Knowledge. Shared Blog

June 2019

Currents of Disruption: Ride-Sharing on Course for Long-Term Growth

-

Tom DeLong, CFA

Tom DeLong, CFA

Research Analyst

What’s next for ride-sharing now that the industry’s leading companies have made initial public offerings? Research Analyst Tom DeLong explains why, despite recent volatility, ride-sharing could be set up for significant growth.

Key Takeaways

- The recent initial public offerings of ride-sharing companies have created an opportunity to learn more about this burgeoning industry.

- Ride-sharing currently accounts for a low single-digit percentage of total household spending on transportation in the U.S., giving the industry ample opportunity to grow, in our opinion.

- A key driver of that growth: In urban environments, many consumers can save money and time by switching to ride-sharing from car ownership, eliminating costs such as depreciation, fuel, maintenance and parking.

Ride-sharing hit a milestone recently when Lyft and later Uber made their initial public offerings (IPO). For many, the IPOs created an opportunity to learn more about the ride-sharing industry – one that we believe has potential to be transformative over the long term.

The Ride-Sharing Industry: A Brief Recap

In basic terms, ride-sharing was created by using technology to disintermediate the transportation industry, specifically black cars, taxis and car rentals. Through an app on their mobile device, users can easily request a ride with increased certainty of both the location and time for pick-up. As the industry has scaled, riders have increasingly used these services as a substitution for taxis and, in some urban environments, for owning a car.

Significant Growth Remains

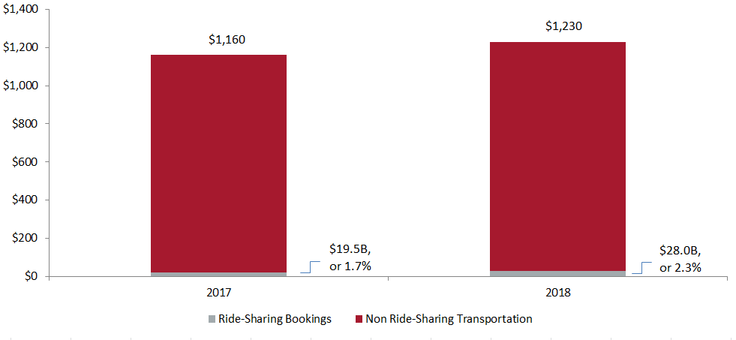

Looking at the available market, we believe the opportunity is vast. Transportation is the second-largest household expenditure in the U.S. after housing, and it is almost twice the size of health care and three times the size of entertainment. As shown in the chart below, more than $1 trillion annually is spent on transportation in the U.S. Although recent growth in ride-sharing looks impressive (more than 40% in 2018), it still represents a low single-digit percentage of the total available market.

U.S. Household Transportation Spend (Billion)

Source: Gartner, as of 4/30/19

We believe ride-sharing has several growth drivers:

Some riders can save money and time when factoring in the total cost of car ownership, including financing, vehicle depreciation, fuel, insurance and maintenance:

- For consumers in urban environments who drive up to 10,000 miles per year, ride-share carpooling is often more affordable than owning a car. For urban consumers driving less than 4,000 miles per year, even private ride-sharing trips can be more cost effective than owning a car.1

- Ride-sharing is also often twice as fast as public transportation.2

Car ownership is inefficient, and ride-sharing could have a large impact on the design of our cities:

- Vehicles are in use for only 5% or less of each day, on average.3

- More than 300,000 riders have given up their personal vehicle because of Lyft.4

- An estimated 5,200 to 8,700 square miles of land is devoted to parking in the U.S., an area roughly equivalent in size to the state of Connecticut (5,543 miles) or New Jersey (8,723 miles).5

Ride-sharing is a significant part of the gig economy:

- Many drivers turn to ride-sharing as a convenient way to supplement personal income, citing the flexibility of scheduling: 91% of Lyft’s drivers work fewer than 20 hours per week.6

Industry fundamentals may be resilient during a recession:

- During a downturn, when unemployment tends to rise, people may look to earn income as drivers, which would increase driver supply.

Both Uber and Lyft have significant capital with which to expand:

- Although Uber and Lyft are investing heavily in growth and, therefore, are currently unprofitable, each has significant amounts of private and now public financing to fund their respective investments.

Autonomous vehicles represent both a disruption risk and an opportunity for ride-sharing networks:

- Autonomous vehicles create disruption risk for ride-sharing companies by making it possible for competitors to enter the market without needing to aggregate a large supply of drivers – although this would require significant capital, and a large-scale rollout would take many years.

- Over the long term, autonomous vehicles could remove one of the most expensive costs for ride-sharing providers – the drivers – for specific types of rides. This could help reduce the cost of a ride for consumers and improve the unit economics for ride-sharing networks.

- Hybrid ride-sharing networks are well positioned to facilitate the gradual introduction of autonomous vehicles on the simplest defined routes while providing human drivers for more complex routes.

All told, we believe ride-sharing is set up for long-term growth, and think it’s worth monitoring the industry’s evolution and impact on the broader economy.

1Source: Company reports; https://www.citylab.com/transportation/2017/10/if-you-drive-less-than-10000-miles-a-year-you-probably-shouldnt-own-a-car/542988/2https://www.washingtonpost.com/news/wonk/wp/2015/01/19/how-uber-and-lyft-have-exploited-long-waits-slow-travel-and-poor-service-to-crack-open-transportation

3Source: http://fortune.com/2016/03/13/cars-parked-95-percent-of-time/

4Source: Company report

5Source: https://ops.fhwa.dot.gov/publications/fhwahop12026/sec_2.htm

6Source: Company report

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe