loan losses without needing to go to markets to raise additional capital.

Diversification across geographies and asset sensitivity should also be considered. From a geographic standpoint, regions of the country that have population growth can often be favorable for banks. The reason is simple: As populations expand, banks will likely experience more loan demand, bolstering overall loan growth. Today, examples of such regions in the U.S. include the Southeast, West and mid-Atlantic.

Additionally, from an asset sensitivity standpoint, we think it is important to consider how banks tend to perform in a variety of rate environments. For example, some banks often excel when the yield curve steepens; others might outperform when the curve flattens. And in today’s environment – where rates may not rise (or could even fall) – investors may want to consider other segments within the broader financials sector such as insurance, which historically has held up better in a flat or falling rate environment.

It remains to be seen if the industry can continue to rebound. But in our opinion, many small-cap banks are benefiting from strong growth drivers. By focusing on risk analysis and diversification, investors could potentially take advantage of today’s relatively attractive valuations, while minimizing downside risk.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe