Knowledge. Shared Blog

June 2019

Software as a Service: Secular Tailwinds, but Valuations Still Matter

-

Jonathan Cofsky, CFA

Research Analyst

Technology Research Analyst Jonathan Cofsky explains why investors should balance the massive earnings potential of SaaS companies and their sometimes lofty valuations.

Key Takeaways

- Software as a Service (SaaS) companies have greatly contributed to this year’s technology sector gains, with much of those gains coming from expanding valuation multiples.

- The earnings prospects of SaaS companies are considerable given the potential market size, the recurring nature of their revenue streams and the stickiness of SaaS products.

- Despite this promising future, investors must pay attention to the sector’s valuation metrics, one of which – price to next-twelve-month revenue – has doubled over the past 18 months.

Cloud computing and Software as a Service (SaaS) are two of the most significant technology trends of this generation – and investors have taken notice. After early-year shakiness, tech stocks have led the market’s rebound, with applications software – the segment that includes SaaS companies – being a major contributor. It’s easy to understand why given the potential size of the market. SaaS may actually expand the universe of potential customers beyond the traditional software user base. But the run-up in SaaS stock prices has, in many cases, been driven by expanding valuation multiples, and despite the sector’s promise, investors must be realistic about what they are paying for.

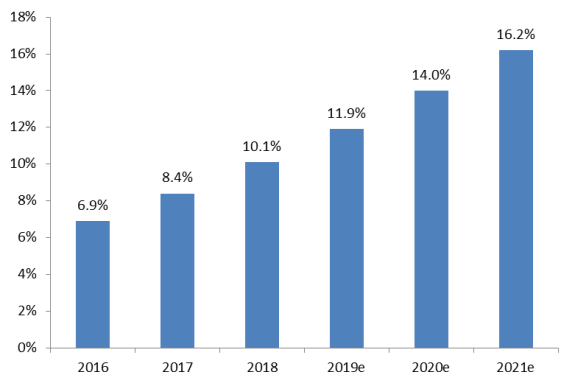

Even with all the buzz surrounding cloud and SaaS adoption over the past several years, we believe we are still in the early-to-middle innings of this megatrend: SaaS currently represents about 40% of the $200 billion enterprise application software market, and the public cloud represents only about 10% of the relevant $1.3 trillion-plus global IT market.

Exhibit 1: Cloud Services as a Percentage of Total IT Expenditure

Source: Gartner

Empowering Customers with the Cloud

SaaS is a powerful growth trend because it does more than replace existing software systems; it also significantly expands the software market as it provides new tools to make workers more efficient. Among these are cloud storage, new collaboration platforms, improved video/chat and e-signatures. Already these are digitally transforming how businesses interact with – and serve – their customers. One realm that stands to potentially drive value is front-office capabilities as businesses deploy SaaS applications to predict and react to customer queries and needs. Over time, machine learning should make SaaS products both easier to use and more valuable – another advantage that is hard to replicate in traditional software models.

Beyond the powerful growth trends – SaaS is growing over 20% per year globally, many multiples of global GDP growth – SaaS has a powerful economic model. These businesses are almost all characterized by recurring revenue, high switching costs and relatively low customer churn. At a high level, this means one can value many SaaS businesses on a multiple of revenue, rather than on more traditional metrics such as operating profit or net income. While a shorthand for discounted cash flow valuations, revenue multiples are still valuable as a high-level metric after understanding the nuances of each business’ long-term unit economics.

The Rise of the Cloud – and of Valuations

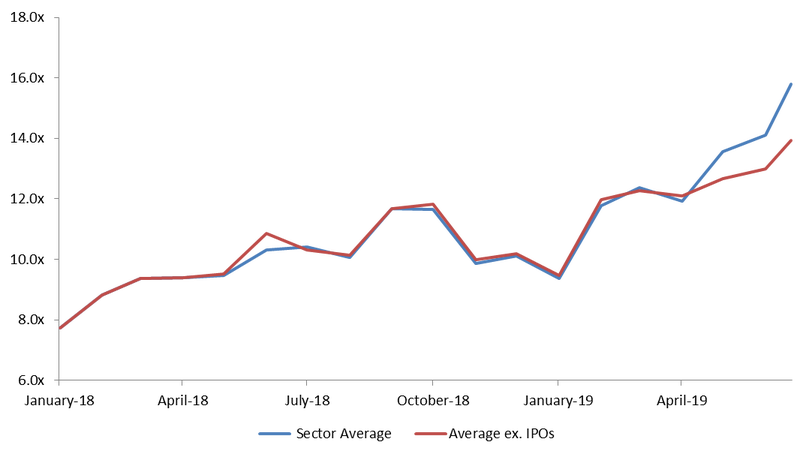

This is where things have gotten trickier. Over the last 18 months, public SaaS companies have maintained an average revenue growth rate of close to 30% per year. However, for that same level of growth, markets are paying twice as much: around 16 times next-twelve-month (NTM) revenue compared to under eight times revenue at the beginning of 2018. Some of this valuation increase can be explained by higher expected operating margins, but much of it is not. Even when investing in a technology megatrend, valuation starting points matter. When valuations shift considerably, it is worth understanding why that is the case and whether something has fundamentally changed versus recent history.

Exhibit 2: Consensus Enterprise Value to Next-Twelve-Month Revenue

Source: Factset

Liking a Sector, Loving a Name

We believe SaaS will continue to be adopted by a range of industries seeking operational efficiencies and higher customer engagement. Yet, we must always be mindful of the “hype” and with it, the elevated valuations that can sometimes accompany stocks associated with a nascent megatrend. Determining which SaaS companies will provide the greater value and have the most resilient business models requires looking beyond the headlines and scrutinizing individual businesses and gauging their ability to execute.

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the attractiveness of an investment opportunity. DCF analysis uses future free cash flow projections and discounts them (most often using the weighted average cost of capital) to arrive at a present value, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, the opportunity may be a good one

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe