Subscribe

Sign up for timely perspectives delivered to your inbox.

Historically low yields, tight credit spreads, and moderate near-term GDP growth outlook across much of the globe have forced investors to lower their return expectations. With the efficacy of extraordinary monetary policies of negative to low interest rates and asset purchases waning, investors must reassess their overall fixed income investment strategy to reflect the changing nature of risk in traditional fixed income portfolios.

Over the past several years, declining interest rates have rewarded fixed income investors who maintained a long duration exposure – a common feature of conventionally managed portfolios. However, conventional wisdom tells us that interest rate rises are on the horizon, heralding a reversal of the tailwind of falling rates. Unconstrained bond strategies attempt to manage against the resulting change to the risk and reward asymmetry,1 while simultaneously targeting an expected return that exceeds the current yield on traditional bond indices. For this reason, unconstrained bond strategies have risen to prominence in recent years; however, lingering questions remain. Specifically:

Throughout this brief, we shine light on each of the aforementioned questions and in the process bring into focus the qualities of unconstrained bond strategies, and reasons why now may be a critical time to rethink unconstrained bond investing.

Generally speaking, unconstrained bond strategies attempt to address one or more of the following key objectives:

Given these foregoing objectives, unconstrained strategies move away from traditional fixed income benchmarks and increase latitude across regions, currencies, sectors, and instruments and even allow for some income producing equity-related instruments. Since these strategies are no longer anchored to traditional benchmarks, they may relax the long-only, no leverage and regional and sector constraints, allow for wider duration bands and utilize both cash and derivative instruments. Furthermore, they can adopt a multi-faceted approach of investing in traditional fixed income securities coupled with derivative based structural alpha2 strategies with the goal of maximizing absolute returns and minimizing the loss of capital.

This combination of increased latitude and a multi-faceted approach affords unconstrained managers the flexibility to opportunistically identify value and fully implement their high-conviction ideas independent of traditional benchmarks such as the Bloomberg Barclays U.S. Aggregate Bond Index (Barclays Aggregate). The end result is a portfolio that seeks to maximize investment returns irrespective of market environment and business and interest rate cycles.

Can one single unconstrained bond strategy address all the key objectives of capital preservation, high income generation, and mitigation of interest rate risk and equity risk? The answer is unequivocally NO.

A single unconstrained bond strategy cannot be all things to all people. For that reason, one cannot paint the unconstrained bond universe with a broad brush; moreover, therein lies the reason why the unconstrained bond universe encompasses many different strategies and makes the comparison difficult, if not impossible, for end investors. Consider the current spectrum of unconstrained strategies:

In our opinion, unconstrained strategies are heterogeneous because they attempt to address different investors’ needs: some are focused on capital preservation; some are focused on diversifying equity risk; still others are focused on generating a return meaningfully higher than a broad index. Therefore, investors should view the unconstrained bond universe not as a monolith, but as a spectrum. At one end of the spectrum are capital preservation focused strategies that target 1% to 3% portfolio volatility and 2% to 3% excess return over LIBOR; at the other end of the spectrum are higher return (e.g., LIBOR + 4% to 6%) seeking strategies with moderate levels of portfolio volatility between 4% to 8%. Finally, unconstrained strategies that target higher volatility may opportunistically deploy structural alpha strategies in non-fixed income markets such as currencies or equities, or in less liquid investments.

Irrespective of where an unconstrained bond strategy lies in the risk spectrum, it is typically expected to exhibit three key characteristics:

Unconstrained bond strategies exhibit qualities of both diversified fixed income strategies and alternative or fixed income hedge funds. They share certain qualities of the former in that they generally hold long positions in corporate, mortgage, structured and emerging market debt, however, they differ in that they have a more expansive investment universe not limited to these select traditional sectors.

Similar to alternative fixed income strategies, they eschew traditional benchmarks, opportunistically target value and seek positive returns regardless of market conditions and business cycles. However, they differ from fixed income hedge funds on multiple fronts, such as the use of leverage, lower fees, and daily liquidity. Unconstrained bond strategies may use notional leverage judiciously, whereas fixed income hedge funds tend to more liberally use both notional leverage and outright borrowing; as a result, unconstrained bond strategies generally exhibit a much lower leverage ratio than fixed income hedge funds.

Finally, unconstrained bond strategies are much more fee-efficient when compared to fixed income hedge funds. Given the low return environment and lackluster performance of many hedge funds over the past 10 years, there simply is no justification for high fees and carried interest.

For traditional pension plans with a total return objective whose strategic asset allocation clearly distinguishes diversified fixed income from core fixed income, the higher volatility (4% to 8% range) unconstrained strategies are generally included in the diversified fixed income segment while the lower volatility (1% to 3% range) unconstrained strategies are used as a complement to core fixed income strategies.

For absolute return oriented investors such as endowments and foundations, who are less interested in asset class taxonomy and more interested in discovering high conviction, best ideas portfolios, the allocation is simple: unconstrained bond strategies could fall under the broad umbrella of fixed income or low beta strategies. These investors avoid benchmark-relative strategies; therefore, unconstrained bond strategies will often serve as a substitute for traditional fixed income strategies that do not meet their return objectives, typically in the CPI + 4% to 5% range.

With investors concerned about costs and liquidity, the proliferation of the liquid alternatives sector has emerged. An externality of the global financial crisis, the liquid alternatives bucket is comprised of a diverse range of investment strategies aimed at diversifying away from traditional equity and fixed income risk. Blurring the lines between mutual funds and private investment vehicles, the use of unconstrained strategies in the liquid alternatives arena has given investors the potential to achieve higher levels of diversification with greater liquidity and lower fees.

Consensus is clear: The salad days are over. We appear to be at the end of a multi-decade fixed income bull market. Investors that utilize duration-laden, benchmark-relative strategies can no longer count on realized gains from the secular decline in interest rates. In fact, looking forward, most of the fixed income portfolio returns will likely come from carry,3 if one can minimize realized losses from the anticipated rise in interest rates.

Compounding the problem, the global financial crisis ushered in the swelling of global government balance sheets, worldwide quantitative easing, and zero or near-zero policy rates which effectively lowered the carry in most fixed income portfolios. Therefore, investors face a lower total return potential from anticipated price depreciation, lower carry, and asymmetry of duration risk in traditional fixed income portfolios. Unconstrained bond strategies are timely and relevant because they seek to address these issues by focusing on capital preservation, maximizing the carry component of total return, and addressing the asymmetry of duration risk in traditional fixed income benchmarks.

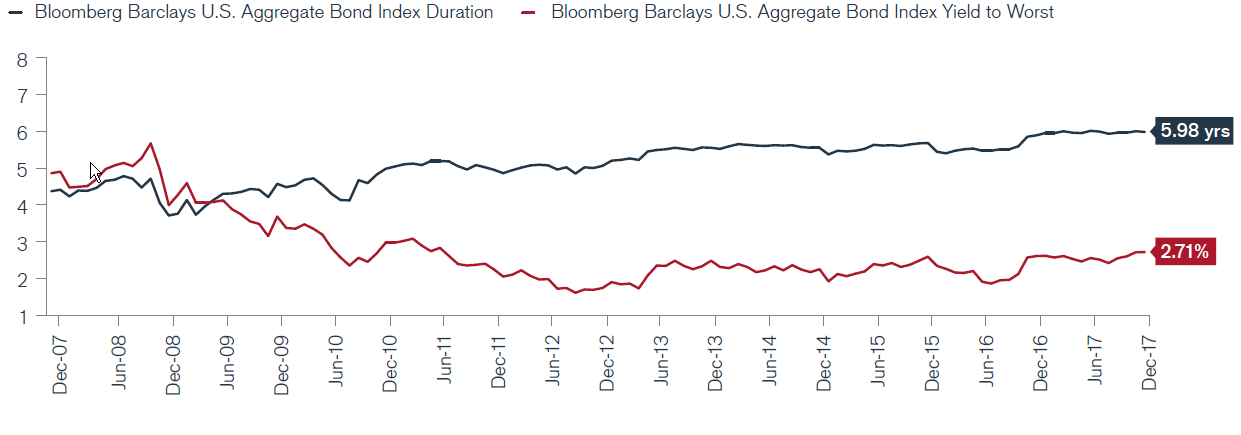

Exhibit 1 demonstrates why investors could benefit from moving away from fixed income benchmarks: the duration of the Barclays Aggregate has lengthened to 5.98 years, while the yield has fallen from 4.9% to 2.71% since 2008. Inherently, portfolios managed to the Barclays Aggregate are taking on more duration risk for far less yield than in the past. Put differently, investors are not being properly compensated for bearing duration risk.

Source: Bloomberg, as of 12/31/17

Currently, major issues and risks plague traditional fixed income benchmarks:

First, indices are biased toward the issuer instead of the investor. Typically, the larger the borrower, the greater the component of the index. The benchmark-focused investor is therefore forced to hold some exposure to this large borrower – regardless of the outright investment appeal of the bonds it issues – because benchmarked managers will not generally take the basis risk associated with avoiding that name for fear of increasing portfolio tracking error. Unfortunately for investors, indices do not assess the borrowers’ creditworthiness. As a result, issuers with less debt comprise less of the index and may be overlooked by managers despite being fiscally accountable with stable balance sheets.

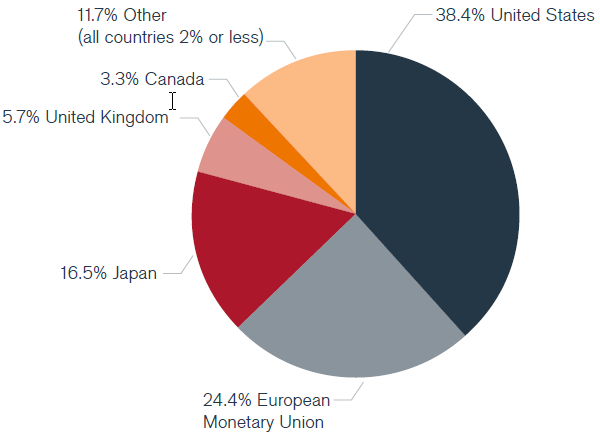

Second, as seen in Exhibit 2, broad global indices only represent a fraction of the fixed income market and are highly weighted toward mature markets such as the U.S., developed Europe and Japan. Growth regions such as Asia ex-Japan and Latin America generally do not form a large part of a manager’s investment universe because these areas make up an insignificant part of the index.

Source: Bloomberg. As of 12/31/17

Third, indices face significant compositional drift, such that past performance and structure in the asset allocation process are not indicative of the future. Government and government-related debt now comprise nearly 70% of the index, as shown in Exhibit 3.

With poor fiscal balance sheets and the extension of duration (see Exhibit 1), investors are exposed not only to a much greater level of sovereign risk, but also to an elevated amount of duration risk. In unconstrained bond strategies, investors may not have to subject themselves to elevated sovereign and interest rate risks. As shown in the right panel in Exhibit 3, unconstrained strategies are not beholden to the limitations of the benchmark. Therefore, now may be the time to loosen the benchmark constraint.

Due to a steady decline in yields over the past 30 years, pensions, foundations and endowments have been able to rely on fixed income to meet their spending needs. Using the current yield on the Barclays Aggregate as the rough proxy for the future expected return on bonds, investors might only expect a paltry 3% return – essentially capturing the carry of the portfolio. That pales in comparison to the 8% annualized return that fixed income investors obtained from 1981 (when interest rates peaked) to today.

In the current environment, investors who maintain the status quo of conventional fixed income approaches will likely be forced to take on greater volatility coupled with lower returns. In these uncertain times, investors must proactively take advantage of all appropriate return opportunities. To mitigate risk associated with conventional benchmarks, adopting a dynamic allocation process that responds to market conditions has the potential to produce superior risk-adjusted returns and improved capital protection over business cycles. The unhindered nature of unconstrained bond strategies should allow investors to maintain a core foundation of stable, liquid investments, while maintaining the flexibility to seek out the best risk-adjusted opportunities through ever-changing market conditions.

Notwithstanding, unconstrained bond strategies are not a panacea for all ills afflicting fixed income investors. Since unconstrained bond strategies are not created equal, investors are advised to match their goals with the objectives of each preferred unconstrained strategy.